Silver Price and Powerful Forces

Commodities / Gold and Silver 2014 Nov 07, 2014 - 05:16 PM GMTBy: DeviantInvestor

Example 1: When a golfer hits a shot to the green he often yells “sit” as he orders the ball to slow or stop near the flag. Even professionals indulge in this bit of satisfying self-delusion. However, the ball responds to powerful forces, such as wind, the undulations of the green, its own momentum, and gravity.

Example 1: When a golfer hits a shot to the green he often yells “sit” as he orders the ball to slow or stop near the flag. Even professionals indulge in this bit of satisfying self-delusion. However, the ball responds to powerful forces, such as wind, the undulations of the green, its own momentum, and gravity.

Example 2: A mother demands that her teenage son clean his room. Instead he responds to powerful forces, such as testosterone surges, cute girls, and teenage rebellion.

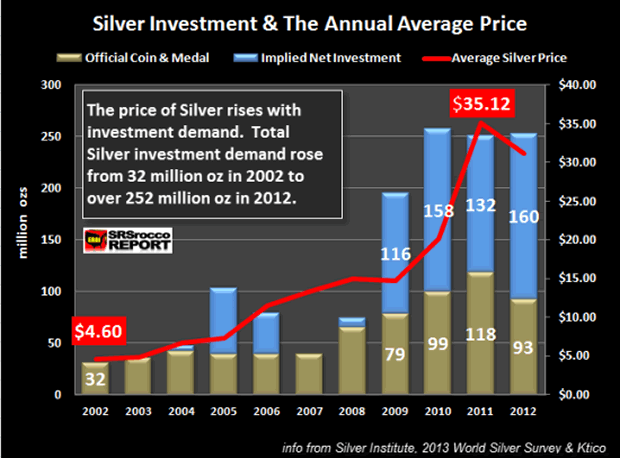

Example 3: Silver prices surged higher in early 2011 and have collapsed since then in spite of increasing investment demand. The silver market was responding to powerful forces. What forces?

- The COMEX is very important in setting global silver prices, but the COMEX is almost entirely a paper market. Relatively speaking very little physical silver changes hands compared to the number of speculative paper contracts. Speculators and large firms such as JP Morgan are powerful forces that can and do move the silver market.

- The Fed has created over $3.5 Trillion since 2008 which recapitalized banks and levitated the bond and stock markets. It seems clear that this powerful force did not want the silver and gold markets moving higher.

- It has been widely reported that the US President met with a group of bankers on April 11, 2013. Shortly thereafter the silver and gold markets crashed, apparently victims of massive paper short sales on the COMEX. Large and powerful forces can indeed move markets.

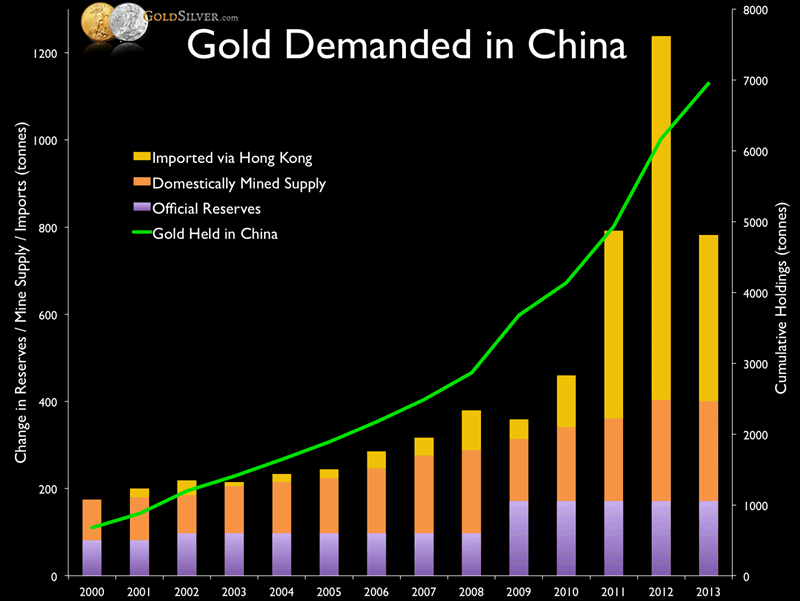

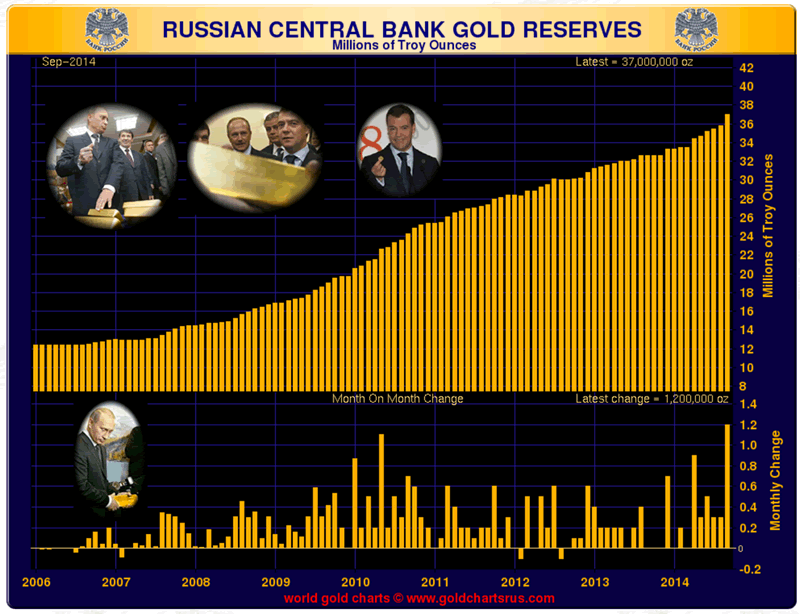

- China and Russia are aggressively purchasing silver and gold, including all their domestic production plus considerable quantities from the West. It is in their best interest to purchase metal at lower prices. Similarly, the West does not want China or Russia dumping their hoard of T-Bonds, which would hurt the T-Bond markets, the dollar, and would force interest rates higher. Some powerful international forces are working to maintain silver and gold prices at lower levels.

What seems strange:

Demand for silver is strong and apparently increasing but the COMEX driven price for silver has been weak; it just hit a four plus year low.

The “all-in” cost of silver production has been widely quoted at or considerably ABOVE current prices. But how long can this continue?

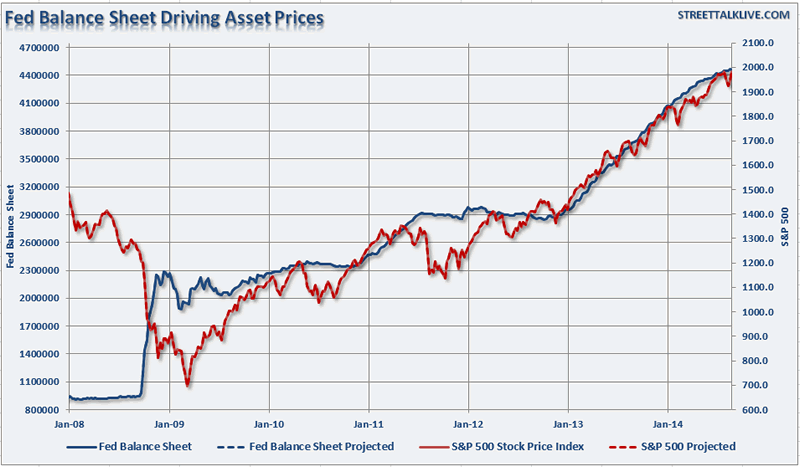

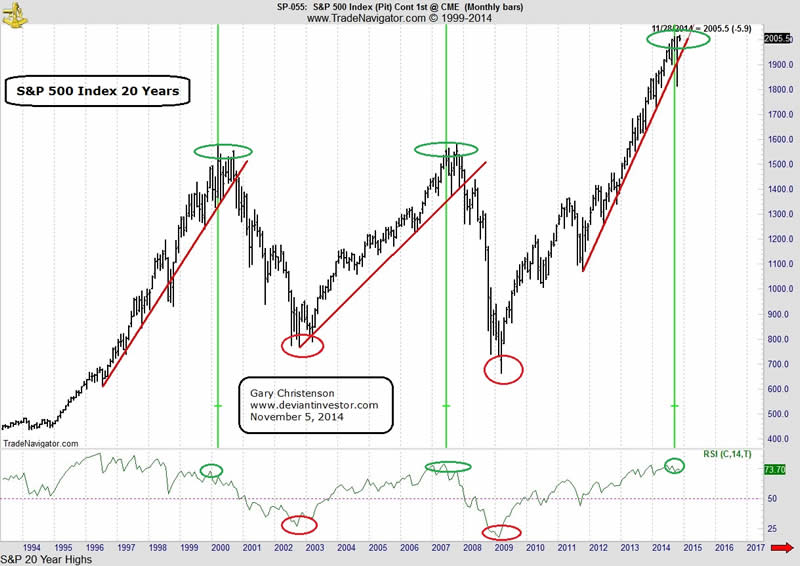

Consider this chart of the S&P 500 Index and the Fed balance sheet. It appears that the $ Trillions created by the Fed dramatically assisted the S&P in its upward journey. But what happens when the newly created dollars, euros, and yen are used to buy silver and gold instead of bonds or stocks?

Fed Balance Sheet

Consider this graph of silver investment demand, which has increased substantially. (2014 demand has been even stronger.)

Silver Investment Demand

Consider these graphs that show (estimates for) Chinese and Russian demand for gold. From which vaults do you think all that gold was removed?

Estimated Gold Demand in China

Russian Central Bank Reserves

Russian Central Bank Reserves

Powerful forces can impact markets for considerable time. Gold has broken its triple bottom at about $1,180. Silver has made a new four year low near $15 – about a 70% loss from its 2011 high. What happens next? My guess is that the High-Frequency-Traders will attempt to squash all rallies until The-Powers-That-Be are properly positioned to make a fortune on the inevitable rally.

S&P 500 Index – 20 years

Silver 20 Years on Log Scale

The longer a market is repressed or levitated, the more violent the correction. I suspect we will see violent corrections in the next six months in the silver, gold and stock markets.

For several years it seems that powerful forces have been aligned against gold and silver. What will happen to prices when some or all of those powerful forces reverse and align in favor of precious metals, for their own protection and profit?

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.