Gold Price Rigging Settlement With UBS - Other Banks To Follow

Commodities / Gold and Silver 2014 Nov 10, 2014 - 02:27 PM GMTBy: GoldCore

Suspicions that the price of precious metals are frequently manipulated by a few international banks were further confirmed over the weekend. UBS agreed to settle with various international regulatory bodies investigating rigging in foreign exchange and precious metals markets.

Suspicions that the price of precious metals are frequently manipulated by a few international banks were further confirmed over the weekend. UBS agreed to settle with various international regulatory bodies investigating rigging in foreign exchange and precious metals markets.

While failing to admit wrongdoing one person familiar with UBS's internal probe said that the bank found “a small number of potentially problematic incidents at its precious metals desk," reports the Financial Times:

UBS is expected to strike a settlement over alleged trader misbehaviour at its precious metals desks with at least one authority as part of a group deal over forex with multiple regulators this week, two

people close to the situation said. They cautioned that the timing of a precious metals deal could still slip to a date after the forex agreement.

Regulators around the world have alleged that traders at a number of banks have colluded and shared information about client orders to manipulate prices in the $5.3 trillion a day forex market. UBS has previously disclosed that it launched an internal probe of its precious metals business in addition to its forex investigation. It declined to comment for this article.

Unlike at other banks, UBS’s precious metals and forex businesses are closely integrated. The business units have joint management and the bank’s precious metals staff – who mainly trade gold and silver – sit on the same floor as the forex traders.

A small number of problematic incidents in precious metals trading, a small number of problems in forex trading, some problems in LIBOR ... It seems that major banks have quite a large amount of small numbers of rigging problems.

While UBS have agreed to settle with regulators, the victims of price manipulation- mining companies and people who have bought precious metals in recent years and incurred financial losses - will receive not a penny. Nor is there any way for them the get to the bottom of what actually occurred.

It is important to remember the context of this settlement. Those who have voiced concerns that precious metals markets are being rigged have been dismissed as conspiracy theorists for years.

The Gold Anti Trust Action Committee or GATA have been very vocal and most prominent in this regard.

Yet, the so called conspiracy ‘theories’ are being proven to be real conspiracies by banks.

Former advisor to President Reagan and Assistant Secretary of the U.S. Treasury, Dr. Paul Craig Roberts pointed out over the weekend how the smashes on precious metals, similar to what happened last week, are executed.

Futures contracts representing vast quantities of gold, up to forty tonnes worth, are dumped onto the electronic futures market over the course of a few minutes. This frequently happens after trading in Asia has finished and Europe is not yet open for business. In other words - at a time when the least amount of traders are available to buy. This guarantees a precipitous fall in the price.

Dr. Roberts quite reasonably surmises that this is an act of blatant manipulation to force prices down.

It smacks of either arrogance or desperation that even as the outcome of investigations by regulatory bodies into the manipulation of gold and silver prices are beginning to be made public such displays of manipulation should occur.

Manipulation can be effective in the short term. However, prices will eventually be dictated by real world forces of supply and demand for physical precious metals. This has been seen throughout history and was seen as recently as the 1960’s and the failure of the London Gold Pool which gave rise to the bull market of the 1970’s.

Acclaimed writer of the Dow Theory letters, Richard Russell observed the strong surge in precious metals prices on Friday and saw it as a positive indicator suggesting further gains are likely.

The sage ninety-year-old and respected writer of one of the oldest investment newsletters in the world, wrote that he thinks "big money sees QE4 ahead and is protecting itself."

Given the significant macroeconomic, systemic, geopolitical and indeed monetary risks of today, owning physical gold coins and bars as insurance remains prudent and will again reward those who take a long term view.

Access 7 Key Bullion Storage Must Haves here

MARKET UPDATE

Today’s AM fix was USD 1,172.00, EUR 938.20 and GBP 737.25 per ounce.

Friday’s AM fix was USD 1,145.00, EUR 923.39 and GBP 723.17 per ounce.

Gold climbed $31.80 or 2.8% to $1,175.30 per ounce Friday and silver rose $0.29 or 1.88% at $15.74 per ounce. Gold finished up 0.25% for the week and silver finished down 2.60%.

Gold in U.S. Dollars - 1 Year (Thomson Reuters)

Gold surged 3.2% on Friday as market participants adjudged the recent sell off excessive and bought the dip. The gains may have also been due to a short covering rally.

Spot gold was down 0.7% at $1,168.80 an ounce at 1200 GMT. Gold bullion has built on Friday’s gains and is marginally lower this morning after Friday’s sharp gains. Friday's U.S. payrolls data was slightly lower than expectations and may contributed to safe haven buying and the gains .

Gold in U.S. Dollars - 10 Year (Thomson Reuters)

Silver was down 0.6% at $15.68 an ounce, spot platinum was down 0.2% at $1,210.25 an ounce, and spot palladium was down 0.1% at $766.97 an ounce.

Futures trading volume was double the average for the past 100 days for this time of day, Bloomberg data showed.

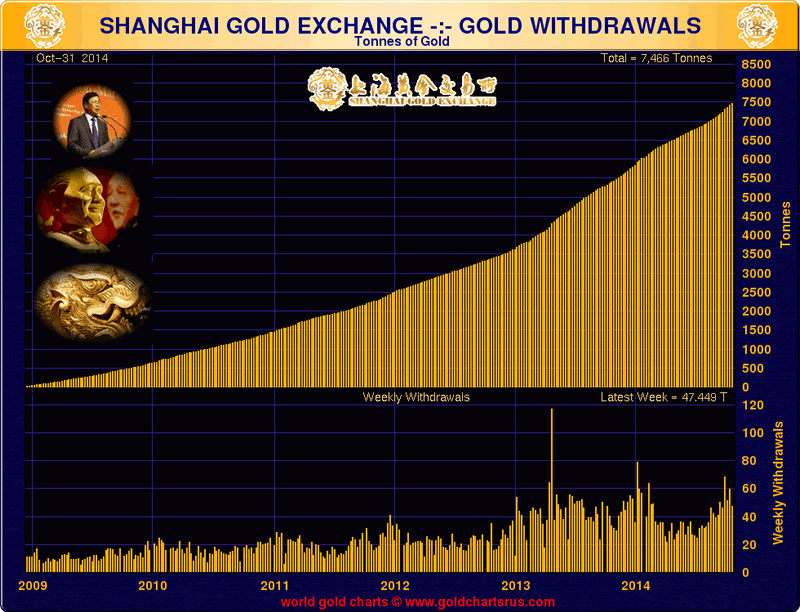

Possibly the single most important benchmark of global gold demand today remains gold withdrawals from the Shanghai Gold Exchange (SGE).

Last week saw a very robust week for Chinese demand despite talk of weak demand and low premiums in China. For the week ending October 31, there were withdrawals of 47.5 tonnes for the week. This means that the world’s largest gold buyer continues to be headed for annual gold demand of some 2,000 tonnes.

Manipulation of markets can work effectively in the short term (see above). However, in the long term prices will be dictated by the global supply and the global demand of 7 billion people, many in Asia who believe in gold as a store of wealth.

Not to mention, sovereign central banks such as the People’s Bank of China and the Russian central bank - who also believe in gold as an important monetary asset.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.