Stock Market Fear and Panic Fractal

Stock-Markets / Stock Markets 2014 Oct 24, 2014 - 05:50 PM GMT Late yesterday afternoon I wrote an email entitled “Panic Cycle Shift.” Make sure you read it if you haven’t yet done so.

Late yesterday afternoon I wrote an email entitled “Panic Cycle Shift.” Make sure you read it if you haven’t yet done so.

Early in September I suggested that the market would have 43 “up days” followed by 43 “down days”. That is still correct. Remember that I am referring to calendar days. Now convert that to market days and the result is 30-31 trading days, depending on the placement of weekends and holidays.

Now it gets interesting. The 31 “market up” days from August 7 to September 19 were not continuous, but interrupted by an 8.6 “market down” interval between September 4 and September 19, leaving an estimated 21.5 more or less continuous days in the rally.

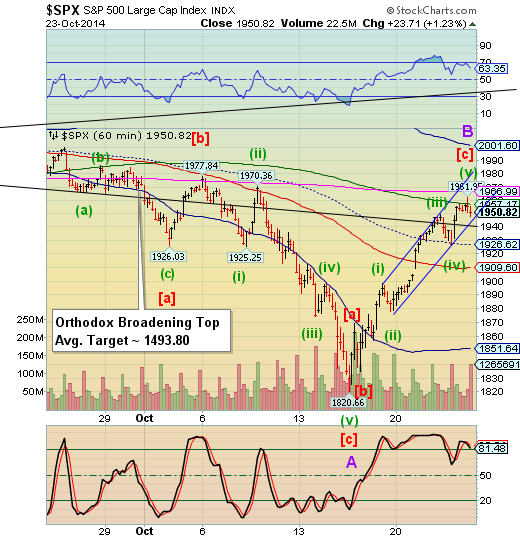

If you add up the number of days in this Cycle (258 hours divided by 7 hours in a day), you get 36.85 days. What gives? What is interesting about this cycle is that it may truly result in 30.7 “total market down” days, or 43 calendar days of actual decline. The 6.15 days of rally that we just saw are then added to the 30.7 to achieve the 36.85 total market days and 49.15 calendar days instead of the 43 days that I had originally proposed. This is what is so fascinating about Cycles. They “shift” in a dynamic way while still achieving their goals. In this case, we may end up with a devastating Wave C that will bring fear and panic to the market.

All of this starts today.

We may be getting a sense of this from the VIX, which has held support at the Intermediate-term level.

Traditionally the market may not react strongly at its top and, being Friday, the VIX may be subject to the usual “smack-down” at the end of the day. However, a “VIX long” or “SPX short” is where we need to be.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.