Does Gold Price Always Respond to Real Interest Rates?

Commodities / Gold and Silver 2014 Oct 28, 2014 - 12:05 PM GMTBy: Arkadiusz_Sieron

Generally, the real interest rates are negatively correlated with the gold price, i.e. the rising interest rates adversely impact the yellow metal. Based on this adverse relationship between real interest rates and price of gold, Elfenbein built a model for the price of gold. According to it, whenever the dollar's real short-term interest rate is below 2%, gold rallies, and whenever the real short-term rate is above 2%, the price of gold falls. Another rule of thumb is that gold moves eight times stronger than the difference between real interest rates and 2%. If the model is correct, the Fed's future interest rates hike may be detrimental for the price of gold. However, there are many objections to the use of such a simple model, and generally to the adverse relationship between gold and real interest rates.

Generally, the real interest rates are negatively correlated with the gold price, i.e. the rising interest rates adversely impact the yellow metal. Based on this adverse relationship between real interest rates and price of gold, Elfenbein built a model for the price of gold. According to it, whenever the dollar's real short-term interest rate is below 2%, gold rallies, and whenever the real short-term rate is above 2%, the price of gold falls. Another rule of thumb is that gold moves eight times stronger than the difference between real interest rates and 2%. If the model is correct, the Fed's future interest rates hike may be detrimental for the price of gold. However, there are many objections to the use of such a simple model, and generally to the adverse relationship between gold and real interest rates.

First, the nature of gold is much more complex than any other commodity, so searching for one ultimate factor determining its price, gold's Holy Grail, will always result in failure. Since lots of factors affect its price, investors should beware of simple models and study history to test popular opinion.

Second, investors should be aware of the shortcomings of the correlation, which does not imply causation. It is equally possible to argue that causality runs in the other direction, i.e. the low gold price causes high real interest rates, or that both the gold price and real interest yields are driven simultaneously by some common external factors. Moreover, correlation often holds only during specific periods. High negative correlation (-0.82) between gold price and real interest rate founded by Erb and Harvey relates only to a period of 15years. With longer periods, the correlation falls to only -0.31.

Third, investors should analyze not only the changes in the real interest rates, but also their levels and trajectories. According to the quoted WGC's report, high and rising real interest rates are much worse for the price of gold than rise from the low level. E.g., between October 2003 and October 2006 US real interest rates increased from -1 to 3%, while gold gained 60% during the period.

Fourth, investors have to remember that investment demand is only the (smaller) part of the whole demand for gold. Therefore, the adverse relationship between real interest rates and gold price is weakened by the jewelry demand, which increases, when the real interest rates rise and the gold price decreases. Similarly, industry demand can also be stimulated by the rise in the real interest rates, because such a rise is often accompanied by an improving economic situation.

Five, the relationship between real interest rates and the gold price does not necessarily hold for countries other than the USA. For example, the real interest rates sensitivity of investors in India is unclear. Additionally, according to the World Gold Council this relationship is weaker than in the past and could further deteriorate, as the relevance of emerging markets will be increasing.

Six, the impact of changes in the real interest rates does not have to be immediate. They are not a tactical day-trading indicator. It takes some time for investors to perceive the impact of changes in nominal interest rates on inflation rates and adapt accordingly, for example by shifting capital from bonds to gold.

Seven, there is no consensus on how to measure the real interest rate. Some analysts use Treasury Inflation Protected Securities, i.e. long-term Treasury bonds adjusted by the inflation rate. Other economists choose short-term Treasury bills and subtract the CPI. However, there are strong arguments that CPI undervalues the inflation rate, so using it overestimates the real interest rate, and underestimate the growth potential of gold.

Hence, as in the case of geopolitics and gold, investors should avoid generalizations. Although changes in the real interest rates usually adversely affect gold price, sometimes gold behaves differently depending on the given economic context. We can easily point out many periods during which this relationship did not hold. For example, from May 2005 to May 2007 the gold price and real interest rates were rising simultaneously.

Why does the adverse relationship between gold and real interest rates not necessarily have to be observed? The reason is quite simple: in some periods other factors may play a significant role. For example, the real interest rate may increase due to rise in the inflationary expectations or risk premium. In such situations, the price of gold can rise as well, provided it would be perceived as an inflationary hedge or safe haven.

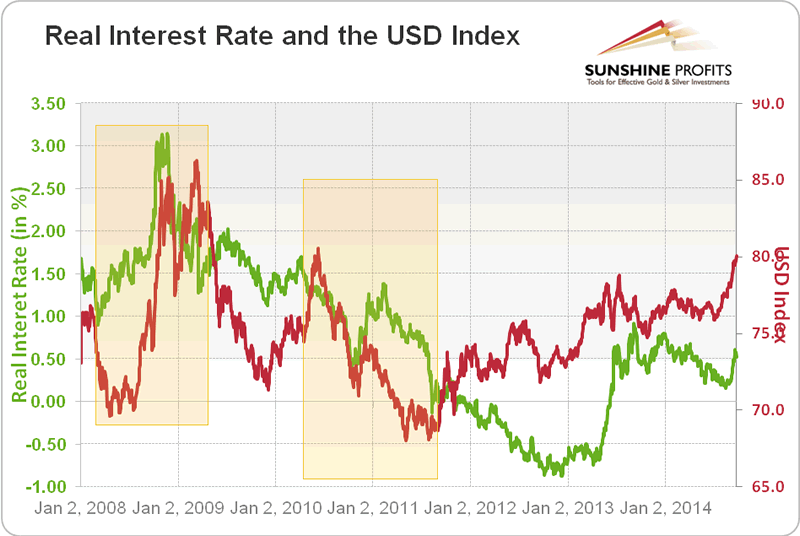

Another important factor, which can affect the gold price simultaneously with the changes in the real rate rates, but in the opposite direction, is the US dollar. For example, the gold price rose from 1985 to 1987, despite the positive and relatively high interest rates. The probable reason was the declining value of the US dollar. This confirms that it is sometimes very difficult to disentangle effects on gold prices resulting from real interest rates and US dollar or other factors. For example, the US dollar may weaken because of the negative real interest rates, discouraging investing in dollar-denominated bonds. Indeed, as the graph shows, the US dollar index has practically never experienced a secular bull without healthy positive real interest rates and a secular bear without falling or negative real interest rates.

Graph: Real interest rates (green line, left scale) and US dollar index (major currencies, red line, right scale) from 2003 to 2014

On the other hand, when the dollar and the American economy are weak, the Fed often lowers the nominal interest rates to support the economy. Therefore, investors should not focus on simple correlations, but always analyze the whole economic context.

The last reason is the impact of higher real interest rates on stocks and bonds. The higher the real interest rate, the lower the valuation and price of bonds and stocks. Lower valuations may interrupt the boom and trigger sales and capital outflow into the gold market.

The bottom line is that although the inverse correlation between real interest rates and gold is quite tempting, investors should not be guided by simple models without reflection. There are very strong arguments in favor of the real interest rates as one of the main drivers for the price of gold, but other factors can disrupt the adverse relationship between real interest rates and gold prices. Therefore, investors should always analyze the whole economic context and examine whether the changes in the real interest rates are accompanied with weakening or strengthening of the US dollar and economy. In order to stay updated on the latest developments in the gold market and US economy we encourage either joining our gold newsletter (it's free and you can unsubscribe in just a few clicks) or subscribing to our premium Market Overview reports (on which the above articles is based).

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.