Deflation Danger - The Last Argument of Central Banks

Economics / Deflation Nov 11, 2014 - 10:53 AM GMTBy: John_Mauldin

For a central banker, deflation is one of the Four Horsemen of the Apocalypse: Death, Famine, Disease, and Deflation. (We will address later in this letter why War, in the form of a currency war, is not in a central banker’s Apocalypse mix.) It is helpful to understand that, before a person is allowed to join the staff or board of a central bank, he or she is taken into a back room and given DNA replacement therapy, inserting a gene that is viscerally opposed to deflation. Of course, in fairness, it must be noted that central bankers don’t like high inflation, either (although, looking around the world, we see that the definition of high inflation can vary). In the developed world, 2% inflation seems to be the common goal. You wouldn’t think that 2% a year is a significant change in the overall price structure, but the panic among economists that would ensue with a 2% price deflation would border on hysteria.

For a central banker, deflation is one of the Four Horsemen of the Apocalypse: Death, Famine, Disease, and Deflation. (We will address later in this letter why War, in the form of a currency war, is not in a central banker’s Apocalypse mix.) It is helpful to understand that, before a person is allowed to join the staff or board of a central bank, he or she is taken into a back room and given DNA replacement therapy, inserting a gene that is viscerally opposed to deflation. Of course, in fairness, it must be noted that central bankers don’t like high inflation, either (although, looking around the world, we see that the definition of high inflation can vary). In the developed world, 2% inflation seems to be the common goal. You wouldn’t think that 2% a year is a significant change in the overall price structure, but the panic among economists that would ensue with a 2% price deflation would border on hysteria.

Inflation and deflation are often topics of discussions as I travel, but I find that there is general confusion about what inflation and deflation actually are. This is understandable, since many economists don’t agree on the definitions, so they are often talking about totally different phenomena. In this week’s letter I have for you a brief essay on the topic of deflation. Depending on your view, you might find some of my thoughts controversial, but I will try to make my case clear, at least. Please note this is the 30,000-foot view and is nowhere close to definitive. If you want great detail, I suggest you get my good friend Gary Shilling’s latest book on deflation (of four that I know of), called The Age of Deleveraging. (It’s only $11.49 on Kindle.)

Definitions of Inflation and Deflation

Generally speaking, there are two schools of thought about inflation. The Austrian school of economic theory, founded by Ludwig von Mises, sees inflation as an increase in the money supply and deflation as a contraction in the money supply. Somewhat similarly (but not entirely!), the monetarist school of economic theory tends to see money supply as the chief determinant of GDP in the short run and of the price level over the long run.

Mainstream economics (generally Keynesian) tend to refer to rising or falling prices as inflation or deflation. They tend to see deflation as a general price decline, often brought about by reductions in available credit, money, or reserves or by the government’s restraint of spending programs.

So when we talk about inflation/deflation, it is important to know whether we’re talking about monetary inflation or price inflation. As we have seen recently, a rising money supply is not necessarily accompanied by rising prices (although there is a certain long-term rhythm to the two different measures).

When I talk to the general public about deflation being something to be avoided, I get confused looks. Don’t we like it when the price of something goes down? Who doesn’t love a sale on something they want to buy? Since the beginning of the First Industrial Revolution, the general tendency for the prices of manufactured goods (in real inflation-adjusted terms) has been to go down as productivity has gone up. This is what Gary Shilling and others refer to as “good deflation.”

You can actually have solid productivity, GDP growth, wealth creation, a general increase in the standard of living, and a buoyant economy during a period of overall price deflation such as we had in the late 1800s – if it is the good kind of deflation.

What is the difference between good deflation and bad deflation? Good deflation is the general fall in prices that comes from an excess supply of goods due to increased productivity and product improvement. From 1870 to 1897 wheat prices fell from $1.06 to 63¢ a bushel, corn from 43¢ to 30¢ a bushel, and cotton from 15¢ to 6¢ a pound. Most of the time farmers received even less for their crops.

While farmers blamed all sorts of people for their falling prices, the primary cause of their problem was overproduction resulting from increases in the acreage of farms and increased yields per acre due to improved farming methods, as well as the advent of railroads that made it easy to get produce to Eastern markets. A farmer had to produce more just to stay even. It didn’t help that global competition from Argentina, Russia, and Canada was added into the mix, as increasingly large oceangoing steamboats made international transportation cheaper and ended an era of American agricultural export advantages.

This period of time saw one-third of farmers move to the cities for other work as they lost their employment on small family farms. That trend in falling farm employment continued until recent years, and farming has seen even greater increases in productivity (yield per acre) in recent decades. Farm and ranch families are just 2% of the US population today. Only 15% of the US workforce produces, processes, and sells the nation food and fiber. Today’s farmers produce almost three times more food with 2% lower inputs than farmers did 60 years ago. A third of American agriculture is strictly for exports.

The late 1800s was a particularly contentious period of history in the United States as farmers blamed railroads, bankers, and industrialists for their problems – a situation not unlike the income inequality debate we have today. And while falling prices weren’t fun for the farmers, the general public enjoyed lower food costs and higher-quality food.

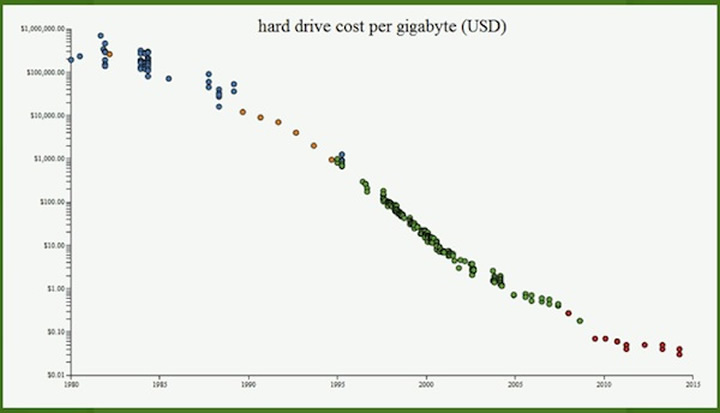

The easiest way to illustrate this trend in the modern area is by looking at the cost of a gigabyte of storage. You can see an interactive version of this chart here. Prices for a gigabyte of storage dropped from $500-700,000 in the early 1980s (depending on what you were buying) to about $0.03 today. Put another way, a gigabyte cost about 2 million times more 35 years ago than it does today. And it has fallen by 50% every few years. The good deflationary fall in prices for data storage has enabled all sorts of industries and products, creating millions of jobs. And we could find dozens of other, similar products whose prices have been falling dramatically.

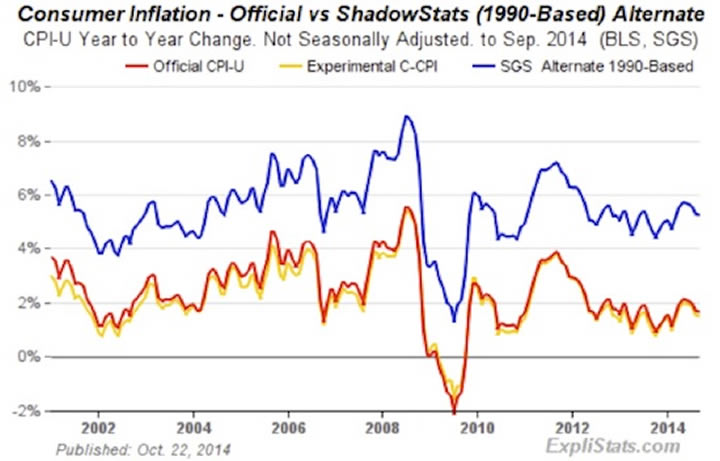

Each month we are greeted by the announcement of the Consumer Price Index (CPI), telling us what the level of general price inflation has been for the previous month and year. I’ve written about CPI extensively in past letters, but basically we need to understand that the CPI is an artificial amalgamation of the prices of various products and services. The composition of the CPI has changed significantly over the last 40 years. As John Williams at Shadow Stats demonstrates, if we used the same measurement methodology that was in force during the Reagan years or the early Clinton years, inflation would be almost 4 percentage points higher now than it is currently calculated to be.

Contrary to some commentators, I do not see this is a conspiracy to mislead investors or consumers, or to slow down the rise in Social Security payments. We should all be grateful that there is a small band of economists who are consumed by the details of what inflation actually is. They go to conferences and vehemently argue with each other (well, vehemently for academic economists) over arcane topics that would bore 99%-plus of the population. They are passionate about trying to find the proper measure of inflation.

My personal feeling is that the adjustments that have been made in the calculation of inflation are generally quite reasonable, if somewhat controversial. With the prices of electronics and many other manufactured goods falling over the decades, how do you measure inflation in those items? Or rather deflation? I still spend about the same amount for a new phone today as I did 10 years ago, but my new iPhone 6+ is a major improvement over the Motorola flip phone I had 10 years ago, by any standard you want to apply. Both could make phone calls, but that is about where the similarity ends. Am I getting better value for my money? More bang for the buck? Absolutely.

Currently, the economists who determine inflation see that increase in value as an actual drop in inflation, and they use a somewhat controversial methodology called hedonics to adjust the prices of a myriad of products for quality. If anti-lock brake systems are now standard whereas before they were optional, then by this doctrine the price of your car went down. (Those who are interested can google hedonics and get a wealth of information on the definition and the controversy.)

Housing is a big component of our spending. Should we use actual housing prices or what the inflation economists call “owner’s equivalent rent prices” as our measure of housing cost increases? If we had used actual housing prices during the 2000s, the inflation figures would have gone through the roof, suggesting to the Federal Reserve that they should be raising interest rates rather than lowering them or keeping them too low. And again, if we had been using actual house prices to calculate inflation during the Great Recession, the economy would have been seen as being swamped by serious deflation. There would’ve been even more weeping and wailing and gnashing of teeth.

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.