Silver Price Breaks Long-term Support Likely to Drop Further

Commodities / Gold and Silver 2014 Nov 03, 2014 - 04:19 AM GMTBy: Clive_Maund

Silver finally broke down from its long-term uptrend late last week, which was a very bearish development that has opened up the risk of an immediate severe drop. As with gold, silver looks set to enter a cycle of company failure and mine closure leading to an eventual production shortfall, which, coupled with a falling dollar after its current deflation induced "swan song" rally has played out, leads in turn to sharply rising prices and a spectacular rally in the stocks of companies who have managed to survive the imminent Great Cull.

Silver finally broke down from its long-term uptrend late last week, which was a very bearish development that has opened up the risk of an immediate severe drop. As with gold, silver looks set to enter a cycle of company failure and mine closure leading to an eventual production shortfall, which, coupled with a falling dollar after its current deflation induced "swan song" rally has played out, leads in turn to sharply rising prices and a spectacular rally in the stocks of companies who have managed to survive the imminent Great Cull.

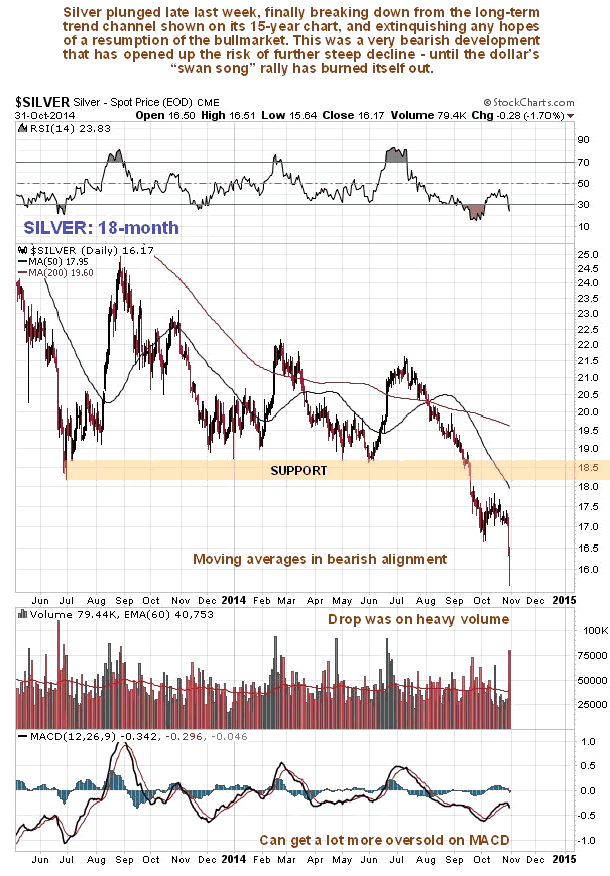

On silver's 18-month chart we can see that it had already crashed its support at last year's lows back in September. Despite this it was thought that it might turn up again, on account of its bullish looking COTs and sentiment indicators, and due to the fact that gold had not dropped below its lows of last year, and especially because silver had not broken down from its long-term uptrend - but last week changed all that as gold broke down below its lows of last year and silver finally succumbed and broke down from its long-term uptrend, both these developments being triggered by the dollar breaking out to new highs as it began another upleg.

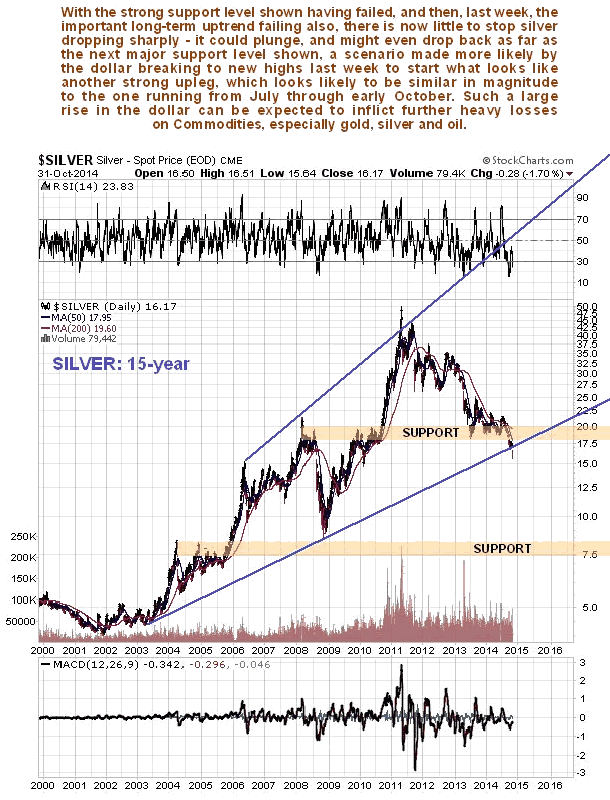

On its 15-year chart we can see the failure of the long-term uptrend late last week, and how this has put silver at risk of a steep drop that could even take it back as far as its strong support in the $8 area.

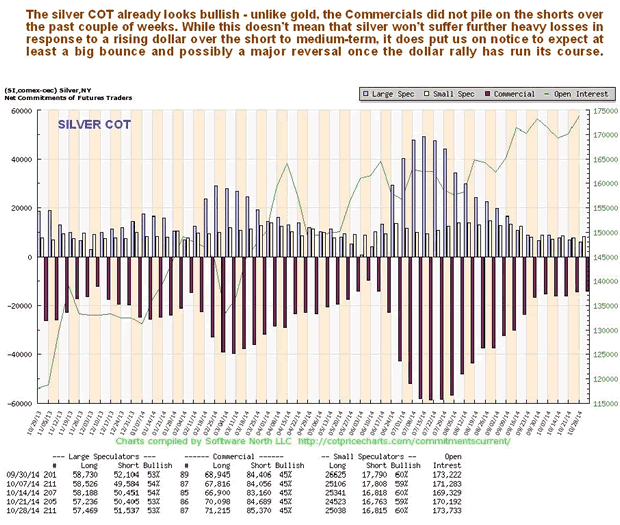

Silver's latest COT chart actually looks encouraging - Commercial short and Large Spec long positions did not ramp up in the past several weeks, as happened with gold, and we would ordinarily consider this COT chart to be bullish, but it is unlikely to come to silver's assistance until the current dollar rally has run its course.

We have taken a look at the outlook for the dollar index in the parallel Gold Market update, and have concluded that it looks set to run to about the 91.5 area, at which point we will be looking for a bottom in gold and silver. Such a rise is likely to inflict further heavy damage to the silver price, which is now vulnerable after the failure of both key support and its long-term uptrend.

Conclusion: silver looks set to drop steeply now until the current dollar rally has played itself out, but this looks set to be the decline into the final low, after which we should see a major resurgence as the dollar comes under renewed pressure after the current deflationary boost is eclipsed by the looming prospect of its losing its reserve currency status.

As usual, many of the arguments set out in the parallel Gold Market update apply equally to silver, and are not repeated here.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2014 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.