India Gold Demand Surges 450% and Bank of Russia Demand At 15 Year High

Commodities / Gold and Silver 2014 Oct 22, 2014 - 06:13 PM GMTBy: GoldCore

Demand for gold continues to be robust and has indeed increased significantly in recent weeks despite gold’s most recent paper driven gold weakness.

Demand for gold continues to be robust and has indeed increased significantly in recent weeks despite gold’s most recent paper driven gold weakness.

Demand in China and India surged again and gold reserve diversification by the central bank of Russia hit a new record high in September as geopolitical tensions rose.

The seemingly insatiable appetite of the growing Indian middle class for gold is causing the government in India to again consider imposing sanctions on the importing of gold.

Gold imports into India in September were worth $3.8 billion. This figure is almost double the $2 billion spent by Indians in August as, once again, the Indian middle class, like their Chinese counterparts, used the opportunity of a weakened gold price to increase their holdings. This was particularly the case in recent weeks and in the run up to the Diwali festival which began yesterday with Dhanteras.

To put this figure in context it is worth noting that in August 2013 gold imports were valued at just $739 million.

Indian gold imports were up 449.7% y/y in September, which is approximately 94 tonnes, using the average gold price for September.

From the point of view of the government in India, this level of demand for the precious metal, which must be imported, is an unwelcome development. "The trade deficit worsened to an 18-month high of $14 billion in September following a 450% rise in gold imports as importers rushed to take advantage of lower prices" reports India's Economic Times.

The government in India claims that this staggering level of demand is causing a weakening of the rupee which undermines India's ability to import the other commodities upon which it depends.

Exactly how the Indian government intend to deal with the problem is unclear. The previous attempt to control gold imports in 2013 was aborted due to it's deep unpopularity and to the fact that vast quantities continued to be smuggled into India regardless, resulting in loss of revenue to the state.

In China, gold imports have surged again.

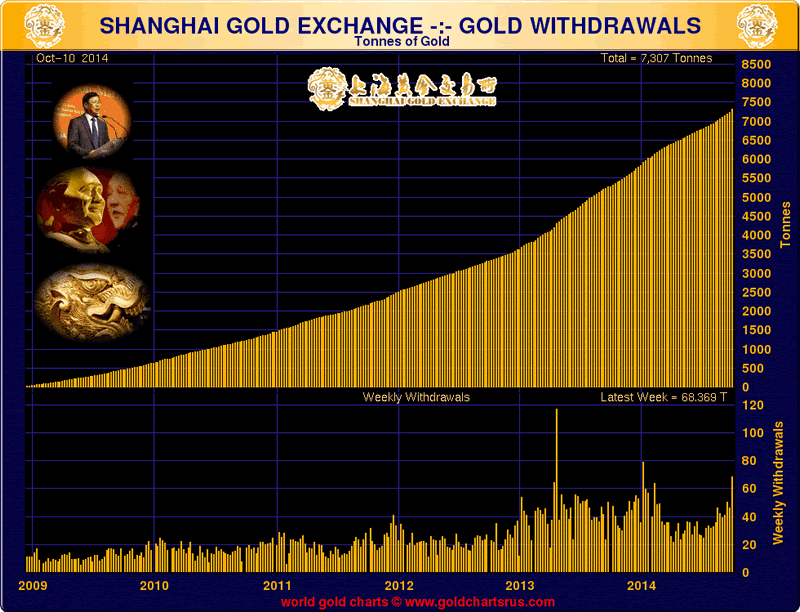

In the world’s largest gold buyer China, premiums recovered to $2-$3 an ounce from $1-$2 overnight, showing higher demand and lending support to global prices. Shanghai Gold Exchange (SGE) gold withdrawals were very high this week and saw a huge rise for the week to 68.4 tonnes with most of the buying after their Golden Week holiday.

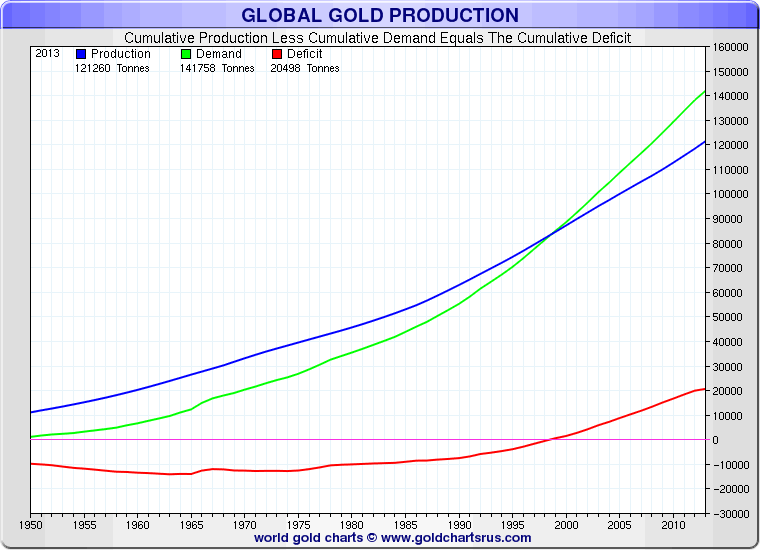

Last year alone, China imported almost 2,000 tonnes of gold as seen in the important metric that is withdrawals from the SGE. To put that figure in context, global mining supply will be around 2,700 tonnes this year.

What we in the West need to appreciate is that - in the case of both India and China, where around one third of the population of the Earth reside, - it is masses of individuals, families and local businesses who are driving this demand.

It is being driven particularly by the burgeoning middle classes who are accumulating whatever gold they can with their disposable income. The desire to own gold as savings and financial security is culturally embedded in these ancient cultures.

Asians experience of fiat, paper currencies has not been a good one.

As such, the demand is not speculative and a cyclical, short term blip. Rather, it would appear to be a long term, structural shift to higher demand. While the trend may dissipate it is very unlikely to reverse into a trend of mass selling and it is unlikely to reverse trend anytime soon given the fiscal and monetary challenges facing the Western and indeed the Eastern world.

Apart from massive store of wealth demand in the East, the gold reserve demand by many large, creditor nation central banks continues unabated.

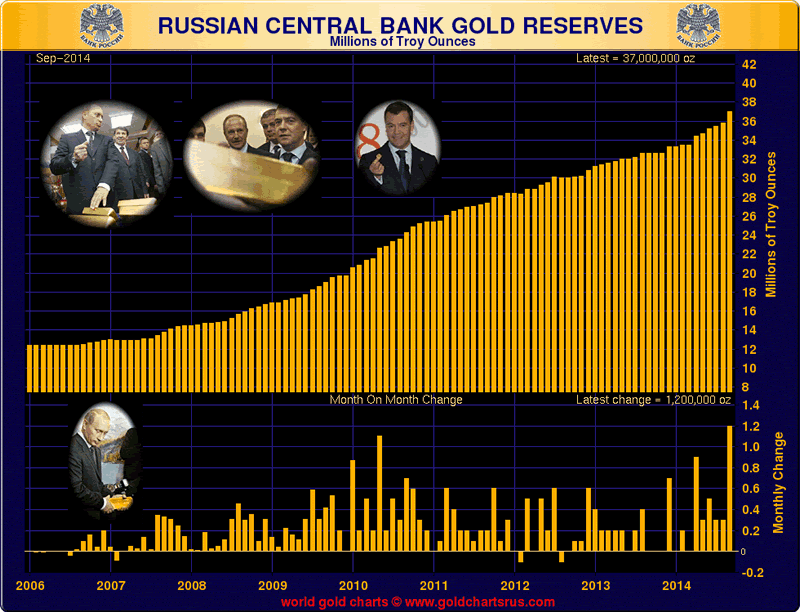

In Russia, the central bank added a very large 37.3 tonnes of the metal to it's reserves in September - it's largest purchase in fifteen years.

It is an indication of the strategic importance that Vladimir Putin and his government place on gold that such a large amount was purchased at this time of international tensions.

The rouble has been under tremendous pressure due to Western imposed sanctions and the slump in oil prices - Russia's largest revenue source. According to the Russian Central Bank: "In the past ten days we have sold about $6 billion" to support the rouble rate, Reuters reported yesterday. And yet $1.5 billion was made available to acquire gold reserves.

Asian people are acting like their own central bank and diversifying their wealth.

It is safe to say that - in the event of a global monetary crisis brought on by a tsunami of insurmountable QE compounded debt - the average Indian or Chinese family will be reasonably well equipped to weather the financial and monetary storm.

The same cannot be said, unfortunately, for their Western counterparts where ownership of tangible assets is abysmally low and only a tiny fraction of the population own gold and silver bullion.

Get Breaking News and Updates on the Gold Market Here

GOLDCORE MARKET UPDATE

Today’s AM fix was USD 1,246.75, EUR 982.08 and GBP 777.66 per ounce.

Yesterday’s AM fix was USD 1,251.75, EUR 978.85 and GBP 774.17 per ounce.

Gold climbed $2.20 or 0.18% to $1,248.30 per ounce and silver rose $0.07 or 0.4% to $17.51 per ounce yesterday.

Silver in U.S. Dollars - 10 Years (Thomson Reuters)

Gold in Swiss storage or for immediate delivery lost 0.2% to $1,246.08 an ounce by 1200 in Zurich.

Silver for immediate delivery lost 0.7% to $17.43 an ounce. Platinum fell 0.5% to $1,276 an ounce. Palladium was 0.4% lower at $776 an ounce.

Gold retreated from the highest in almost six weeks in dollar terms due to profit taking and renewed risk appetite which saw stocks globally bounce from their recent lows although european shares are showing weakness again this morning. Although gold continues to eke out small gains in euro, pound and other fiat currency terms.

Gold reached $1,255.34 an ounce yesterday, the highest since September 10. Demand in India, the second biggest gold buyer, surged before the Diwali festival, Indian’s Christmas.

Diwali, the festival of lights is celebrated tomorrow and Dhanteras, the biggest gold buying festival, was celebrated yesterday. Dhanteras is considered an auspicious time to buy gold coins, bars and jewellery. Researcher CPM Group estimates the holiday generates about 20% of India’s annual purchases.

Platinum in U.S. Dollars - 10 Years (Thomson Reuters)

Gold has risen 3.2% so far in October as stocks fell sharply and traders pushed back estimates for when the Federal Reserve might raise U.S. interest rates from near 0%. The IMF has cut its economic growth outlook this month and Fed policy makers said slowing foreign economies were a risk to U.S. expansion. Indeed, the U.S. economy itself looks very vulnerable to a recession.

The Shanghai Gold Exchange is working to implement China's first forwards and options in gold, in a race to put China as the main Asian pricing benchmark that could rival the London gold fix.

The European Central Bank is planning to buy corporate bonds on the secondary market and may decide as soon as December with a view to begin purchases in early 2015. This is another sign of desperation on the part of central bankers who are attempting to kick start the structurally broken Eurozone economy.

A diversified portfolio of precious metal coins and bars, owned in a segregated and allocated manner in the safest jurisdictions in the world remains very prudent.

See Essential Guide to Storing Gold In Switzerland here

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.