Bitcoin Price Narrow Range, Might Not Be for Long

Currencies / Bitcoin Oct 29, 2014 - 04:55 AM GMTBy: Mike_McAra

To the point: no speculative positions.

To the point: no speculative positions.

Bitcoin companies are already working on various issues regarding regulatory compliance. Arthur Levitt, a former SEC chairman, is now advising two Bitcoin-related companies, we read on the Wall Street Journal Website:

Arthur Levitt, the longest-serving chairman of the Securities and Exchange Commission, is joining the advisory boards of two bitcoin-focused companies.

As an adviser to Atlanta-based BitPay, a bitcoin payment processor, and Vaurum, a Palo Alto-based bitcoin exchange for institutional investors, Mr. Levitt says he hopes to "help them understand the imperative of a robust approach to regulation" if bitcoin is to fulfill its promise to further shake up the world of finance. The appointments will be formally announced Tuesday.

(...)

"The intellectual firepower behind [bitcoin] enterprises is astonishing," Mr. Levitt said. "But I think in terms of compliance and regulations, they are relatively immature."

He said bitcoin needs regulation to build the trust of the broader population and boost adoption. Bitcoin firms "must have as their top priority a greater public understanding of what bitcoin is, how it works" and of the improvement it brings by "imposing competitiveness on establishment practices and procedures," he added.

This is probably a major development for the companies involved, but also a sign that Bitcoin startups are approaching the theme of regulation with care and seriousness. No doubt, Mr. Levitt's expertise might help the firms realize what might be required of them by the SEC or other government agencies.

It also seems that Mr. Levitt's comments show that he has some understanding of Bitcoin companies. As we have expressed in the past, the action of promoting Bitcoin and making the general audience aware of what the currency exactly is will be one the most important parts of the evolution of the system.

On top of that, it's inevitable that more regulation will come in so the companies should get ready for this and possible make preemptive moves either to sit down with regulators and try to get the up to speed on what Bitcoin is, or consult people familiar with the regulatory requirements Bitcoin and Bitcoin startups might face in the future. Mr. Levitt's appointment falls into the second category.

For now, let's focus on the recent developments in the market.

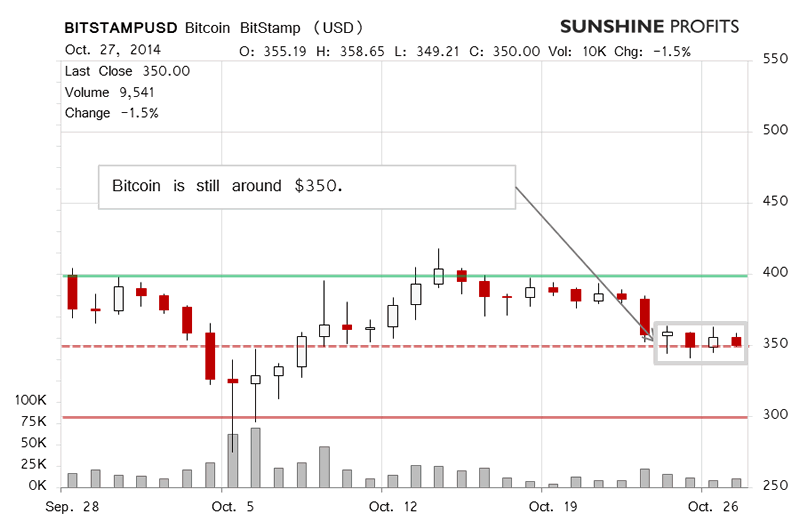

On the BitStamp chart we continue to see the pattern of small moves around $350. Yesterday was a classic case of such a development with the price range relatively narrow and the volume still relatively weak and we commented on that situation in the following way:

Today, Bitcoin hasn't moved much and is still above $350 (this is written after 1:15 p.m.). We still haven't seen enough clarification to determine which scenario, depreciation or appreciation, is currently in progress. For the time being, it seems that the market is experiencing a period of weakness with the volume down and the currency not exactly breaking with its recent trend. As such, it seems that we might see a slip below $350 (dashed red line in the chart), to $300. The action, however, is not conclusive enough to go short.

Not much has changed since this comment was posted. We've seen some movement above $350 today (this is written before 11:15 a.m. ET) without this level being breached (dashed red line in the chart). On the other hand, the volume seems to be down today to relatively low levels. Combine this with the fact that the range of moves has generally been on a slide since the recent slump (with one exception) and you get a picture where we haven't seen a strong move for some time, the short-term outlook is deteriorating and Bitcoin might be ready to follow the recent trend down.

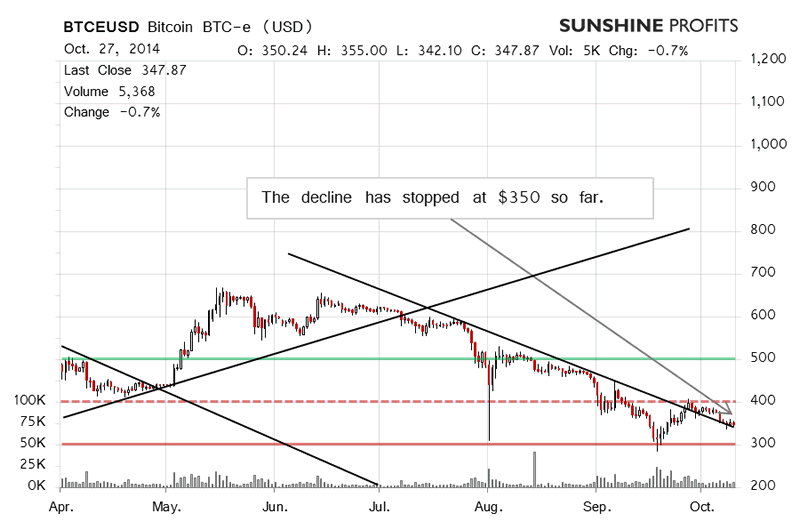

The long-term BTC-e chart displays a consistent image. Bitcoin has been going down since mid-October and this decline seems to fit well with the overall trend which has been down for some time now. Yesterday, we went on to write:

The overall picture is more of a move down than anything else. This move follows a relatively strong correction to the upside. We've seen around half of the recent move up being wiped out. We're getting close to the point where we might just as well see a rebound. We haven't seen any sign of it yet.

The situation might actually get more bearish if we see a slip below $350 but also if we see a period of weak depreciation or stagnation. It seems that if we see a move down, the currency might go as low as $350. The situation looks more bearish than not today but the circumstances don't seem bearish enough to go short at the moment.

These remarks are still up to date today. Bitcoin hasn't moved below $350 strongly and the volume has been modest. Yet another day has passed since the recent slump and without a significant rebound. All this makes the short-term outlook even more bearish than it was yesterday. However, at the moment of writing, there hasn't been a meaningful sign of weakness, either. In these circumstances we stick to the previously-outlined strategy of waiting on the sidelines with limit orders ready to be triggered on a sign of more action in the market.

Summing up, we don't support any speculative positions at the moment.

Trading position (short-term, our opinion): no current positions. A sell limit order, entry at $332, stop-loss at $377, take-profit at $307. Additionally, a buy limit order, entry at $427, stop-loss at $357, initial target at $500.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.