The Most Important U.S. Economic Charts You'll See

Economics / US Economy Nov 01, 2014 - 11:28 AM GMTBy: DailyWealth

David Eifrig writes: The market is crashing... Ebola is running rampant... Look out for cloaked and bearded ISIS warriors.

David Eifrig writes: The market is crashing... Ebola is running rampant... Look out for cloaked and bearded ISIS warriors.

You can always find a lot of fear-mongering in the news and in financial markets. Right now, it appears to be a particularly worrisome time.

Most of it is nonsense...

The breathless fear-casting is largely meant to salvage dropping news ratings.

Always remember... paying too much attention to "news" is bad for your personal health and wealth. Regular readers of Retirement Millionaire understand the power of stress on your health, especially worrying about things you cannot control – things like the mini-wars around the Middle East. And it's not rational to fear things that will never do any damage to you.

So today, we're going to take a breath, calm down, and assess our risks. Doing so will help us "sleep well at night," especially when it comes to the economy. After all, no systemic problems – like a subprime meltdown, a tech bubble, or a gas crisis – are really fueling a serious panic.

Actually, the economy is healthy by virtually every measure I know. Let me show you...

The global economy is really based on the consumer. In the U.S., the consumer accounts for about 70% of the economy. So let's start there...

Consumer spending is growing. Personal consumption expenditures – essentially the amount of money that people are spending – have reached $11.9 trillion per year.

A lot of economic indicators are hitting new highs since the economy is bigger than ever. So let's focus more on growth rates than nominal dollar figures.

The growth in personal expenditures is now hitting 4.1%. In other words, personal spending is 4.1% higher than at the same time last year. That's up from 3% in February, not to mention it's a total reversal from the 3.3% contraction in 2009.

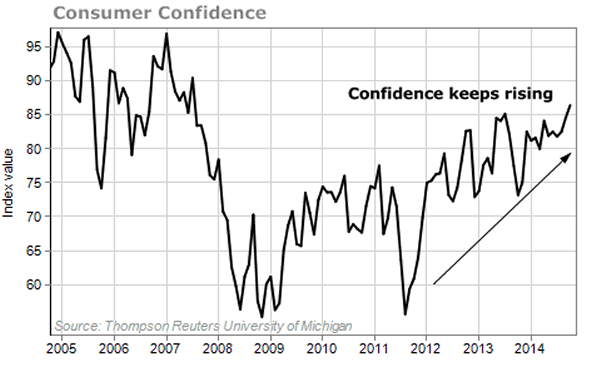

The reason people are willing to spend... is confidence. According to the University of Michigan Consumer Sentiment Index, consumers are consistently getting more excited about spending. The index's current reading of 86.4 is above its 85.1 average dating back to its 1966 beginning... and we're now at the highest reading since 2006.

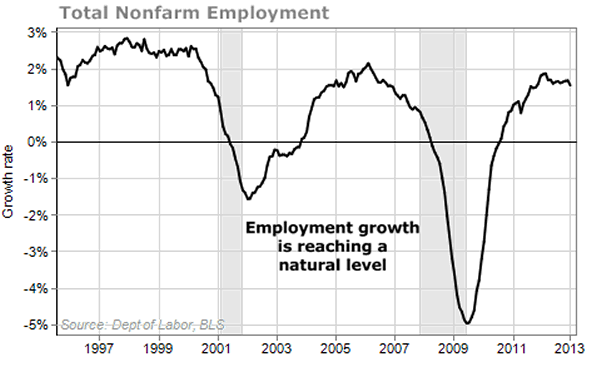

The reason people have gotten so confident... they are working again. The growth of total nonfarm employees finally hit a rate of about 2% per year. That matches a growing population, an increasing rate of retiring Baby Boomers, and the aging of America. It's also about the normal rate of growth since the 1990s.

That employment growth also comes along with sharp declines in unemployment and initial unemployment claims.

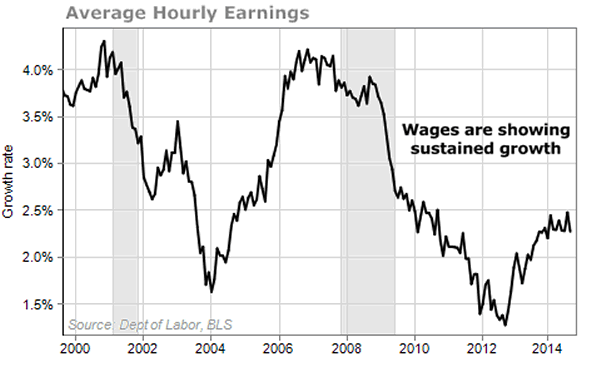

Most important, we've finally seen some momentum in wage growth. During the first few years of the recovery, workers' wages showed slowing signs of growth. That has turned around a bit. The average hourly earnings of production employees is now $20.67, about 2.2% more than last year. It's still slow, but growth is picking up.

That consumer activity is passing into the business side of things.

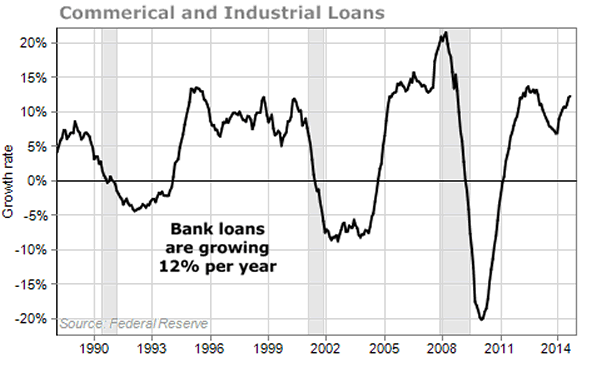

For example, businesses are getting bank loans for expansion and capital investment. Total bank loans are growing at about 12% per year. That's higher than it has been for most of the last 30 years.

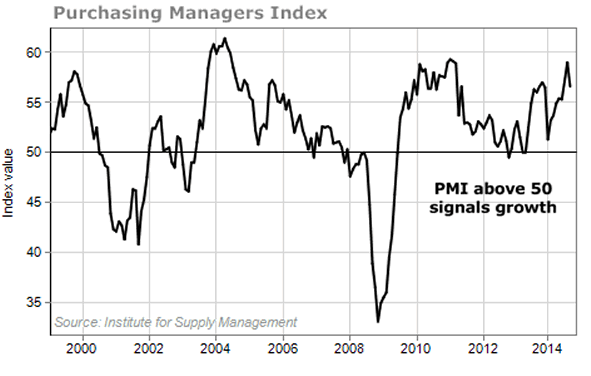

You can also see this in the excitement levels of manufacturers. The Institute of Supply Management Composite Index takes a monthly poll of 400 purchasing managers across various manufacturing sectors, asking about their plans for investing and buying.

When the index is above 50, it means these manufacturers plan on expanding their business.

Right now, the Purchasing Managers Index (PMI) is about as high as it gets. The current reading is 56.6. That's a hair under its August high of 59.

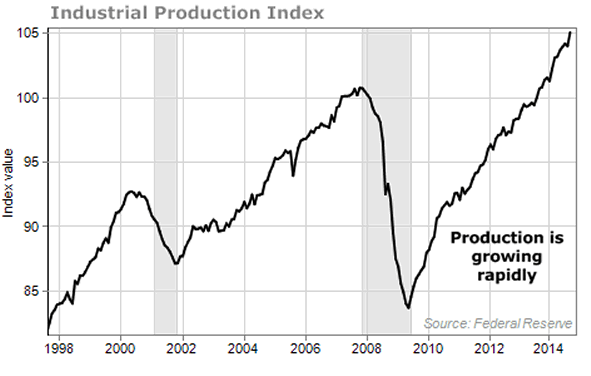

That index measures future plans, but real production is already growing fast. The Industrial Production Index combines the actual production of 312 different materials from manufacturing, mining, and electric and gas utilities in the U.S. Its growth is accelerating and hitting new highs each month.

Economics doesn't get simpler than this. Consumers are happy. They are spending. The factories respond by picking up production. Total industrial production is running at 79.3% of capacity, a new post-recession high. Plus, oil prices are about 20% lower than just a few months ago. Low energy costs should keep pushing these trends forward.

So don't buy into the fear-mongering of the 24-hour news cycle. The same things that have driven this bull market are still in place... Interest rates remain low, the economy is healthy and growing (albeit slowly), and now, we have the added benefit of lower oil prices.

As soon as these things begin to change, we'll let you know.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig Jr.

P.S. You can receive my latest economic updates and stock recommendations straight to your inbox with a risk-free trial subscription of Retirement Millionaire. And for a limited time, we're offering a 60% discount off the normal price. You can get the full details right here.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.