When You Know a Company Cares: 3 Keys to Investing in a Bull Market

Companies / Investing 2014 Nov 04, 2014 - 04:29 PM GMTBy: Submissions

Chad Shoop writes: U.S. stocks are still very much in a bull market — just one with increasing volatility. In October, stocks suffered the sharpest drop since 2011, and then rebounded just as rapidly to close the month at, or near, all-time highs. It only leaves you guessing what the markets will do next.

Chad Shoop writes: U.S. stocks are still very much in a bull market — just one with increasing volatility. In October, stocks suffered the sharpest drop since 2011, and then rebounded just as rapidly to close the month at, or near, all-time highs. It only leaves you guessing what the markets will do next.

When the market is sitting at an all-time high, people are skeptical to purchase shares of a company. They think it’s bad investing, when all it really means is you just have to be extra careful about what you choose to invest in.

To find a company that cares about returning value to its shareholders — and that will be a good value over the longer term — you need to focus on firms that meet these three requirements:

- Does the company have a long history of offering dividend paying stocks?

- Does the company make a habit of increasing its dividend payments, as measured by three consecutive years of doing so?

- Does the company conduct share buybacks each year?

If the answer is “yes” to each of these questions, you can be comfortable jumping into these stocks.

Increasing Shareholder Value: What to Look For

These three items combined represent a company that has consistently grown shareholder value with its excess cash.

There are only a few options companies have to spend their excess capital on. The main three are paying dividends, buying back company shares and expanding capital expenditures. And if you’re consulting your investor checklist, two of these expenditures meet the requirements, while one is not the most ideal.

A company paying a dividend to investors shows that it cares about increasing value for its shareholders, which attracts more investors and tends to send shares higher, thereby increasing your return on investment.

Share buybacks allow the company to reduce the amount of shares outstanding, essentially boosting earnings per share without them even needing to grow. Dividing the company’s net income over a smaller amount of shares makes each share more valuable, which also boosts shareholder value.

Last on their list of things to spend excess capital on are capital expenditures. These are a great way to grow a business by investing more in research and development to create new products or simply making a strategic acquisition, and offers a potential increase in shareholder value — but it isn’t a sure thing for the company.

Take Facebook (NYSE: FB) as an example. The company recently reported a solid growth quarter, but once it announced its plans to triple its capital expenditures to invest in the business, the shares tanked.

I am not suggesting capital expenditures are bad, but when you compare them to dividends, I’ll take the cash in my pocket almost any day.

You want to invest in a company that provides dividend paying stocks, increasing the amount of those payments and increasing the value of shares. Capital expenditures are not the best way around that.

One stock that I really like today that meets all three of my proposed criteria is GlaxoSmithKline (NYSE: GSK).

Dividend Paying Stocks, Share Buybacks — Glaxo Has It All

At the peak of the stock market decline in mid-October, Glaxo was trading at its highest dividend yield ever — and that says a lot considering the company has paid a dividend every year since it became public in 1998. And today it is still yielding 5.5% despite a recent bounce.

As an added bonus, the stock is not trading at all-time highs like the rest of the market, leaving room for the security price to rise. In fact, the shares are still 16% off their 52-week high.

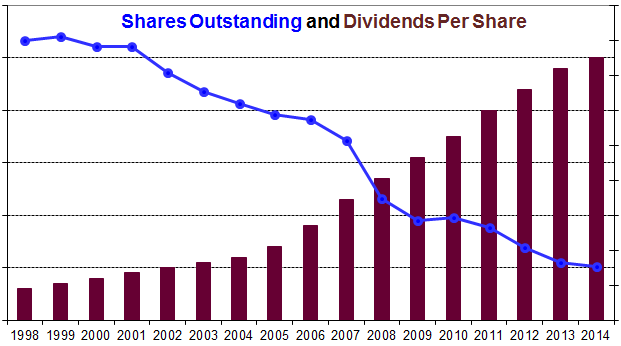

But, aside from paying a dividend every year, Glaxo has also steadily increased the amount of dividends paid per share. It has also reduced its shares outstanding almost every year.

Another thing that really stood out to me was Glaxo maintained these dividend increases and share buybacks right through the Great Recession without a hiccup. Take a look:

This demonstrates that the company is focused on paying dividends and increasing the value of shares — the core of building shareholder value.

In fact, the company’s dividend is expected to increase 3% this year and the firm bought back $25 million worth of shares in the third quarter.

As you can see, this is a company intent on building shareholder value that hits all three items on my checklist. In this bull market, GlaxoSmithKine is one of the few stocks that are a buy today.

Regards,

Chad Shoop

Editor, Pure Income

http://thesovereigninvestor.com

© 2014 Copyright Ted Baumann - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.