Why You Should Always Be Invested in the Stock Market (Even Now)

Stock-Markets / Stock Markets 2014 Oct 23, 2014 - 12:01 PM GMTBy: Money_Morning

Keith Fitz-Gerald writes: On the heels of the worst volatility in nearly 20 years, and more “crash talk” than we’ve heard maybe ever, it’s starting to look like a smart time to hit the eject button and get out of the markets altogether.

Keith Fitz-Gerald writes: On the heels of the worst volatility in nearly 20 years, and more “crash talk” than we’ve heard maybe ever, it’s starting to look like a smart time to hit the eject button and get out of the markets altogether.

In fact, that’s probably the most common question I’m hearing these days:

“Do I really want to be in stocks right now?”

Believe me, I get it. Folks are emotionally shattered from seeing their wealth cut in half twice – once in 2000 and again in 2007-08. That’s why 55% of Americans have no money in the stock market at all, according to a Federal Reserve Board analysis from last year. I think the number is actually higher, because of the anecdotal evidence I gather on a daily basis.

That means hundreds of millions of people are missing this blindingly simple tactic that drives our Total Wealth strategy.

If only those people would look at this chart…

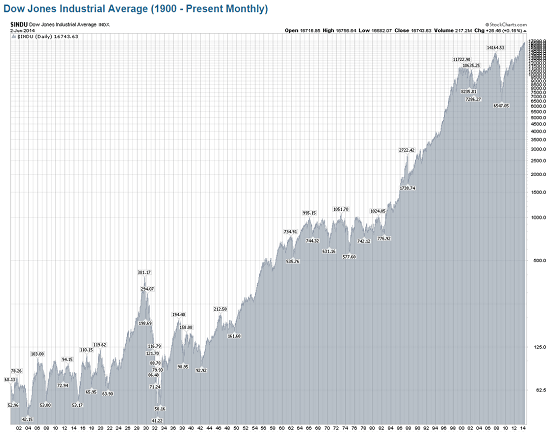

Take a look at the Dow Jones over the last 114 years.

Despite two world wars, multiple invasions, presidential assassinations, the Cold War, hot wars, recession, depression, and all manner of events that no doubt seemed “catastrophic” at the time, it continued to push higher.

Since 1900, it rose a staggering 24,285%.

Why did it keep going up? Because the companies that comprise the Dow continued to make products, provide services, and grow earnings. It’s that simple.

There are more people on this planet every single year. There’s more money being created. There’s more velocity. Capital is a creative force, too. As more wealth is created, investors joining the party are willing to pay increasingly higher prices to go along for the ride. It really isn’t more sophisticated than that.

That’s why “always own stocks” is another Total Wealth tactic.

Many people don’t think of this as an investing tactic. But truth be told, it may actually be the most important tactic of all, because if you don’t own stocks you can’t participate in what I think of as “the upside of humanity.”

The Power of Owning Publicly Traded Companies

Think about this for a minute and ask yourself…

…do you go to the store?

…do you buy stuff?

…do you keep your lights on?

…do you need food?

…do you need medicine?

When you own a company’s stock – whether it sells burgers or banking services or biopharmaceuticals – you are an owner in an enterprise that exists solely for the purpose of making money, and you’re tapping into the earnings of that company. They have a common goal, and that’s to provide great returns to investors. And, over time, most do.

Owning stocks is not a matter of whether you “like” the headlines or not, only whether you’ll make money from doing so. Over time, the answer is clearly yes.

Sure there are going to be speed bumps along the way, but even those are great buying opportunities – at least if you believe in “buy low and sell high” like I do.

Obviously, there are considerations that have to be made for your age, your risk tolerance and your objectives, but those are really shades of grey that depend your situation. Not one of the factors I’ve just mentioned negates the argument itself.

And that argument is precisely?

…You ALWAYS want to own stocks, because that’s the best way to tap into the “upside of humanity” and build your personal financial dreams faster.

Especially today. Right now.

You may be thinking “there’s got to be a catch.” I hear you… That’s a perfectly normal emotion and a common one, too especially lately.

It’s not too good to be true – you always want to own stocks even if you’re one of millions who have come to the conclusion that big banks are a four-letter word and there’s a near total lack of adult supervision in Washington.

How do I know this is true?

The same way you do. If companies were not creating wealth, the economy would not be growing.

Simple as that.

But don’t take my word for it.

More Proof from the Brightest Minds

My reasoning is backed by some of the brightest minds in the business and piles of incontrovertible academic research backed by reams of data.

Some of my favorites include Wharton Professor Dr. Jeremey J. Siegel’s work in his best-selling book, Stocks for the Long Run which is now in its 5th edition. My copy of Benjamin Graham’s treatise, The Intelligent Investor, is so dog-eared that it belongs in a used book store reject pile. First published in 1949, it’s as timeless and applicable today as it was then. There’s also What Works on Wall Street by James P. O’Shaughnessy. It’s one of my favorites because it’s an unambiguous look at more than 90 years of results based method research and current statistics.

Admittedly, the best theories are worth squat if they don’t work. So I’ve made it a point over my career to seek out the greatest investors of our time in an effort to learn what’s helped them turn modest investments of a few thousand into billions over the years. And have been fortunate enough to meet many of them. Names like Sir John Templeton, Warren Buffett, Jim Rogers, Peter Lynch, and Mark Mobius.

Or consider the words of Austrian economist Joseph Schumpeter who noted in his 1942 work, Capitalism, Socialism and Democracy:

The fundamental impulse that sets and keeps the capitalist engine in motion comes from the new consumers’ goods, the new methods of production or transportation, the new markets, the new forms of industrial organization that capitalist enterprise creates. (p. 83)

What Schumpeter was driving at is the self-evident rationale for the continuous development of new products, new services and the pursuit of profit – growth by any other name. He knew – and I agree – that growth is an evolutionary process that continually creates increasing amounts of wealth.

That’s why what you really want to be asking right now is now “Should I be in stocks?” but “Where should I put my money to get the biggest bang for my buck?”

And I’ll be back with a very exciting new answer to that in a few days.

Best regards for great investing,

Keith

Source : http://totalwealthresearch.com/2014/10/always-stock-market-even-now/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.