Western Economies Experiencing Early Stages of Stagflation

Economics / Stagflation May 22, 2008 - 05:40 AM GMTBy: Mark_OByrne

Gold and silver continued to surge yesterday with gold up nearly 1% (up $8.25 to $927.80) and silver up 2% (up $0.35 to $17.97). Gold continued to rally in Asia but has succumbed to some profit taking in early trade in Europe.

Gold has risen on the continuing oil surge with oil reaching new record highs (above $135) again this morning and oil remains near these record levels.

Gold and silver continued to surge yesterday with gold up nearly 1% (up $8.25 to $927.80) and silver up 2% (up $0.35 to $17.97). Gold continued to rally in Asia but has succumbed to some profit taking in early trade in Europe.

Gold has risen on the continuing oil surge with oil reaching new record highs (above $135) again this morning and oil remains near these record levels.

After falling to a monthly low below 1.58 to the Euro last night, this morning the dollar is tentatively stronger versus the Euro but is down against sterling and most other currencies.

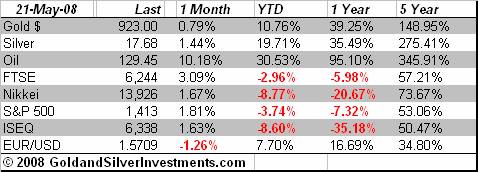

Investors are prudently hedging against inflation with gold and some see gold as a safer play than oil right now because gold has had a healthy correction and is flat in the last 30 days while oil has surged to new record highs and is up more than 10% in the last 30 days. Uncertainty regarding the outlook for stock markets which historically have performed very badly in periods of stagflation will lead to a resumption of safe haven demand in the coming weeks.

The gold/ oil ratio strongly suggests that oil is now a hold or sell while gold is again a buy. Similarly with the silver/ oil ratio.

Western Economies Experiencing Early Stages of Stagflation

The inflation genie is well and truly out of the lamp and with the Federal Reserve reducing their growth forecasts for the year yesterday, the U.S. and most western economies are now facing a nasty bout of stagflation.

Federal Reserve officials reduced their projections for economic growth this year by almost a full percentage point and raised their forecasts for inflation amid curtailed bank lending and a record rise in the prices for oil and other commodities. Policy makers estimate U.S. gross domestic product will increase by 0.3 percent to 1.2 percent this year, compared to the 1.3 percent to 2 percent growth they predicted in January, according to Fed records released today. Consumer prices, minus food and energy costs, (a ridiculous barometer of inflation if ever there was one) are projected to rise by 2.2 percent to 2.4 percent.

Stagflation has arrived and yet there continues to be a ‘hear no evil, see no evil' and head in the sand attitude and a wishful thinking that these conditions will soon disappear and we can return to the “good” decade of the 1990's. While we all hope for such an outcome, the reality is likely to be much different as the benign financial and economic years of recent history degenerate into a far less benign and challenging financial and economic era.

This new era will be marked by low or no growth and high inflation and gold and silver's finite qualities will come into their own again. Real diversification and risk aversion remains essential.

Today's Data and Influences

Today sees the release of Weekly US jobless claims, with economists forecasting a total of 375,000 new filings compared with 371,000 in the prior week.

Silver

Silver is trading at $18.02/18.07 per ounce at 1100 GMT.

PGMs

Platinum is trading at $2187/2207 per ounce (1100 GMT).

Palladium is trading at $453/458 per ounce (1100 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.