What USA Today Got Wrong About the Stock Market Fear Gauge

Stock-Markets / Volatility Oct 31, 2014 - 05:52 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes:

Like many newspapers racing for headlines during the recent pullback, USA Today Money highlighted a rapid rise in the VIX as proof positive that “fear” had returned to the markets.

Keith Fitz-Gerald writes:

Like many newspapers racing for headlines during the recent pullback, USA Today Money highlighted a rapid rise in the VIX as proof positive that “fear” had returned to the markets.

That fear had “spiked,” to use their words.

Take a look at this clipping…

Here’s the problem.

USA Today doesn’t understand what the VIX is measuring.

That means millions of readers were left with the wrong message.

The VIX’s rapid rise was actually a tremendous profit opportunity. And will be again when it happens next.

Today I want to talk about “trading volatility.” It’s a tactic that’s a great complement to the Total Wealth approach. It’s easy to understand and even easier to do than you might think, especially if you use the limited risk approach I’m going to share with you in a moment.

But first, we’ve got to take a quick look at what volatility actually is – and why USA Today is wrong that a spike in volatility is synonymous with a spike in fear. That way, trading it will make sense.

Chances are, you’ve probably heard the term before. It may even seem like that’s all anybody is talking about lately, given that the Dow, the S&P 500, and the Nasdaq look like they’ve been co-opted by a roller coaster designer or a preschooler with a passion for drawing on walls using Crayolas. But I’m willing to bet you’ve never thought about actually trading it.

There are a number of reasons why you would want to. Trading volatility can:

- Increase diversification

- Boost returns

- Limit risk

And now is a better time than ever to get started.

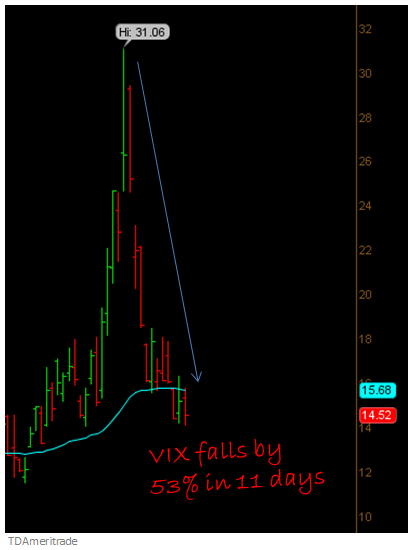

That’s because the VIX, which is a measure of volatility associated with the S&P 500, jumped almost two-fold on October 15, from a low of 16.09 to an intraday peak of 31.06. Again, that’s the highest level recorded since 2011. It’s since backed off to 14.52 as I write this.

Many traders are wondering if the worst has passed, especially since sharp VIX spikes tend to be accompanied by equally sharp declines in the S&P 500.

Frankly, I could make the argument either way, but to do so would really be a moot point. What matters is that the VIX is nowhere near levels we saw in 2001, 2008, or even in 2010 and 2011, when the volatility index crested to near 50 before retracing to its longer-term average of about 20.

That makes sense if you think about what was happening at each of those times. In 2001 we saw the first real dot.bomb wipeouts. In 2008 it was all about the Financial Crisis as derivatives imploded. In 2010, stocks fluctuated wildly on fears of a European debt crisis. In 2011, the U.S. suffered a credit rating downgrade, leading many to believe that the end of the financial universe was upon us. In mid-October, we had Ebola and the fear that goes with it.

I don’t want to downplay that “fear” one bit, but I do want to make a point.

What the VIX Is REALLY Telling You

The VIX is an expression of the underlying volatility of S&P 500 index options. That means it’s really an expression of expectations over the next 30 days, not the next 30 minutes.

For example, a reading of 15 means that traders believe that the S&P 500 will move by less than 15%/√12, or 4.33%, over the next 30 days. The VIX is always expressed in percentage points based on a single standard deviation move, which is 68%, give or take, if you remember your high school statistics classes.

Those numbers reveal a 68% probability of a 4.33% movement in the S&P 500 within 30 days – hardly worth the panic you saw in the news the week of October 13th-17th.

The other thing worth mentioning here is that a high VIX reading does not guarantee stocks are going to go down.

In fact, high VIX readings tell you that stocks could just as easily go up.

Two Key Takeaways on Volatility

First, the VIX rises because there’s uncertainty, not necessarily because there is fear.

That’s a common misperception promulgated by the media because it makes for sensational headlines. (USA Today is hardly the only major media outlet guilty of this.) And that speaks to something else we talk about all the time – why it’s important to buy when others are selling. Other investors pay lip service to this, but we take it to heart because that’s the path to profits.

I know high VIX readings can be scary, but take a deep breath.

As an investor, this second side to the volatility coin means that there is ample incentive for to stay in the game even if things get crazy.

Ergo… if you’re investing in companies with growing earnings, cash flow, and market share like those I recommend here as part of the Total Wealth process or as part of my newsletter, the Money Map Report, then volatility is not a bad thing.

Second, you want to learn to embrace volatility because of what it actually represents – opportunity.

As an investor, you can appreciate the fact that there is plenty of movement in the VIX, which is exactly what you want to see if you’re trying to profit from changes in price. If you ever hang around professional traders, that’s something you’ll hear a lot. What they hate is markets that go nowhere because that limits their opportunity – and yours.

How to Trade Volatility

As you might expect, there are lots of ways to trade volatility ranging from the very simple to the hopelessly complex. I’m for “simple” every time.

The VIX is a range-bound index. As such, it’s not so much the reading that matters, but where it is at any given moment in time.

For example, if the VIX is low, that generally means traders see little on the horizon that makes them uncomfortable. Buying long-dated VIX call options is the path to potential profits in this scenario. Any time the VIX is under 14, that’s a great time to start adding a few contracts to here and there. Then you wait.

The play is very straightforward. Somewhere in the next 10-12 months, the odds are good that some whammy will strike, anxiety will rise and the VIX will explode higher, taking the VIX call options you own along for the ride. What that “whammy” is actually doesn’t matter. It could be a Fed announcement, another Ebola case, a change in the White House, or something else.

If the reverse is true and the VIX has spiked, that means uncertainty is higher than normal. So buying VIX puts is your play because what you are banking on is a “calming down” and a return to reason that reduces uncertainty. That usually happens much faster than people realize. My research suggests that buying puts that match the VIX reading about 30-45 days in front of expiration is the sweet spot, though as the data below illustrates, markets can “calm down” even sooner.

Right now, for example, the VIX has fallen by 53% in only 11 days.

How would that work out?

Well, let’s just say you bought the VIX November 2014 $15 calls back in October 3, 2014, for $2.13 per contract before the S&P 500 rolled over. By October 15 when Ebola-related fears hit in earnest, those same options would be worth $7.35, for a 245% return in less than two weeks.

Or, let’s suppose you waded in just as fears peaked and bought the VIX November 2014 $26 puts for $6.15 per contract. Only six days later, those same puts would be worth $9.45 because the VIX had relaxed. That’s a 54% gain.

In closing, trading the VIX can make sense if you’re looking for a way to boost your returns and diversify your holdings using a limited risk choice that can harness an area of the market that is largely untapped.

As always, though, you never want to put all your eggs in one basket.

My suggestion is that you keep any VIX trade to 2% or less of tradable capital to minimize risk, even though you are trading “risk” itself. That way, you won’t blow up your portfolio – even if the markets try to.

See you next week.

Best regards for great investing,

Keith

Source : http://totalwealthresearch.com/2014/10/usa-today-got-wrong-fear-gauge/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.