A GREAT Model to Understand Gold Price Swings

Commodities / Gold and Silver 2014 Nov 04, 2014 - 06:05 PM GMTBy: EWI

What do the last three chairs of the U.S. Federal Reserve have in common?

What do the last three chairs of the U.S. Federal Reserve have in common?

Well, it's not their taste in structured black blazers. It's the fact that they all see gold as a kind of Winston Churchill-like nesting doll -- a riddle wrapped in a mystery inside an enigma.

July 2013: Then Fed chairman Ben Bernanke told Congress he doesn't "pretend to understand gold prices... nobody does."

November 2013: At her confirmation hearing, Fed successor Janet Yellen concurred: "I don't think anybody has a very good model of what makes gold prices go up or down."

October 25, 2014: At the New Orleans Investment Conference, former Fed "The Maestro" Alan Greenspan explained that gold's "value as a currency is outside of the policies conducted by governments." (Wall Street Journal)

Translation: Folks, the highly revered institution I used to work for -- the one whose policies are often cited by the mainstream as a "catalyst" for gold prices -- doesn't actually control the marketplace.

But wait! 4 days later, on October 29, Greenspan then told the Council of Foreign Relations that the Fed's $4 trillion balance sheet is a "pile of tinder, but hasn't been lit." Once the central banks stop "sitting on" their reserves, said tinder will ignite, "inflation will eventually have to rise," and in turn, "gold will move higher, measurably so." (FXstreet.com)

Translation: Those policies actually do control the gold market -- it just takes a while for their potency to kick in. Like, say, 5 years of quantitative easing, 10 rate cuts to 0%, and $4 trillion in "inflation"-producing stimulus.

It makes you think: For those supposedly at the helm of where gold prices are going, they sure don't seem know how they got there.

But what if you could know? Not only how gold prices got to where they are, but also why and sometimes even where they are headed before they even turn?

Bernanke, Yellen, Greenspan, they're half right: Gold prices are difficult to understand. And there is no such thing as a 100% fool-proof model to forecasting its price trends. But there is a "good model" -- a great one, in fact: Elliott wave analysis.

Unlike conventional analysis, which looks outside the market for clues to future price action, Elliotticians look on the price charts themselves. There, when volatility doesn't blur the lines, we can detect specific patterns that indicate where prices are likely moving next.

You can use gold's 3-year-long sell-off as a prime example. Back in 2010-2011, gold's bullish "fundamental" picture was allegedly in the bag. The U.S. Federal Reserve just launched its $1-trillion-a-year quantitative easing program, which was widely expected to fuel gold's inflationary fire. An August 25, 2011 Gallup Poll confirmed:

"Americans Choose Gold as the Best Long-Term Investment."

Also this May 10, 2011 Reuters: "Deutsche Bank Eyes $2000 Gold. We believe the main beneficiary of super low interest rates in the U.S., a weak US dollar ... and ongoing questions over the stability of the financial system will be gold."

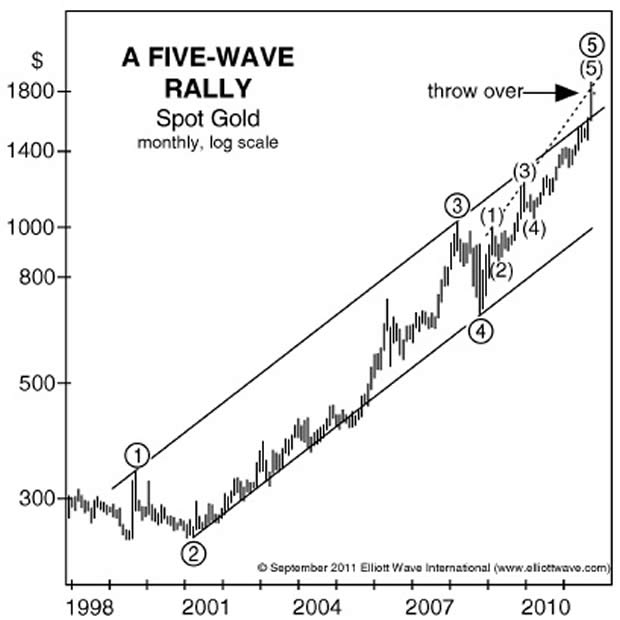

Elliott Wave International, however, saw a different outcome for gold on the metal's price chart: an impending decline. In the September 2011 Elliott Wave Financial Forecast, our analysis included the following chart, which showed gold prices at or near the end of a decade-long, 5-wave advance.

"Gold's wave structure is consistent with a terminating rise. [Elliott waves progress and therefore top out in 5 waves]. As this monthly chart shows, prices exceeded the upper line of the channel formed by the rally from the 1999 low in what Elliott terms a throw-over. A throw-over occurs at the end of a fifth wave, and represents a final burst of buying. The pattern is confirmed as complete once prices close back under the upper line, which currently crosses $1650."

From its September 2011 peak of $1921.50, gold prices have plunged 30%-plus, hitting a 4-year low on November 3 -- indeed confirming the Elliott set-up of a long-term tradable top the waves warned about three years ago.

An independent perspective like this gives you the opportunity to see financial markets in a radical new light; one that brings you closer to understanding the reason why prices move the way they do, and anticipating those moves before they take place.

Gold: The Big Picture and the Near-Term Outlook

You can better understand gold's price swings when you know the big picture in this precious metal. In these two 5-minute video clips from his presentation at the San Francisco MoneyShow in August 2014, EWI's Chief Market Analyst Steve Hochberg looks at a long-term chart of gold to demonstrate how extreme opinions cause most people, governments and central banks to act on a trend at just the wrong time. He then explains his current analysis, and he offers you his outlook for gold over the coming months. His forecast has already begun to take shape.

This article was syndicated by Elliott Wave International and was originally published under the headline A GREAT Model to Understand Gold's Price Swings. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.