Gold And Silver – Elite Supernova Death Dance In PMs?

Commodities / Gold and Silver 2014 Nov 01, 2014 - 05:15 AM GMTBy: Michael_Noonan

On several occasions, over as many months, comments have been made here to the effect

that reading developing market activity is the best source for knowing what to expect,

moving forward. Most people have a need to rationalize the markets by coordinating

known events with the current price. Last year, it was how many record coin sales around

the world would impact the market, then the number of tonnes China and Russia were

importing. Lately, the opening of the Shanghai Gold Exchange where true price discovery

could be expected, the ongoing disappearance of reserves held by COMEX and LBMA, etc,

etc, etc., none of which had the market impact for which so many had hoped.

On several occasions, over as many months, comments have been made here to the effect

that reading developing market activity is the best source for knowing what to expect,

moving forward. Most people have a need to rationalize the markets by coordinating

known events with the current price. Last year, it was how many record coin sales around

the world would impact the market, then the number of tonnes China and Russia were

importing. Lately, the opening of the Shanghai Gold Exchange where true price discovery

could be expected, the ongoing disappearance of reserves held by COMEX and LBMA, etc,

etc, etc., none of which had the market impact for which so many had hoped.

Despite all the overt bullish demand for physical metals, gold and silver have been making new recent lows, reaching levels few imagined, even just several months ago. What has been missing is an explanation for why the PMs continue to decline, and we have been postulating that the Rothschild elites have been responsible for the perpetual downward manipulation in defiance of known fundamentals.

History proves all fiat money systems fail, and the United States with its toxic fiat Federal Reserve Notes, in the multi-trillions are destined to join the same fate of failure. Is it any different this time? No, but degree to which circumstances have been distorted is far beyond anything else, historically. As a consequence, expectations have not been able to adjust to the greatly exaggerated conditions.

A supernova is when a very big star explodes. This happens when a star runs out of energy to make heat and light, so it collapses, then explodes, its brilliance at its peak just prior to its ultimate demise.

What we are witnessing is the likely supernova death dance of the existing Rothschild dynasty, flaring up in its culminating demise after a few hundred years of unparalleled financial power. The “silver stake” in the heart of that insidious group is silver and gold, the kryptonite against the Rothschild central bank fiat.

This is not to imply that the end will be immediate for it may yet take much more time, a more likely scenario. A few indicators are the switch of the head of Deutsche Bank, as one example. Its current CFO is to be replaced by an ex-Goldman Sachs executive, one of the primary sources for elite-control of how business is conducted. This indicates the status quo is still calling the shots. Deutsche Skatbank is now going to charge its large depositors a .25% fee for keeping their cash in the bank, a negative interest rate. Only the fiat central bankers would keep draining people of their own money. “What’s yours is ours,” is their motto. As long as it is business as usual, PM are going nowhere.

Another key event is the Swiss referendum at the end of November to see if the central bank will be required to increase its gold holdings to 20% from the current 7.8%. This event will be a huge tell. Obviously, Swiss central bankers are solidly opposed to this restriction, preventing them from irresponsibly issuing fiat at will. If passed, the Swiss would have to purchase around 1,700 tonnes of gold, and that is about 70% of total annual gold production. It would create havoc for the gold-selling manipulators.

The referendum is popular with the people who favor a return to more sound money management for their economy. If the measure fails, it will once again demonstrate that people do not matter, only bankers and their corrupt debt-enslavement of the masses. A win for the bankers is a loss for everyone else, and it will tell you that the timetable for a recovery in gold and silver will still be on hold and central bankers are still in control. It will be a set-back for anyone’s timetable.

We cannot point to anything in the US because the public is fed a constant flow of lies from the elite back-pocket-owned media. Gold is not considered to be any kind of a store of value, and its holding by the public has been erased from their pliant minds. The only buyers and holders of precious metals are those who are more independently minded and more informed, but even their mental mettle is being tested by this constant suppression of prices.

Are the elites winning? Absolutely. Can they persist over time? Absolutely, but the probability of keeping price suppressed keeps diminishing with the passage of time. When will that point in time come? That is another absolute, which is: not a day sooner than when it happens, and not even the Rothschilds could provide the answer if their sordid lives depended on it. The best anyone can do is to accept what is, the unknown or the unknowable.

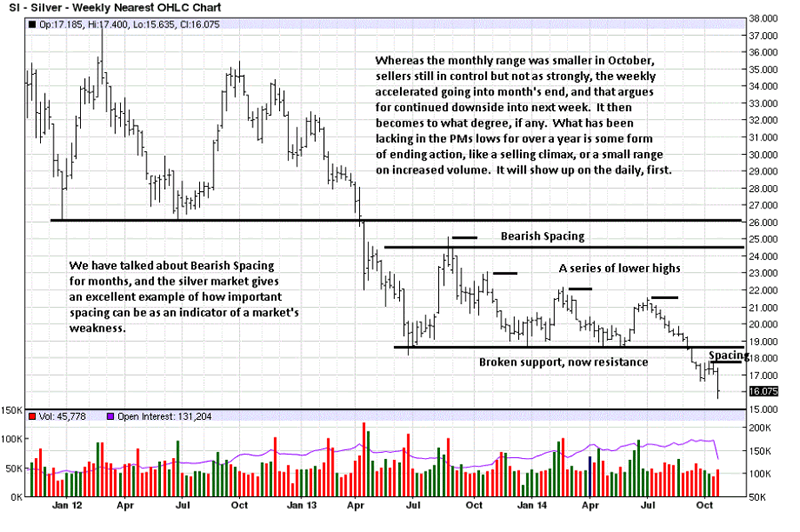

We were as surprised as anyone that 26 in silver did not hold, and also when it took over a year as price moved in a trading range, and even more surprised to see a 16 handle, even 15, briefly, last week. However, it is what it is, and it is a clear message that the elites are not going to give up easily, if at all, even if self-destruction is required. All anyone can do is be prepared for what is certain to come, even though its certainty as an event is anyone’s guess.

Are PM holders dissatisfied, disillusioned? Many are, maybe most, but their feelings cannot and will not change what is. If anyone bought and held gold/silver with the expectation of selling it for a higher price over the past year or two, then that was a speculation, less leveraged than buying futures, but speculation nonetheless. The primary reason for buying and holding gold/silver, it seems, is as a store of value for when the fiat system collapses, as it will, and under this consideration, time was less of a factor, even though expectations have been somewhat dashed.

With little or no intent to sell one’s holdings, one has less value than in the past few years. It is more akin to the housing bubble. Many who own homes have seen their property values decline. Does that mean home owners will sell simply because the price has dropped? No. The same holds true for stackers of silver and gold. You do not sell simply because price is lower. The driving down of price is intended to take the wind out of the sails of PM holders. That alone should be a sufficient message that owning both gold and silver is the right tactic.

What has ben missing during this 3+ year decline in PMs has been what we have pointed to on several occasions, a form of ending action that sends a message that a change in trend is in progress. Last Thursday and Friday’s sharply higher volume and wide ranges lower is the kind of activity that leads to the end of a trend. There is not enough to say it has happened, to be sure, but the end game is starting to step up and be closer to a resolve of ending of the down trend.

The monthly shows no promise of change in the direction where price has been headed. It may not be what many want to hear, but it is what the market is indicating. A point to be made for addressing the disappointment of how price has declined without respite for the past few years. It stems in large from believing the bullish news related to gold and silver and hanging one’s hopes on such events, even though there was no indication from the charts that a trend change was in the making. This is why we never stop saying that the charts are the best source for market indications.

Ultimately, fundamentals will prevail, but the greatest weakness of fundamentals is the almost total absence of timing, and in the markets, as we all know, timing is everything.

Here is a great example of what having a bias in a market can do. We have talked about bearish spacing for over a year, and it is called “bearish” spacing for a reason, that being a sign of market weakness. Within the trading range of the past 17 months, the market has shown a series of lower swing highs. A lower swing high is another indication of weakness, and they are a hallmark of a bear trend.

Yet, price kept holding the 18.60 area, giving reason to “believe” a bottom may be forming. [Beliefs are perceptions about reality but not necessarily reality itslef. Change the belief, and you change the reality.] We are not impervious to the bullish news about PMs, and the fact that we have been buyers of the physical before and after the highs gives a bias toward “believing” fiat will fail and gold and silver will prevail.

Maintaining a bias translates into how markets are perceived. The combination of bearish spacing, a series of consecutively lower swing highs, especially when the last swing high rally fizzled out in June, meant the probability of support breaking increased significantly. Our bias allowed for seeing and recognizing both, but the biased “belief” partially blocked the importance of what the market’s message was sending. This is why we are surprised to see support broken, but can more readily accept what is because the market never wavered in its bearish message.

Last Thursday and Friday are signs of panic selling, based on the sharp increase in volume at the lows. That the sharp increase occurred at the lows tells us strong hands are in the market taking whatever sellers have to offer. It is too soon to assess if last week is a sign of bottoming activity, but the level of volume is an important tell.

As an aside, the gold/silver ratio is just over 72:1, and this favors buying silver over gold on the premise that the ratio will come in at some point in the future. It says that at some point, silver will out perform gold.

The fact that the gold/silver ratio still shows gold as being stronger than silver is evident in the charts. Gold has breached its 1170 area support, but not by much. Keep in mind that support is an area and not some absolute number.

Chart comments apply, and not much more can be added.

We view the sharp decline and equally sharp volume increase as a positive development. Why? It tells us that the end of the trend is nearing more than the market has indicated for the past few years. These low levels are a gift for physical PM buyers. Anyone who bought gold at $1,600 or higher, expecting considerably higher prices should view being able to buy it 25% cheaper should be as ecstatic as the Chinese and Russians, both of whom are buyers of the physical knowing full well the higher prices are coming. Their time frame is much longer, but their convictions as to direction are no less resolute than yours have been and should continue to be.

Fundamentally, the most bearish news last week came from Alan Greenspan who said to buy gold. “Come into my house,” said the spider to the fly.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.