The Gallery of Crowd Behavior: Goodbye Stock Market All Time Highs

Stock-Markets / Stocks Bear Market Oct 25, 2014 - 03:34 PM GMTBy: Doug_Wakefield

"Complex Systems that have artificially suppressed volatility tend to become extremely fragile, while at the same time exhibiting no visible risks. In fact, they tend to be too calm and exhibit minimal variability as silent risks and accumulate beneath the surface. Although the stated intention of political leaders and economic policymakers is to stabilize the system by inhibiting fluctuations, the result tends to be the opposite." - Nassim Nicholas Taleb and Mark Blyth, May/June 2011 issue of Foreign Affairs.

"Complex Systems that have artificially suppressed volatility tend to become extremely fragile, while at the same time exhibiting no visible risks. In fact, they tend to be too calm and exhibit minimal variability as silent risks and accumulate beneath the surface. Although the stated intention of political leaders and economic policymakers is to stabilize the system by inhibiting fluctuations, the result tends to be the opposite." - Nassim Nicholas Taleb and Mark Blyth, May/June 2011 issue of Foreign Affairs.

"The October 2014 Global Financial Stability Report (GFSR) finds that six years after the start of the crisis, the global economic recovery continues to rely heavily on accommodative monetary policies in advanced economies. Monetary accommodation remains critical in supporting the economy by encouraging economic risk taking in the form of increased real spending by households and greater willingness to invest and hire by businesses. However, prolonged monetary ease may also encourage excessive financial risk taking." - IMF Global Financial Stability Report, Oct 8 '14

Financial Storm Clouds Cast A Deep Shadow Over IMF Summit, The Guardian, Oct 11, '14

"Ever since the global economy bottomed out in the spring of 2009, the hope has been that the world would return to the robust levels of growth seen in the years leading up to the financial crash. Time and again, the optimism has proved misplaced, with the IMF repeatedly revising down its forecasts. This year was no exception....

What concerns the IMF is that the slowdown - particularly in the advanced countries of the west - may be permanent....

José Viñals, the IMF's financial counselor, said: "Policymakers are facing a new global imbalance: not enough economic risk-taking in support of growth, but increasing excesses in financial risk-taking posing stability challenges."

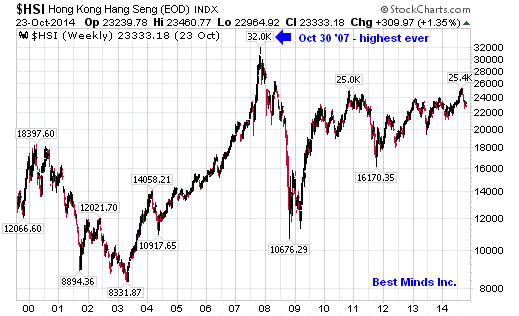

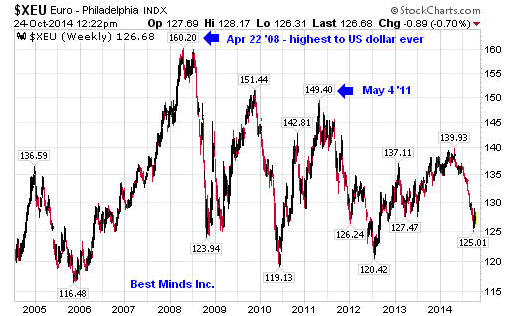

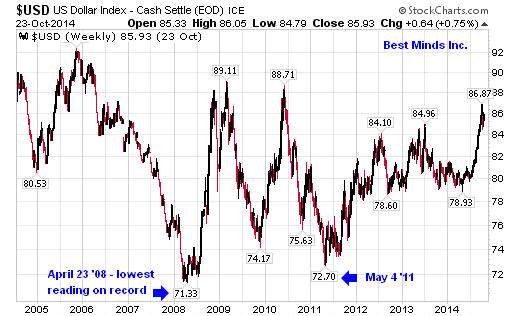

On November 2, 2007, I released my first "The Gallery of Crowd Behavior" piece. On May 2, 2011, I released "The Gallery of Crowd Behavior Returns".

The first one focused on the Hong Kong stock market. The second primarily on the euro and dollar. Below are multi year charts of these three markets at the time these two public articles were released.

Now before you point out that I am a cherry picking articles that illustrate the timing of information and turning points in history that look very good, I will admit that is exactly what I have done. However, I have learned from some of the best technicians in the financial industry that market technicians ARE the ones who are looking for a point where markets could turn. That's part of their job.

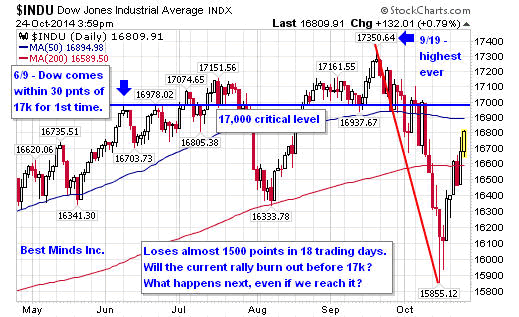

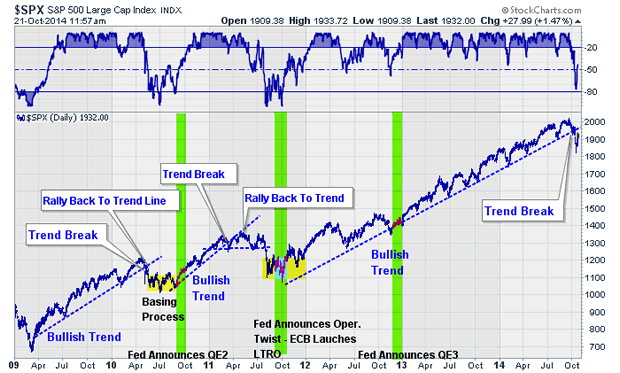

So on this Friday, October 24, 2014, after watching world markets since the close of September options on September 19th, I thought that it might be a good time to review a few pictures hanging in the current "gallery". Clearly, if the weeks and months ahead prove that September 19th was THE final top in US stocks in the latest and largest global financial bubble on record, then my comments will not have come within a few days of THE last "all time high" hyped headline.

As world markets come into the Federal Reserve's next scheduled press release on Wednesday, Oct 29th, we are all waiting for two issues to be resolved; will they continue their path since December 18, 2013 and announce that effective November 1st, QEIII funds go to zero, and will the Dow be able to break above 17,000 or will this line prove to be the final wall of resistance before starting the next phase of selling?

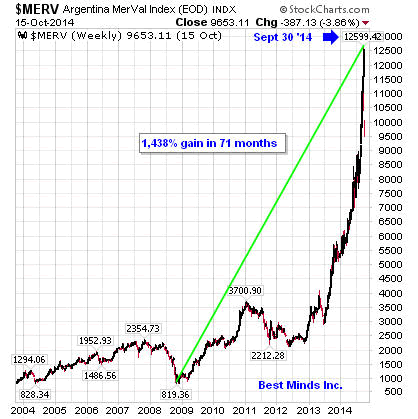

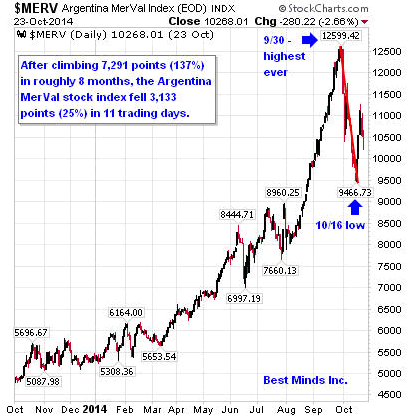

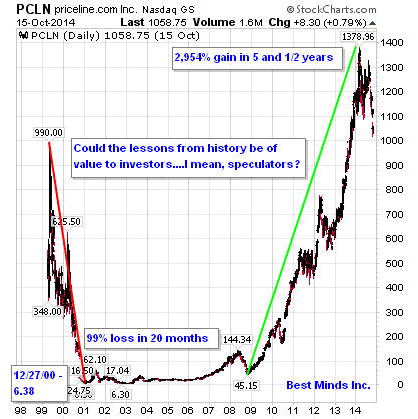

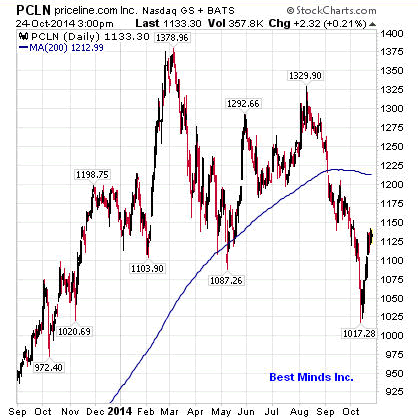

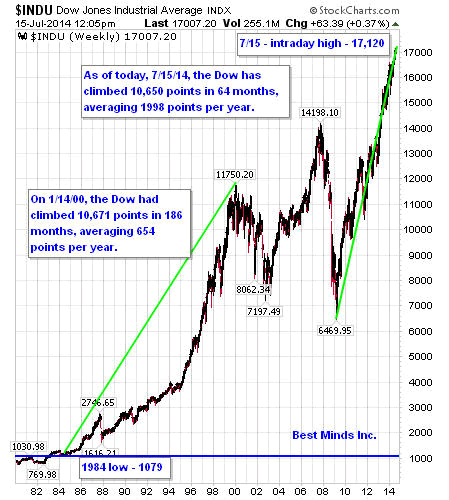

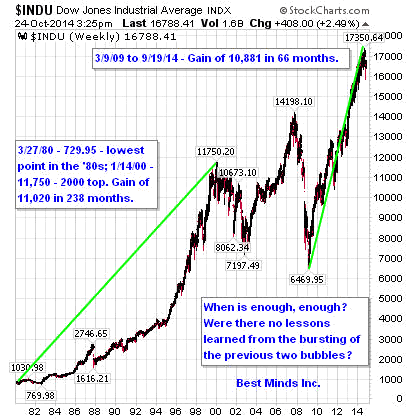

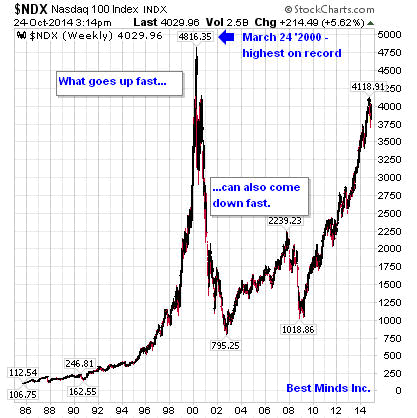

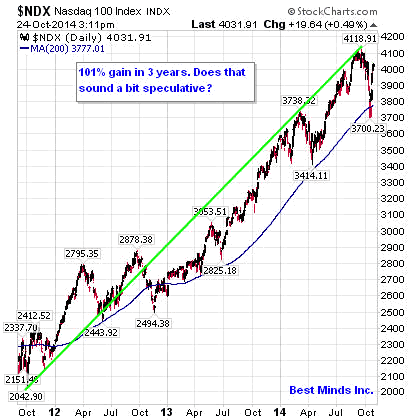

While we wait to learn the answer, let me share with you a few charts you may not have seen. I would encourage you to share these with family, friends, business associates....anyone. Ask yourself, "Does this look like sustainable long term behavior, or more like the Japanese stock markets ascent to the heavens before starting the longest bear market in modern history in January 1990, and the 83% collapse of the NASDAQ 100 when the dot.com bubble burst, comparable to the 89% collapse of the Dow between 1929 and 1932?"

If you believe this behavior looks very unsustainable, then what actions are you planning on making or have made with your investments? Do you know which markets have been declining for the last 3 years, while others have been advancing over the same timeframe? Do you have a strategy in place to capitalize on this huge shift across global markets?

Source of chart above, The Yuan Stops Here, 7/15/14

In 2007, the Hang Seng hit its highest level ever, and collapsed over 66% in the next year. In 2011, the dollar produced a bottom and the euro hit a top that has held for almost 3 and ½ years.

Isn't it time all managers, business leaders, investors, political leaders, etc, etc, dust off the lessons that should have been learned from the two most destructive bear markets from financial speculation based on the idea of "unlimited money" and cheap credit? Isn't it time for everyone to review their own plans in light of what the "gallery" is showing us from around the globe? Do we really need to experience the downside of the next financial mountain to understand what can happen when crowds, whether computers or humans, move from buy to sell?

Bulls become bears, and bears become bulls.

"Every boom must one day come to an end." - Ludwig von Mises (1928)

"Therefore everyone who hears these words of Mine and acts on them, may be compared to a wise man who built his house on the rock. And the rain fell, and the floods came, and the winds blew and slammed against that house; and yet it did not fall, for it had been founded on the rock. Everyone who hears these words of Mine and does not act on them, will be like a foolish man who built his house on the sand. The rain fell, and the floods came, and the winds blew and slammed against that house; and it fell--and great was its fall."

When Jesus had finished these words, the crowds were amazed at His teaching; for He was teaching them as one having authority, and not as their scribes." Matthew 7: 24-29

Complacency Time Has Gone

If you have no experience in growing money on the downside of a financial bubble, I cannot think of a better time to subscribe to The Investor's Mind. Yesterday, I released a special global edition called, At the Top of the World. It is amazing with all the hype given "another all time high" since the start of 2013, how little attention has been given to various world markets that have not returned to that level since reaching it in 2008, 2000, and yes, even 1990.

The cost for procrastination is rising rapidly, and the value for good research becoming extremely low in comparison to the speed in which wealth can be destroyed. Click here to start the next six months reading the newsletters and trading reports as we come through this incredible period in market history, and attain my latest special edition of The Investor's Mind: At the Top of the World.

Doug Wakefield

President

Best Minds Inc., a Registered Investment Advisor

2548 Lillian Miller Parkway

Suite 110

Denton, Texas 76210

www.bestmindsinc.com

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Copyright © 2005-2014 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.