U.S. Mint Sells Out of Silver Eagle Coins as Buying Surges

Commodities / Gold and Silver 2014 Nov 06, 2014 - 06:42 PM GMTBy: GoldCore

The gulf between the physical precious metals markets and the paper or electronic gold and silver markets is growing again and risks becoming as broad as it has ever been. Demand for gold and particularly silver bullion has been very high across the world in recent weeks.

The gulf between the physical precious metals markets and the paper or electronic gold and silver markets is growing again and risks becoming as broad as it has ever been. Demand for gold and particularly silver bullion has been very high across the world in recent weeks.

The sharp price falls in recent days has led to even greater demand and concerns about supply and rising bullion premiums. Now the U.S. Mint is sold out and the Canadian Mint is rationing supplies.

This comes at a time when silver is being hammered in the futures market by entities who are selling enormous volumes of gold and silver futures. They are using leverage and are engaged in a form of naked short selling that is pushing the spot prices for physical delivery lower.

By forcing the price down so dramatically they cause those parties who speculate on a higher price in the precious metals futures markets to capitulate. They also cause some physical owners, weak hands who are nervous regarding gold and silver prices, to sell. Often at the worst times. It also has the effect of dampening spirits in the precious metal markets and creating very negative sentiment.

Sentiment is as poor as we have ever seen it regarding gold and silver amongst many analysts especially in banks, the media and the public.

Silver in USD - 5 Years (Thomson Reuters)

However, there is a huge dichotomy as sentiment amongst the hard asset community or those who understand the importance of gold and silver as stores of value is very positive and they are the ones who are accumulating again on this price dip.

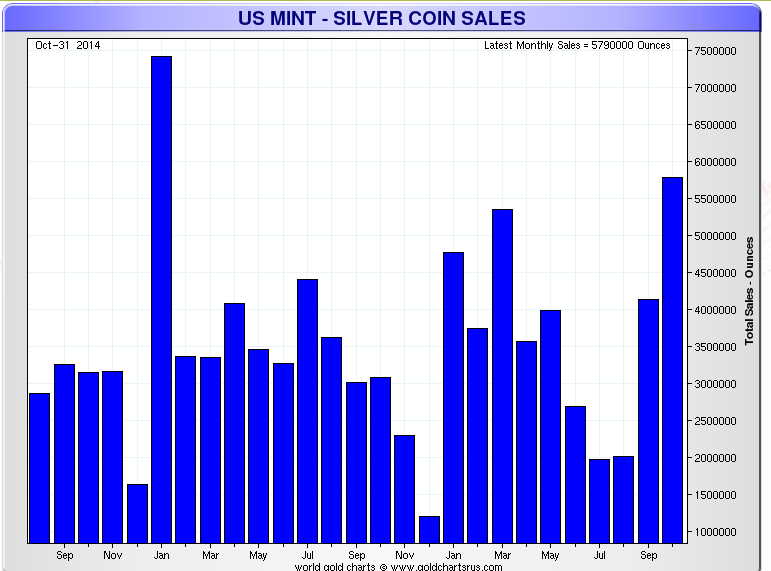

Bullion dealers across the western world have been reporting shortages in silver bullion coins and bars. Yesterday the U.S. Mint who, heretofore had not reported any issues regarding supply, announced that they had been cleared out of their entire remaining inventory of 2014 silver eagle coins.

With two months still remaining in the year their stock was cleared out yesterday when dealers, desperate to meet exploding retail demand,bought two million silver eagle coins in only two hours.

So why is demand so robust at a time when the market action suggests that silver is not a desirable asset to own?

Silver in USD - Year to Date 2014 (Thomson Reuters)

The ratio between the price of gold and the price of silver is now at around 74:1. The historical average has been roughly 15:1. Were this mean to be reverted to again, the price of silver would need to rise to around $76 even at these depressed gold prices.

After six years of talk of recovery many people in the west have grown distrustful of the ability and will of their leaders to effect positive change for ordinary people and fear another crisis is imminent.

They are taking matters into their own hands by becoming "their own central bank" as Doctor Marc Faber puts it.

It is worth considering Dr. Faber's take on Goldman Sachs talking down the precious metals markets.

"I would say Goldman Sachs is very good at predicting lower prices when they want to buy something." It may be that prices have been forced down specifically because large entities feel the need to begin accumulating physical gold and silver now that QE has been shelved. At least for now.

Despite huge complacency, on par with that seen in 2006 prior to the last crisis, there remains considerable geopolitical, financial and monetary risk throughout the world. The increased demand we have seen in recent days is not likely to be a mere blip on price weakness and will likely continue until prices have risen significantly again.

We strongly advise owning allocated and segregated individual bullion coins and bars stored in the safest vaults in the safest jurisdictions in the world.

Get Breaking News and Updates on the Gold Market Here

MARKET UPDATE

Today’s AM fix was USD 1,144.50, EUR 914.94 and GBP 717.11 per ounce.

Yesterday’s AM fix was USD 1,145.25, EUR 917.30 and GBP 720.96 per ounce.

Gold fell $25.30 or 2.17% to $1,142.40 per ounce yesterday and silver slid $0.75 or 4.68% at $15.28 per ounce.

Gold inched higher on Thursday as a pull back in the U.S. dollar took some pressure off the yellow metal after its downward spiral to four-year lows. Prices remained essentially flat ahead of a European Central Bank meeting later today.

In London, gold for immediate delivery climbed 0.4% to $1,144.90 an ounce as of 10:58 a.m. On the Comex in New York, bullion for December delivery fell 0.1% to $1,144.10 an ounce.

Gold’s 14-day relative strength index (RSI) was under 30 for a fifth day, signaling to some investors that prices will rebound.

Spot silver slipped 0.2% to $15.3035 an ounce. An ounce of gold bought as much as 75.1862 ounces of silver yesterday, the most since January 2009. The ratio was at 74.8179 today. Silver has dropped for its 7th day its longest losing streak since April 2013.

Spot platinum climbed 0.4% to $1,209.75 an ounce after the price fell yesterday to $1,197.13, the lowest in a month. Palladium was little changed at $758.75 an ounce.

Investors await non farm payrolls and expect 235,000 jobs to be added in October, and the jobless rate held at over a six-year low of 5.9%.

As the recent election showed, there is huge discontent regarding the U.S. economy. Middle America does not think the economy has improved. The headline figures disguise a very fragile economy where the middle classes and poor continue to struggle financially.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.