Obamacare Is Not a Revolution, It Is Mere Evolution

Politics / Healthcare Sector Oct 26, 2014 - 08:58 PM GMTBy: MISES

Roger McKinney writes: The Patient Protection and Affordable Care Act focused the attention of Americans on government regulation as few issues have. However, they should have paid attention decades earlier because states have been eating away like termites at freedom in the healthcare insurance market for decades. The PPACA adds little to existing state regulations. States began dictating to insurance companies what to cover, whom to cover, when to cover them and how much they could charge in the 1950s. Massachusetts, home of Romneycare, the template for Obamacare, enacted the first state mandate in 1956 requiring insurers to cover mentally and physically handicapped children.[1]

Roger McKinney writes: The Patient Protection and Affordable Care Act focused the attention of Americans on government regulation as few issues have. However, they should have paid attention decades earlier because states have been eating away like termites at freedom in the healthcare insurance market for decades. The PPACA adds little to existing state regulations. States began dictating to insurance companies what to cover, whom to cover, when to cover them and how much they could charge in the 1950s. Massachusetts, home of Romneycare, the template for Obamacare, enacted the first state mandate in 1956 requiring insurers to cover mentally and physically handicapped children.[1]

States have mandated coverage in four areas: benefits, providers, populations, and rates. Benefit mandates decree types of care, such as mammograms, well-child care, drug and alcohol abuse treatment, but also acupuncture and wigs for cancer patients. Provider mandates ordain payments to healthcare providers such as chiropractors, podiatrists, social workers and massage therapists. Population mandates increase the number of people covered under a policy, such as extending coverage to non-custodial children and grand children. Rate mandates prevent insurance companies from charging premiums that reflect risk, in effect using low risk policy holders to subsidize high risk members.

States have mandated coverage in four areas: benefits, providers, populations, and rates. Benefit mandates decree types of care, such as mammograms, well-child care, drug and alcohol abuse treatment, but also acupuncture and wigs for cancer patients. Provider mandates ordain payments to healthcare providers such as chiropractors, podiatrists, social workers and massage therapists. Population mandates increase the number of people covered under a policy, such as extending coverage to non-custodial children and grand children. Rate mandates prevent insurance companies from charging premiums that reflect risk, in effect using low risk policy holders to subsidize high risk members.

Through the 1960s, state legislatures focused on commanding insurance companies to cover more people. In the1970s, states began to require that insurance policies cover non-physician practitioners, such as psychologists, podiatrists, and dentists. States expanded coverage to high-risk individuals who had been turned down for coverage by one or more insurers in the 1980s.

The decade of the 1990s ignited the war between managed care plans and their subscribers. State legislators entered the war on the subscriber’s side, launching a fusillade of new mandates dealing with the types of coverage offered. Among the many laws were minimums for hospital lengths-of-stay and coverage for hospital care following procedures such as normal childbirth, cesarean delivery, and mastectomy.

In addition, states enacted any-willing-provider (AWP) laws, forcing managed care firms to admit any provider willing to abide by the terms of the network contract. Freedom-of-choice (FOC) laws required that managed care plans allow subscribers to visit any licensed provider they desired as long as the subscriber paid a larger out-of-pocket fee when they used a provider from outside the network. Direct access mandates allowed subscribers to visit specialists, such as OB/GYNs, dermatologists, ophthalmologists, psychiatrists, chiropractors, etc., without first getting approval of the subscriber’s primary care physician (PCP). Managed care plans had tried to limit the rapid growth in medical care expenses by requiring the approval of a PCP before subscribers visited costly specialists.

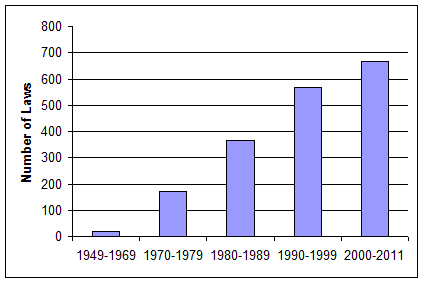

The new millennium continued the onslaught of state regulations aimed at healthcare insurers. Between 1950 and 2000, states had enacted an average of 22 laws per year, with the average for the last decade rising to 57 per year. The first 11 years of the twenty-first century saw the average climb to 61 mandates per year.[2] The chart below depicts the growth in state mandated laws over the past six decades. As of 2011, the total number of laws controlling insurance coverage amounted to 2,262 according to the Council for Affordable Healthcare Insurance (CAHI). [3]

Figure 1: Mandated Benefit Laws

The most popular new mandates cover autism, diabetes, oral and infusion chemotherapy, diabetes and screenings. As the number of news diagnoses of autism has exploded, so have the mandates. “To date, 29 states have passed autism mandates and the amount of proposed legislation grows each year. Advances in diagnosis (including a new rapid test to screen for autism) and treatment, along with a well organized national advocacy movement, guarantees autism mandates will remain high on legislative priority lists” [4] according the CAHI.

Oral and infusion chemotherapy is a regimen in cancer treatment that can be administered at home instead of a clinic or hospital. At least 15 states have passed such mandates. Diabetes is growing rapidly in the US as a result of the obesity epidemic. A 2009 University of Chicago study concluded that the number of diabetics will double in the following 25 years. As a result, 41 states have mandated coverage of diabetes. [5]

Mandates to pay for screening have increased in part because “most legislators and policymakers believe all preventive care saves lives and money. Recent studies reported in the Journal of the American Medical Association and elsewhere, however, are casting doubt on this idea. A number of screening tests have been shown to produce ‘false positive’ results, leading to expensive and unnecessary treatments.” [6]

The least-discussed mandates are those applying to what companies can charge for premiums. Rate mandates are a form of state price controls. Before one can appreciate the impact of price controls, one needs to understand how normal insurance works, such as car or house insurance, and prices premiums. Insurance companies hire actuaries to establish rates using probability theory, statistics and risk theory. Greater risks result in higher premiums. Things that affect risk in healthcare include geography, demographics (age and gender), and health status.

Consumers grasp these concepts easily with home and car insurance. For example, a house located in a flood plain will cause the owner to pay higher insurance premiums. Home owners in the southern plains states pay higher premiums than those on the west coast because of the frequency of hail in thunderstorms on the plains. Car insurance for teenage boys costs much more than the same coverage for girls or for older married men. These are examples of higher risks that cause higher premiums. The same should be true of healthcare insurance, but it is not.

Some states impose rate bands on insurance premiums. Rate bands set upper and lower limits on how much premiums can vary from the average due to risk factors such as gender, age, or health status. Many states allow the insurer to vary premiums by no more than 50 percent from the average. For example, if the average premium is $1,200 per month, the company can charge no more than $1,800 and no less than $600, which produces a 3:1 ratio of highest to lowest premiums. Other states allow no more than a 2:1 ratio. Such rate bands force young, healthy subscribers to subsidize the premiums of older, sicker ones.

The managed care provider I work for had a hemophiliac as a subscriber for many years who regularly cost the company over $1 million per year in medical bills. Oklahoma enforces rate bands on premiums, so the company could not charge that member any more than other subscribers whose medical expenses totaled less than 10 percent of his. Fortunately for our company, his employer chose another health care insurer.

So far we have looked at state mandates only, but the federal government has not remained unconcerned about health care insurance. The federal government issued the Pregnancy Discrimination Act in 1978, the Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA), the 1996 Health Insurance Portability and Accountability Act (HIPAA), the 1996 Mental Health Parity Act, and the 1996 Newborns and Mothers Health Protection Act (NMHPA).

The Pregnancy Discrimination Act requires health plans to provide benefits for prenatal and maternity services comparable to the coverage for other conditions. COBRA requires companies with 20 or more workers to continue providing the group insurance to former employees who have been separated, though the former employee and not the company pays the premiums. The premium cannot exceed 102 percent of the group premium.

HIPAA limits preexisting-condition clauses to one year before enrollment. In addition, the insurer must waive such clauses for subscribers who change plans if they have satisfied the waiting period for coverage under the previous plan. Plans cannot consider pregnancy a preexisting condition nor subject newborns or adopted children who are insured within 30 days of birth or adoption to the plan’s preexisting-condition clause. Under the Mental Health Parity Act, plans that include coverage for mental health care must provide the same annual and lifetime reimbursement ceilings for such care that they offer for other non-mental health related ailments.

Unintended Consequences

In a 2007 review of the literature about the effects of state mandates on insurance premiums, the authors concluded “Despite exhaustive research, little compelling evidence exists that state health insurance mandates do, in fact, have a significant impact on these outcomes.” [7] Is it really possible such massive state interventions in the insurance market, most of which create higher demand, have no impact on prices?

CAHI says it just ain’t so: “Health insurance actuaries have warned that virtually all mandates increase the cost of coverage by increasing utilization over time (referred to as “frequency of use”). Why is this so? Mandates require insurers to pay for care that consumers previously funded out of their own pockets, if they purchased it at all. Changing the dynamics of payment creates more frequent use of the service and a resultant increase in premium costs to all health insurance beneficiaries.” [8]

CAHI estimates that mandates can boost premiums from 10 percent to 50 percent depending on the state, number of mandates, and the type of policies.

Jensen and Morrissy found in 1990 that some benefits boost premiums significantly. Adding chemical dependency treatment lifted premiums 9 percent on average. Psychiatric hospital stays raised premiums 13 percent. Visits to psychologist increased them by 12 percent and routine dental services by 15 percent.[9]

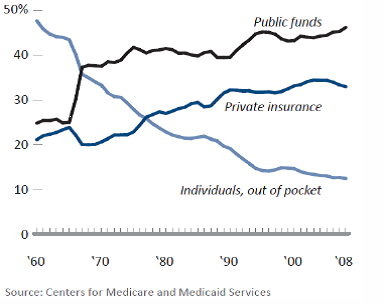

James Bailey, an economist at Temple University, discovered results similar to those of CAHI: “When a mandate is passed, more medical spending is channeled through insurers, rather than being paid directly out-of-pocket by consumers. This partly explains the long-term shift away from out-of-pocket spending in the US health care market. … As more medical spending is done using insurance, health insurance costs and premiums will rise.” [10] The graph in figure 2 below depicting the source of healthcare spending appeared in Bailey’s paper.

Bailey conducted regression analyses on changes in mandates and premiums from 2008 to 2010 and found that each added mandate during that period increases annual premiums on average $35. He concluded “Given the total increase in average premiums of $545 from 2008 to 2010, these results imply that mandates were responsible for 25-45 percent of premium increases.” [11] Average annual premiums for individual coverage in 2010 were $4,952.

Why is it so difficult to determine the price effect of state mandates on insurance premiums? The answer is that all people do not respond in the same way to price changes. Insurance companies try not to raise premiums if possible because in most states they compete for customers on the basis of premium prices. Most groups offer more than one insurance provider to their employees. Healthier employees will switch to cheaper plans, so insurance companies may choose to increase out-of-pocket expenses instead of raising premiums. Or they may reduce non-mandated benefits.

Figure 2: Source of Funds for US Healthcare Spending 1960 - 2008

If an insurer raises premiums, companies paying the premiums for employees may opt for reduced benefits, switch insurers, have employees pay a larger share of the premium, or abandon company-paid insurance completely. The cost of mandates may be masked by the rising number of uninsured. Finally, companies may choose to become self-insured, in which case they are exempt from state mandates but must follow federal mandates. Self-insured plans cover over 57 percent of privately insured people.[1]

Whatever the cause, insurance premiums have risen fast according to Milliman, an independent actuarial and consulting firm. The Milliman Index estimated that premiums for a family of four have doubled in less than nine years, from $9,235 per year in 2002 to $19,393 in 2011. [13]

Conclusion

Liberty-loving people are right to be appalled by the power grab and destruction of freedom found in the Patient Protection and Affordable Care Act. However, just about every evil in the legislation has already been inflicted on the market through 50 years of state destruction of the healthcare market. Even the requirement that everyone have insurance was pioneered by Mitt Romney in Massachusetts. PPACA does little more than federalize earlier state abuses of power. For businesses in healthcare, especially insurance companies, there is nothing new here.

Roger McKinney is an analyst for an HMO and teaches economics for a small private college. See Roger McKinney's article archives.

You can subscribe to future articles by Roger McKinney via this RSS feed.

© 2014 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.