Silver Eagle Sales Climb 87% Higher in October

Commodities / Gold and Silver 2014 Nov 02, 2014 - 05:38 AM GMTBy: Jason_Hamlin

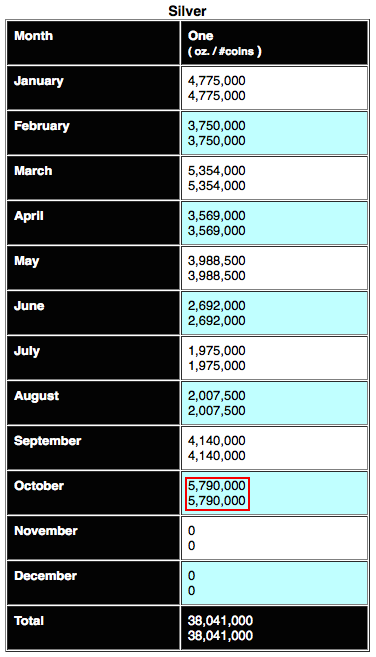

Silver Eagle sales for the month of October were the highest of the year at 5,790,000. This is up 40% versus September and a whopping 87.5% versus October of last year. With 38 million Silver Eagles sold thus far in 2014, the 2013 record of 42.7 million coins may very well be broken.

Investors appear to be taking advantage of the dip in silver and depressed paper prices. Several dealers are now reporting that premiums are climbing rapidly and the more popular silver coins are out of stock and on backorder. Cornerstone Bullion reported that:

The chart below shows the wild roller coaster ride that silver has been on over the past 5 years. Notice that the price is currently testing support around the $15-$16 range, where it had previously dipped and consolidated in early 2010. Analysts are coming out of the woodwork forecasting silver in the single digits, but at some point the supply and demand fundamentals are going to collide with the paper prices. I have a feeling that we are witnessing the capitulation stage now.

Follow our views on the gold market and track which stocks we hold in our portfolio by becoming a premium member.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. You can try it for just $35/month by clicking here.

Copyright © 2014 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.