China Gold Demand Surges as Chinese Investors Diversify

Commodities / Gold & Silver May 23, 2008 - 08:29 AM GMTBy: Mark_OByrne

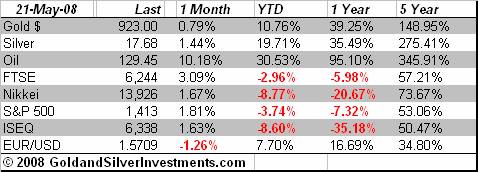

Gold was down 1% ($ 9.50 to $9 18.10 ) but silver remained firm and closed marginally lower ( down $0.06 to $17.9 2 ) and profit taking on oil's weakness was seen by many as the primary cause of yesterday's sell off . Gold traded sideways in Asia but has rallied in early trade in Europe.

Gold was down 1% ($ 9.50 to $9 18.10 ) but silver remained firm and closed marginally lower ( down $0.06 to $17.9 2 ) and profit taking on oil's weakness was seen by many as the primary cause of yesterday's sell off . Gold traded sideways in Asia but has rallied in early trade in Europe.

With increasing doubts about the sustainability of the recent rebound of the dollar and of global stock markets, safe haven demand for gold is likely to reaccelerate in the coming weeks.

The dollar has not shown any direction this morning and oil has rebounded somewhat after yesterday's sharp sell off and this is leading to a lack of direction in the gold market in trading in London.

Today's Data and Influences

Today , the focus will return to the US housing market with existing home sales for April due for release this afternoon . The data is expected to confirm continuing serious difficulties in the U.S. housing market which is likely to lead to a continuing contraction in GDP growth with obvious implications for the dollar and US economy.

China Gold Demand Surges as Chinese Investors Diversify

While the World Gold Council confirmed an expected decline in demand for gold in the first quarter after the huge price increase (from $840 at the start of the year to over $1000 by mid March or a 19% increase in less than 3 months ) demand remained remarkably robust (especially investment demand) and shows that there is a floor under the market supporting prices at these levels.

While jewellery demand declined expectedly, it is investment demand that is assuming increasing importance especially in light of the deteriorating global macroeconomic and financial fundamentals.

Resource Investor reported that "in marked contrast to India, demand in China grew by 15% to 101.7 tonnes, with both jewellery and investment demand increasing during the first quarter as continued economic strength allowed consumers to increase their purchases regardless of the rising price. Jewellery demand rose 9% to 86.6 tonnes and investment demand surged 63% to 15.1 tonnes ."

China is assuming increasing importance in the global economy and in the gold markets and will continue to do so and Chinese demand is likely to increase towards the huge levels seen in India which will result in a markedly higher gold price in the coming years.

Gold ownership for Chinese citizens was legalised in 2004. A system for selling bullion to the largest population in the world (some 1.3 billion) is now in operation. And the effect on global gold demand is likely to be staggering. The Chinese Central Bank is also diversifying out of US dollars and into gold. In March 2006, the National Development & Reform Commission of China said that “China intends to more than double its gold reserves to 1,270 tons this year.”

An other important development in China is that the Shanghai Gold Exchange (SGE) has allowed tangible gold trading by individual investors. The new gold trading allows investors to receive tangible investment grade (0.9999) gold on delivery. It is an additional investment alternative and will likely lead to diversification amidst increasing uncertainties in the stock market. T he Chinese stock market has been very volatile of late and is down 43% in the last 6 months (from over 6,000 to 3,500).

China's appetite for gold continues to increase and according to the China Gold Association, China became the third biggest consumer of gold in the world earlier this year.

In an interesting and important article ( http://www.chinadaily.com.cn /bizchina/2007-07/04/content _909536.htm ) in the China Daily:

" . . . Chinese analysts noted that trading of tangible physical gold itself would attract many more individual investors. "Compared with the previously traded products for individual investors on the SGE, paper gold for example, the trading enables investors to deliver tangible physical gold and would hence attract many investors," said Tang Mingrong, an analyst with Ling Rui Gold Investment Co. "The increasing need of hedging risks by individual investors spurs the launch of physical gold trading," Tang said. Buying gold is widely seen as an effective way to reduce risks in an investment portfolio, as gold prices remain relatively more stable in times of economic and market uncertainties. Concerns about worldwide inflation also add to the charm of investing in gold. "The further opening of the gold market to individual investors would provide them more investing channels and alleviate the excess liquidity in the nation's financial market," said Wang Lixin, general manager of World Gold Council, Greater China. "

With the recent huge volatility in the Chinese stock market and increasing signs of rampant speculation in stocks, it seems likely that there will be further diversification into gold by Chinese investors resulting in sharply higher prices in the medium and long term.

Silver

Silver is trading at $18.0 5 /18. 10 per ounce at 1100 GMT.

PGMs

Platinum is trading at $21 75 /2 185 per ounce (1100 GMT).

Palladium is trading at $453/458 per ounce (1100 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.