The End of QE Is Not the End of Bad Policy

Interest-Rates / Money Supply Nov 06, 2014 - 06:13 PM GMTBy: MISES

John P. Cochran writes:

Recently the financial press and media has been abuzz as the Federal Reserve moved closer to the anticipated end to its massive bond and mortgage backed securities purchases known as quantitative easing. James Bullard, President of the St. Louis Federal Reserve Bank, stirred controversy last week when he suggested the Fed should consider continuing the bond buying program after October. But at the October 29th meeting, the policy makers did as anticipated and “agreed to end its asset purchase program.” However one voting member agreed with Mr. Bullard. Per the official press release, “Voting against the action was Narayana Kocherlakota, who believed that, in light of continued sluggishness in the inflation outlook and the recent slide in market-based measures of longer-term inflation expectations, the Committee should commit to keeping the current target range for the federal funds rate at least until the one-to-two-year ahead inflation outlook has returned to 2 percent and should continue the asset purchase program at its current level” (emphasis added).

John P. Cochran writes:

Recently the financial press and media has been abuzz as the Federal Reserve moved closer to the anticipated end to its massive bond and mortgage backed securities purchases known as quantitative easing. James Bullard, President of the St. Louis Federal Reserve Bank, stirred controversy last week when he suggested the Fed should consider continuing the bond buying program after October. But at the October 29th meeting, the policy makers did as anticipated and “agreed to end its asset purchase program.” However one voting member agreed with Mr. Bullard. Per the official press release, “Voting against the action was Narayana Kocherlakota, who believed that, in light of continued sluggishness in the inflation outlook and the recent slide in market-based measures of longer-term inflation expectations, the Committee should commit to keeping the current target range for the federal funds rate at least until the one-to-two-year ahead inflation outlook has returned to 2 percent and should continue the asset purchase program at its current level” (emphasis added).

The action yesterday completes the phase out, which began in January 2014, of the controversial QE3 under the leadership of Ben Bernanke and continued unabated under Janet Yellen.

“Not the End of Monetary Easing”

While the headline in the Wall Street Journal highlighted the action as closing a “chapter on easy money,” a closer look illustrates this is perhaps not the case. The Journal, on the editorial page the same day offers a better perspective, supported by data and the rhetoric in the press release. Much to the determent of future economic prosperity, “The end of Fed bond buying is not the end of monetary easing.”

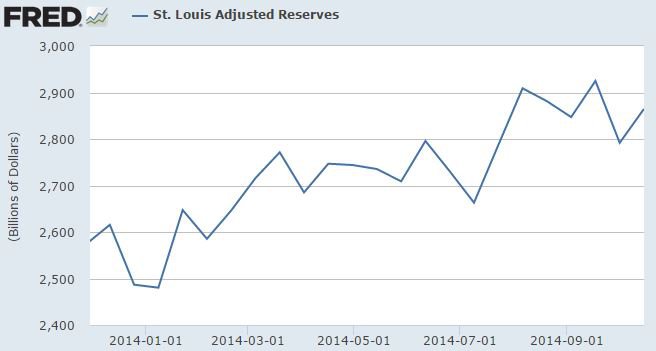

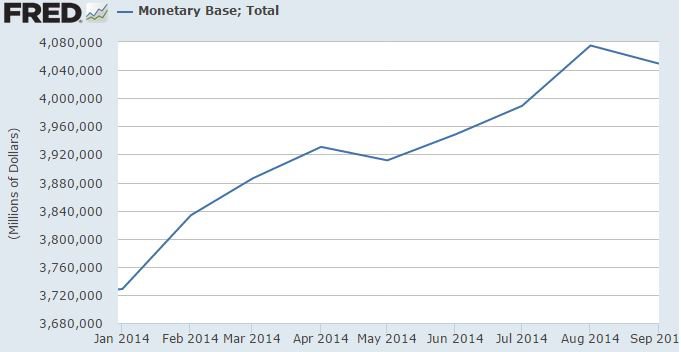

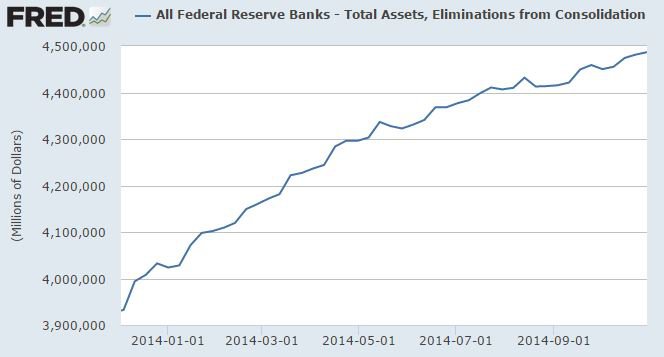

While quantitative easing has contributed to the massive expansion of the Fed balance sheet — now nearly $4.5 trillion in assets — it is not the whole story. Even as the Fed ends new buying of favored assets, the Fed balance sheet will not shrink. As pointed out by the Wall Street Journal, “QE is not over, and the Fed will still reinvest the principal payments from its maturing securities.” Even more relevant, during the phase out there was a continuing expansion of three broad measures of Fed activity; St. Louis Fed adjusted reserves (Figure 1), the monetary base (Figure 2), and Federal Reserve Banks — Total Assets, Eliminations from Consolidation program (Figure 3). (All data from FRED economic data series St. Louis Federal Reserve. Calculations are mine.)

Figure 1: St. Louis Fed Adjusted Reserves

Figure 2: The Monetary Base

Figure 3: Federal Reserve Banks — Total Assets, Eliminations from Consolidation

The Fed’s Balance Sheet Continues to Expand

Despite some ups and downs, adjusted reserves increased 15.8 percent from January 2014 through September 2014, the monetary base by 8.6 percent, and consolidated assets by 10.7 percent. Given QE purchases were $85 billion per month at their peak, this continuing expansion of the Fed balance sheet and the other relevant monetary aggregates, the phase out and end of quantitative easing represents not a change in policy stance, but only a shift in tools. Monetary distortion has continued unabated. The only plus in the change is that more traditional tools of monetary manipulation create only the traditional market distortions; Cantillon effects, false relative prices, particularly interest rates, and the associated misdirection of production and malinvestments. Temporarily gone is the more dangerous Mondustrial Policy where the central bankers further distort credit allocation by picking winners and losers.

As illustrated by the Fed speak in the press release, post QE3-forward policy will, despite John Taylor’s optimism that this would not be the case, continued to be biased against a return to a more balanced, less potentially self-defeating rules-based policy. Instead driven by the Fed’s unwise dual mandate and the strong belief by Fed leadership in Tobin Keynesianism, policy will continue to “foster maximum employment.” This despite strong theoretical arguments (Austrian business cycle theory and the more mainstream natural unemployment rate hypothesis)[1] and good empirical evidence that any short-run positive impact monetary policy may have on employment and production is temporary and in the long run, per Hayek, cause greater instability and potentially even higher unemployment.

The Lasting Legacy of QE

As pointed out by David Howden in “QE’s Seeds Are Already Sown,” and as emphasized by Hayek (in Unemployment and Monetary Policy: Government as Generator of the “Business Cycle”), and recently formalized by Ravier (in “Rethinking Capital-Based Macroeconomics”), the seeds of easy money and credit creation, even when sown during times with unused capacity, bring forth the weeds of instability, malinvestment, bust, and economic displacement. They do not bring the promised return to prosperity, sustainable growth, and high employment.

Since the phase-out is only apparent, and not a real change in policy direction, Joe Salerno’s warning (“ A Reformulation of Austrian Business Cycle Theory in Light of the Financial Crisis,” p. 41) remains relevant:

(G)iven the unprecedented monetary interventions by the Fed and the enormous deficits run by the Obama administration, ABCT also explains the precarious nature of the current recovery and the growing probability that the U.S economy is headed for a 1970s-style stagflation.

While highly unlikely there is still time to do the right thing, follow the policy advice of Rothbard and the Austrians, as argued earlier in more detail here and here. Despite some short run costs which are likely small compared to the cost of a decade of stagnation, such a policy is the only reliable route to return the economy to sustainable prosperity.

John P. Cochran is emeritus dean of the Business School and emeritus professor of economics at Metropolitan State University of Denver and coauthor with Fred R. Glahe of The Hayek-Keynes Debate: Lessons for Current Business Cycle Research. He is also a senior scholar for the Mises Institute and serves on the editorial board of the Quarterly Journal of Austrian Economics. Send him mail. See John P. Cochran's article archives.

© 2014 Copyright John P. Cochran - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.