Bitcoin Price Decline Stopped, Possibly Temporarily

Currencies / Bitcoin Oct 25, 2014 - 12:09 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

CeX, a British second hand goods chain, is starting to accept Bitcoin, we read on CoinDesk:

Technology exchange and retailer CeX is set to become the first high street retailer in the United Kingdom to integrate bitcoin payments nationwide.

CeX will roll out bitcoin payments at 30 of its 266 UK stores beginning today. More stores will join the initial group in coming weeks as staff are trained, the firm told CoinDesk.

The move follows a trial run at its Glasgow location, where a bitcoin ATM was installed and the store leadership conducted a temporary bitcoin-only payments initiative. In April, CeX began accepting and paying for consumer goods in bitcoin through its website.

(...)

[David Butler, CeX commercial director,] said:

"Customers love having the choice to use bitcoin. We want to pay customers selling their technology to CeX as fast as possible and bitcoin is a great solution. Much as we offer cash, not everyone wants a wallet full of bank notes and Faster Payments into bank accounts take at least a day."

The company said in its announcement that it intends to hold onto bitcoin earned through the integration instead of cashing out for pounds or other fiat currencies.

At present, it seems that the move is going to attract mostly Bitcoin-savvy customers but it definitely is a step making Bicoin more recognizable even among CeX customers not familiar with it.

While one retail chain doesn't make all the difference in the world, it's good to see more and more businesses willing to accept Bitcoin, not only in the U.S. but also outside of it.

For now, let's turn to the charts.

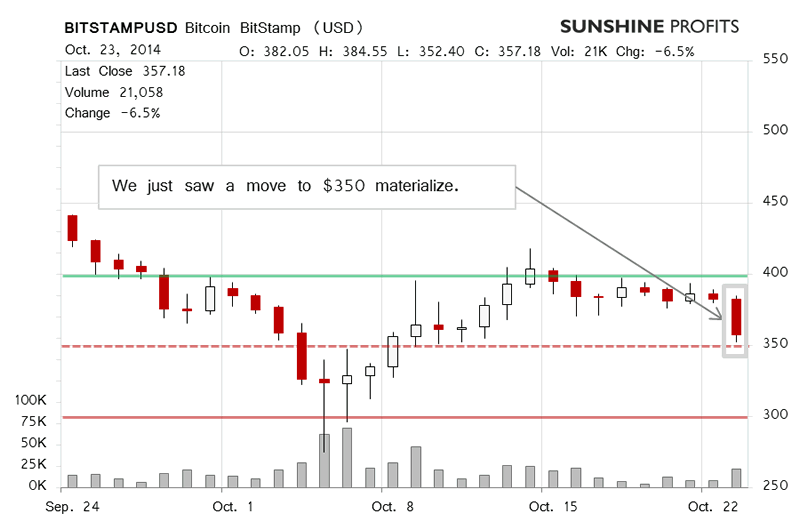

On BitStamp, we saw a pretty sizeable move down yesterday and on highly elevated volume. The same day we wrote:

Bitcoin has plunged 4.8% from yesterday's close, to only slightly above $360. Not surprisingly, this has been on elevated volume, but not necessarily on volume that would suggest a very significant slump.

One way or another, we've seen possible first signs of deterioration. It's still too early to tell whether this is a one-day thing, but our bet here would be that it's not. If you take a look at the third cited paragraph, you'll see that yesterday we expected a move to $350 or lower. This is still the case - we tend to think that the current slide is a first one in a series of less-pronounced slides, either to happen in quick succession or to be more distributed in time.

Based on this, it seems that it might be a good idea to ride on the current wave down if it gets more momentum and then prepare to reposition oneself for possible appreciation.

After the publication of that alert, the volume went further up making the decline more significant in our eyes. In this sense, our yesterday's comments remain up to date.

The action today has been up and down with Bitcoin going as low as $345 at one point before recovering to above $360 (this is written before 11:00 a.m. ET). The volume today is significant, perhaps not matching what we saw yesterday but still relevant (the day is not over, so there's still room for an uptick).

Right now two scenarios seem worth noting to us. In the first Bitcoin lingers around $350 for some time without significant trading volumes and afterwards starts a strong rally. This is what we saw in April-May this year. The second scenario would see Bitcoin go down to around $300, possibly after a period of wavering. This is a tricky situation since we might actually see more depreciation now before a move up but we outline the suggested positions later in the alert.

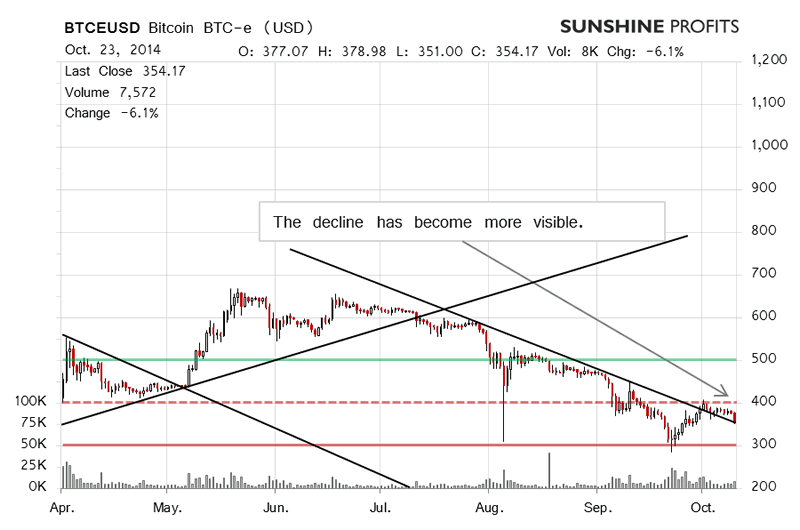

On the long-term BTC-e chart, we see that the depreciation has taken Bitcoin visibly down. Yesterday, we wrote:

(...) the situation has been somewhat clarified and we've seen a move down on possibly increased volume. The volume hasn't been up as much as it has been on BitStamp but the overall situation nonetheless suggests more bearish action just now.

We're still on the lookout for a more important rebound to the upside but, taking into account the action today, the situation has further deteriorated and a bet on lower prices might be a good idea, provided that the move down gets more momentum.

This is still what we think about the market. It seems now that the decline might have stopped. If we see a more pronounced decline, it might be a good idea to ride some of it, but not just yet. This is why we keep our suggested sell limit order unchanged.

Expecting depreciation in the days or weeks to come, we still prefer to be ready for any significant rally which might come after such a slide, hence we also outline a buy limit order below.

Summing up, we don't support any speculative positions now.

Trading position (short-term, our opinion): no current positions. A sell limit order, entry at $332, stop-loss at $377, take-profit at $307. Additionally, a buy limit order, entry at $427, stop-loss at $357, initial target at $500.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.