Gold Price, Dow Stock Market Index and VIX Analysis

Stock-Markets / Financial Markets 2014 Nov 02, 2014 - 04:25 PM GMTBy: Austin_Galt

Gold

Gold

Gold hit new lows in October so the bears are growling. Popular consensus seems to be they will continue to dominate the short term landscape. I suspect a bear trap has been set and they are about to be gored by the bulls.

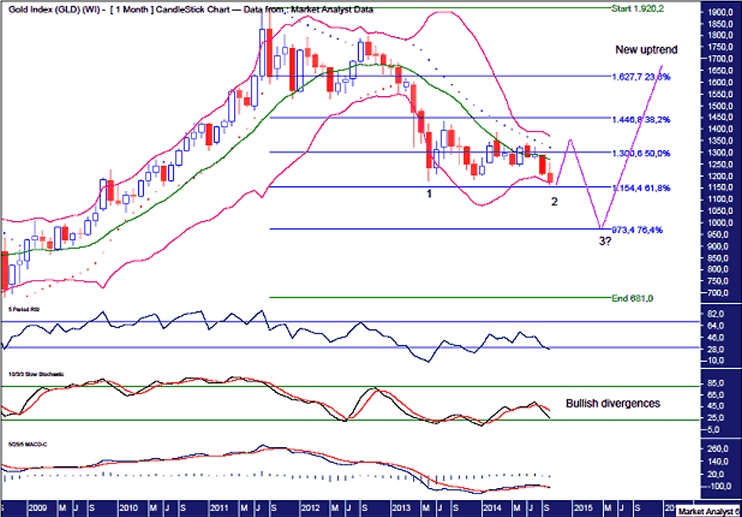

Let's take a look beginning with the monthly chart.

Gold Monthly Chart

We can see price has broken the key support level of $US1180 which was triple bottom support. This will mean many analysts will turn bearish if they weren't already. The way I see it is this support level was very obvious so it was odds on to get busted at some stage. Not to mention triple bottoms rarely end trends.

So price is now in no man's land, so to speak, and it may look a little scary for the bulls. So with the break of support meaning the majority are now bearish, that means the contrarian play would be to go long. And it is the contrarian play that often appears as the scariest play.

However, it is this break to new lows that has increased my confidence in my long term outlook. Why?

The new low brings into play the very common bottoming pattern which I call the "three strikes and you're out" low. This involves three consecutive lower lows. This is already in play with gold's cousin silver.

In general, with this bottom formation, if the second low is only marginally lower than the first low then the third and final low will be much lower than the second low. This is the scenario I favour for gold. Conversely, if the second low is much lower than the first low then the third and final low is likely to be only marginally lower than the second low. This looks to be the case with silver.

So if gold can make a low shortly then a rally can occur and then the final move to low will likely see a big whoosh to the downside. That fits in beautifully with my long term outlook.

And what evidence is the for a rally to occur now?

The Bollinger Bands show price is now down to the lower band. This may provide support and I'd like to see the expected rally get back up to the upper band.

The lower indicators, being the Relative Strength Indicator (RSI), Stochastic and Moving Average Convergence Divergence (MACD), are all showing bullish divergences on this new low.

Also, while the Parabolic Stop and Reverse (PSAR) indicator is showing a bearish bias with the dots above price, I would like to see this bearishness unwound before the move to final low. This would require a rally which busts the dots. Those dots are currently at US$1323 and are likely to be around US$1300 for the month of November.

Let's move on to the weekly chart.

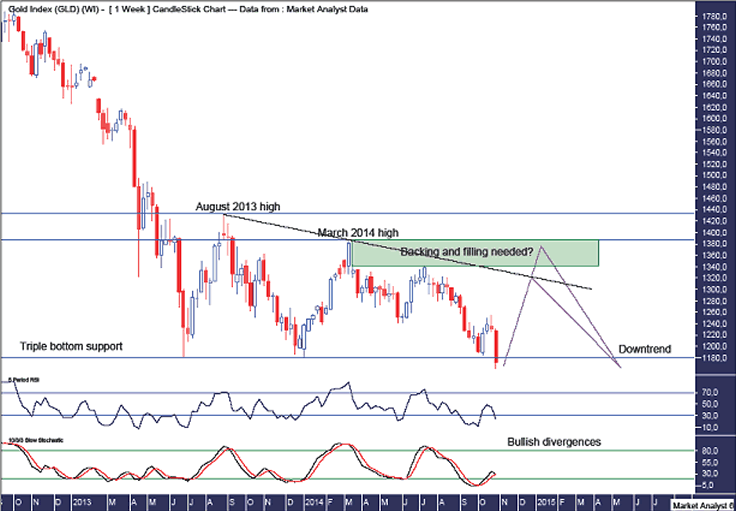

Gold Weekly Chart

We can see price has only marginally broken the triple bottom support. I would like to see price trade a touch lower as the current low looks too marginal to my eye.

The RSI and Stochastic indicator look set to show a bullish divergence with this low. Yet more evidence a rally may be close at hand.

So, if a rally is to take place, how high can we expect price to trade?

I have drawn a green highlighted rectangle which borders the July 2014 high at US$1339 and the March 2014 high at US$1387. My instincts lead me to believe this area needs some backing and filling. I am still looking for price to trade up into this area before the final move to low gets underway. Time will tell.

I have drawn a black down trend line across the tops of the August 2013 and March 2014 highs. I have been looking for price to break this trend line in a fake out move that lures in the last of the bulls before the bears bite back. I still favour this happening but with the recent move to new lows I give slightly more of a chance to this trend line holding price.

As for Elliott Wave labelling, well I haven't done so as I'm not so sure what it would be with the move to new lows. I am aware that many technicians are labelling the July 2014 high as the end of wave 4. That may well be so.

Now I am not an Elliott Wave expert but I'd be interested in what the labelling would be if price trades back up into the green highlighted rectangle which would mean price trading above the July 2014 high.

Personally, I only use Elliott Wave theory in a broad context to provide some structure to the picture. Actually, it's really just to make me feel all warm and fuzzy inside. The EW count holds no sway over my thinking. If there is EW labelling that fits in with the scenario I like then that's just fine and dandy. If not, then quite frankly, I couldn't give two hoots.

Let's move on to the daily chart.

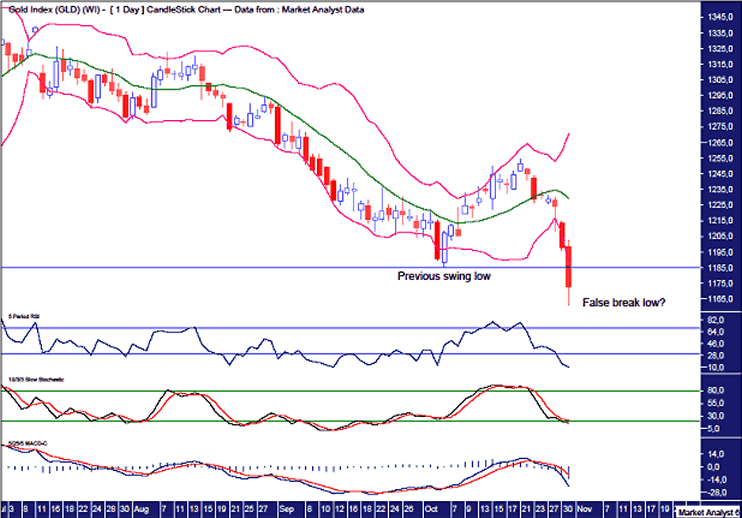

Gold Daily Chart

I have drawn a horizontal line denoting the previous swing low set on 6th October at US$1184. Price has cracked below there and there would have many bulls stopped out and many bears that have shorted the break.

The lower indicators, being the RSI, Stochastic and MACD, are looking bearish and in oversold territory. However, there is the potential for bullish divergences to accompany a low if it formed now. Another scenario is price rallies a little from here before trading lower and putting in a lower low that is also accompanied by bullish divergences. Let's see.

The Bollinger Bands shows price trading well outside the lower band. Highs and lows often form when price trades at these extremes outside the bands confines. Just look at the previous swing low for evidence of that.

Also, a common pattern for low is a false break low. With the negativity currently abounding in gold, I think the false break low set up is a excellent possibility here.

Finally, to touch on the fundamentals, many have been calling for much higher prices in gold due to the money printing of central banks around the world with the US Federal Reserve leading the charge. Some are bewildered by the big decline in price over the last few years. This is why I always favour the technicals over the fundamentals.

Now I am a massive fundamental gold bull and expect it to be one of the best "investments" heading into the end of this decade. However, gold will decide when the time is right to make the move higher. The technicals suggest that time is not yet...to me anyway.

I liken the current gold situation to that of the sub prime real estate situation last decade. We all knew there were serious problems with sub prime real estate in the US as early as 2006 and probably before. That's why some fundamental kingpins (you know who I'm talking about), were calling for a meltdown in the stock market well before it happened. The fundamental guys are smart in being able to identify the problem but they are usually too early with their calls.

I am very confident the gold price will soar much higher in the years to come and when it does the reason given will be all the money printing which begs inflation. So we already know what the reason will be. We just have to be patient and wait until gold gets in the mood. And it is the technicals that will be key in identifying that mood change!

Dow

Wow! What an impressive comeback the Dow has made from its mid October low! I've been calling for one last high to end this bull market but I must admit that I didn't expect it to have happened by the time I wrote this report.

Originally I was thinking price may find a short term high just below the September high before heading back down to put in a higher low and then heading back up to new all time highs. It was only on Thursday this past week that I suspected something was up. Why?

The move into the end of the week exhibited much more strength than I was expecting. This surprised me. Actually, market surprises don't really surprise me anymore. In fact, I'd be surprised if the market didn't surprise me. I now try and predict where and when I will be surprised.

But I digress. Sometimes when in doubt I find it helpful to think through the scenarios and specifically focus on what are the most popular and least popular ones. Now determining the contrarian position is much easier said than done. But here's my opinion for what it's worth.

The most popular scenario seemed to be a secondary high now before the bear market is on. Gone. The next most popular scenario is marginal new highs before the bear market is on. It is this scenario that I have been favouring....until now.

So what is the least popular scenario or contrarian position?

A barnstorming run higher which smashes into all time highs and surges much higher. I believe this is the contrarian position and it is this scenario that I now favour.

Let's check out the action on the weekly and monthly charts.

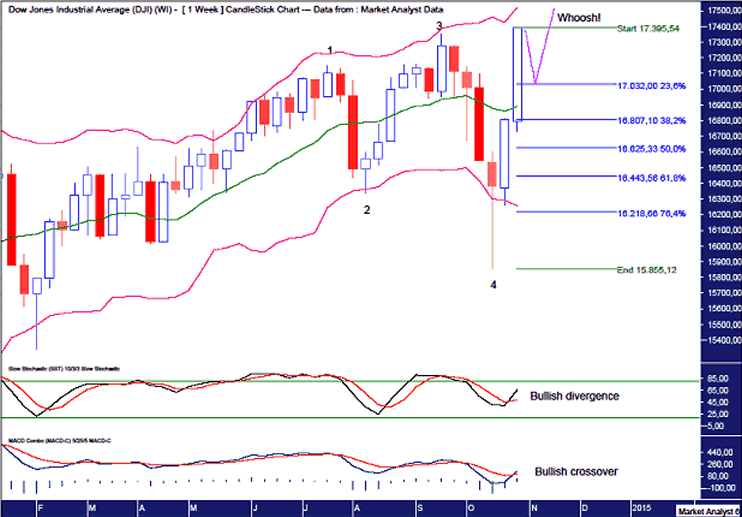

Dow Weekly Chart

The Bollinger Bands show the October low traded well outside the lower band. This often signifies a low just as it signifies a top when price trades well above the upper band.

So we now have a 5 point broadening top in play. And a "three strikes and you're out" top formation with the third and final high seemingly underway.

But how high can we expect price to trade?

Considering the second high or point 3 in the broadening top was only marginally above the first high, I favour the third and final high to be much higher than the second high. If the second high was much higher than the first higher then I would expect the third high to be only marginally higher.

So I am now expecting a big whoosh up to finish this bull market once and for all.

But how high?

Well, I find blue sky territory difficult to prognosticate so I must admit it is my work on some other world indices that leads me to believe we have around another 7% higher to go. Give or take 1%. That would produce a Dow high around 18400.

But let's not get ahead of ourselves. First, I believe a little pullback is in order. The surge to new highs on the last day of the month would have stopped out many bears while many bulls would have bought on stop. Once this buying is flushed out a move back below the previous high should occur.

And how low could we expect price to pullback?

Considering the strength being exhibited by price , I favour a minor pullback only. I have added Fibonacci retracement levels of the move up from October low to recent high. Price may trade a bit higher before correcting but it shouldn't overly affect the analysis.

So, a minor pullback would see price retreat to around the 23.6% level. Which stands at 17032. I doubt the bears have enough firepower to take price down to the 38.2% level at 16807.

The Stochastic indicator showed a bullish divergence on the October low and now has a bullish crossover in place while the Moving Average Convergence Divergence (MACD) indicator also shows a bullish bias with the blue line now above the red line.

There is a Bradley Model turn date on the 20th November but I have my doubts it will be able to stop the stampeding bulls. This model has been very helpful in the past but it canbe expected to be on song 100% of the time. Let's see.

So if not the 20th November, when could we expect the final high to occur?

I suspect the end of December or perhaps the start of January. I must say, with the No Mercy cycle expected to hit in 2015, I am leaning to the end of December. We'll know soon enough.

Despite some decent potential upside, I doubt I'll get involved preferring to wait for the final top as a shorting opportunity.

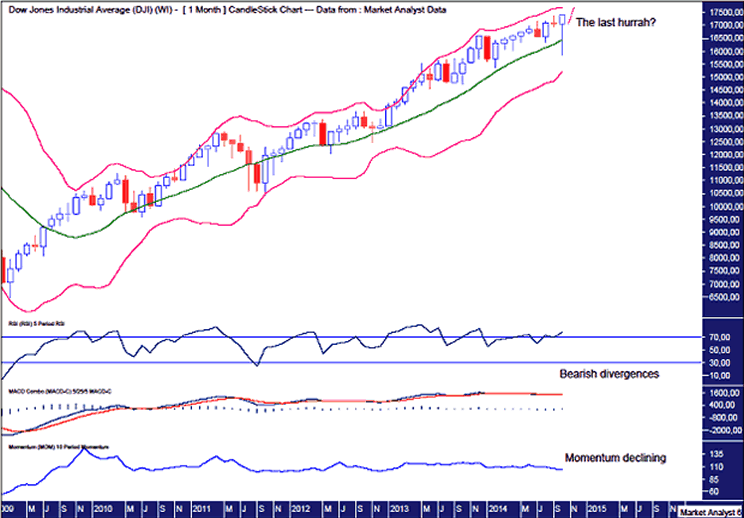

Dow Monthly Chart

While the weekly chart looks impressive, let's calm down and regather our senses with the monthly chart. The lower indicators, being the Relative Strength Indicator (RSI) and Stochastic indicator are still showing some serious bearish divergences while Momentum is still declining and suggesting something ominous is close at hand.

The Bollinger Bands show price finding support around the middle band. Now I'd like to see price trade well above the upper band which would most likely signify the bull market is done.

So, it appears all that is left now is one last hurrah.

VIX

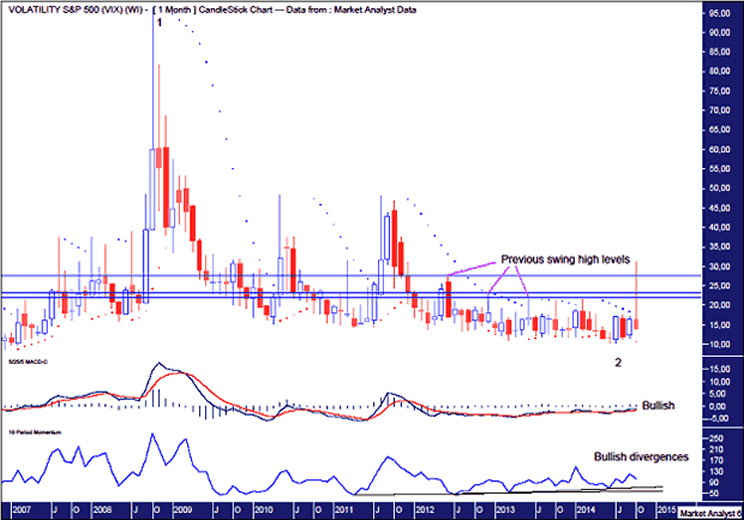

The Volatility Index (VIX) spiked up to a mid October high at 31.03 which blew away previous resistance levels. That was just the entrée. It's now time to digest that and get ready for the main course. Let's pick over the monthly and daily charts.

VIX Monthly Chart

We can see the big candle wick for October took out some major previous swing high levels. Many stock market bears were getting all giddy over this and rightly so. But this is just a taste of what is to come.

The Parabolic Stop and Reverse (PSAR) indicator now has a bullish bias after the dots to the upside were torched. As often happens after this, price then comes back to test the support given by the dots on the downside. The dots currently stand at 10.80 and I seriously doubt price will go below there now.

The Moving Average Convergence Divergence (MACD) indicator is bullish with the blue line above the red line after showing multiple bullish divergences into the final low back in June. Things look ready to pop here in the coming months.

The Momentum indicator also showed multiple bullish divergences and it now looks primed for a big move up.

I have added simple Elliott Wave annotations which show the all time high of 96.40 in 2008 to be the end of wave 1. The recent June low at 10.34 was higher than the previous major swing low of 8.60 set in 2006. So that is a higher low and can be considered the end of wave 2. That implies wave 3 is already underway which can be expected to eventually take out the all time high. Get ready to hold on to your hats folks!

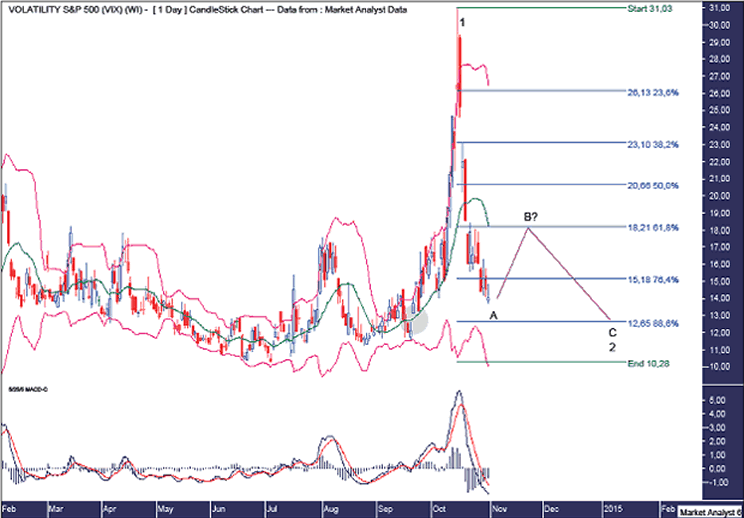

VIX Daily Chart

The Bollinger Bands show price at the recent high trading well above the upper band. This often calls for some regression to the mean and that is exactly what looks to be occurring now. Perhaps price will eventually put in a higher low around the lower band.

The MACD indicator shows the averages diverging quite a lot so a move back to "normality" looks on the cards. A rally in price should do just that although I do favour any rally being fairly muted.

I have added Fibonacci retracement levels of the move up from the June low to recent high. Pullbacks at the start of new bull trends often show deep retracements and I favour exactly that here. I am looking for price to get back to around the 88.6% level at 12.65.

I have drawn a green highlighted circle which shows a gap. The high of the gap is 13.13 while the low is 12.61. I am looking for this gap to be filled before the next major leg up commences. Interestingly, this gap is right around the 88.6% Fibonacci level.

Price is now just above the gap but I doubt it will get filled on this move down. I favour price rallying first before coming back down again and it is then that I expect the gap to be filled.

From the monthly analysis, it appears that major wave 3 up has already begun. The recent move up looks like wave 1 of this wave 3. That was just the appetiser - the French Fries move. Now we await the wave 2 low which may take a while to unfold and I suspect we are in the middle of an ABC correction with the B wave ahead of us. Then once the wave 2 low is in place we can expect minor wave 3 of major wave 3 to start - the Big Mac move. Mmmm!!!

By Austin Galt

Austin Galt is The Voodoo Analyst. I have studied charts for over 20 years and am currently a private trader. Several years ago I worked as a licensed advisor with a well known Australian stock broker. While there was an abundance of fundamental analysts, there seemed to be a dearth of technical analysts. My aim here is to provide my view of technical analysis that is both intriguing and misunderstood by many. I like to refer to it as the black magic of stock market analysis.

© 2014 Copyright The Voodoo Analyst - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.