Oil based Stock Indexes are Top Global Performers

Stock-Markets / Crude Oil May 23, 2008 - 06:38 AM GMTBy: Donald_W_Dony

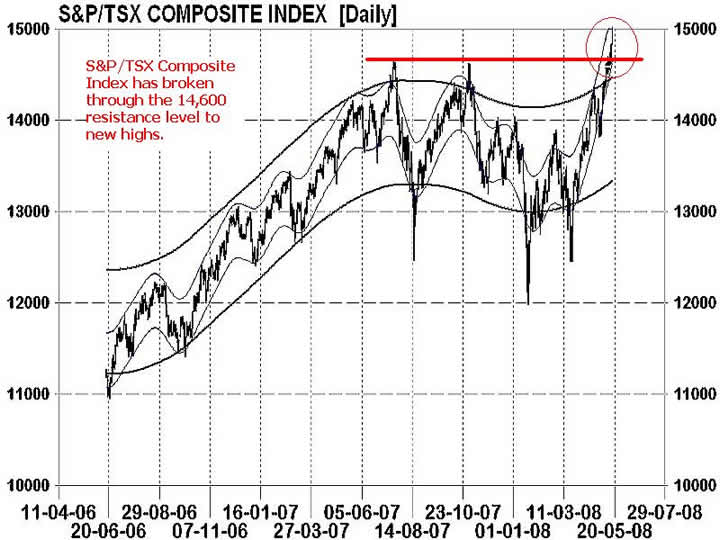

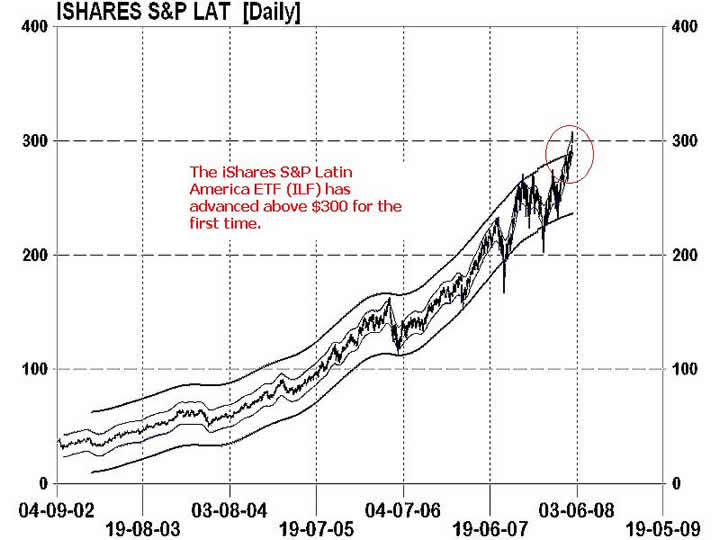

When all of the global equity indexes are reviewed for performance in 2008, one common thread binds the top performing groups. Those countries that have increasing oil production capabilities are the clear winners. Canada's energy heavy S&P/TSX, Russia and Latin American stock indexes have rallied to new highs whereas non-commodity-based and even other types of natural resource-based indexes have remained down.

When all of the global equity indexes are reviewed for performance in 2008, one common thread binds the top performing groups. Those countries that have increasing oil production capabilities are the clear winners. Canada's energy heavy S&P/TSX, Russia and Latin American stock indexes have rallied to new highs whereas non-commodity-based and even other types of natural resource-based indexes have remained down.

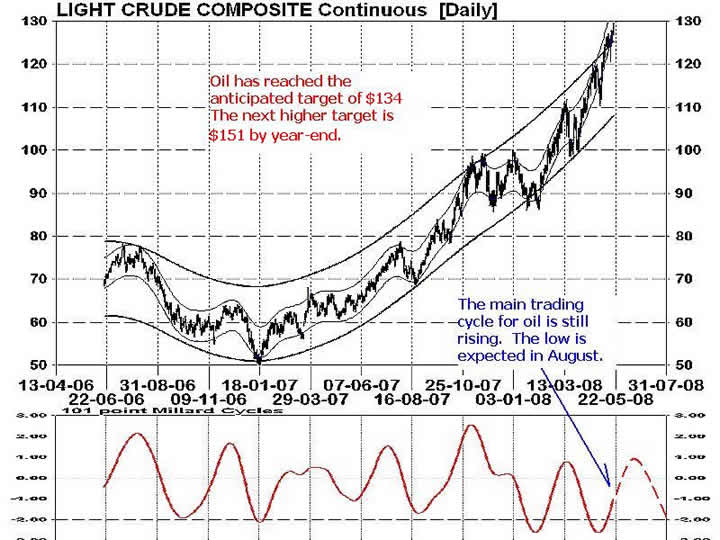

Chart 1 illustrates the dramatic rise in price of crude oil since early 2007. The fundamental demand from the expanding economies of Asia, and primarily China, have resulted in the importation of millions of additional barrels of oil per day to satisfy their growing economies. This additional strain on the global inventory is the primary cause for the rapid rise in energy prices.

This advance in the commodity's value has rocketed the profits of many energy companies in 2008 which has lifted those world stock indexes that are heavily weighted to this commodity to the top of their class. The stock indexes of Canada (Chart 2), Russia and several Latin American countries (Chart 3) have out performed virtually all other indexes including the S&P 500 and NASDAQ. And with the fundamental demand over supply favouring higher energy prices in the future, these few oil and gas weighted equity indexes will likely remain the best performers in the years to come.

Bottom line: The mounting global demand for oil and the shrinking supply will continue to drive the price of the commodity higher in the future. Estimates of $200+ per barrel in 2009-2010 are realistic projections given the soaring demand and shrinking supply.

Investment approach: The projected advance in oil can be tracked by several exchange traded funds (ETF). The Horizon BetaPro Bull (HOU) is a leveraged ETF that moves 2-to-1 to the price of crude oil. The United States Oil (USO), an ETF that tracks the percentage increase in West Texas Intermediate crude, has become one of the most popular ways to play the recent rally in oil in U.S. dollars. The iPath S&P GSCI Crude Oil Total Return exchange-traded note (OIL) is another vehicle that follows the movement of this commodity.

Additional research and investment suggestions are available in the upcoming June newsletter. Go to

www.technicalspeculator.com and click on member login

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2008 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.