Currency War - How to Profit from a Stronger U.S. Dollar

Stock-Markets / US Dollar Oct 22, 2014 - 06:00 PM GMTBy: Money_Morning

Peter Krauth writes: The Fed plans to wind down its asset purchases this month, but Japan and the United Kingdom are still buying, full swing.

Peter Krauth writes: The Fed plans to wind down its asset purchases this month, but Japan and the United Kingdom are still buying, full swing.

Meanwhile, the European Union is just looking to get started.

And, while the Fed is expected to begin raising rates next year, Europe and Japan recently pushed theirs below zeroas deflation appears to be the bigger threat.v

That's sent the U.S. dollar into a major run up, with the euro and yen on the losing side.

This adds up to a global currency conflict that's giving us a very rare, very lucrative opportunity right now…

The Double-Edged Sword of a Stronger Dollar

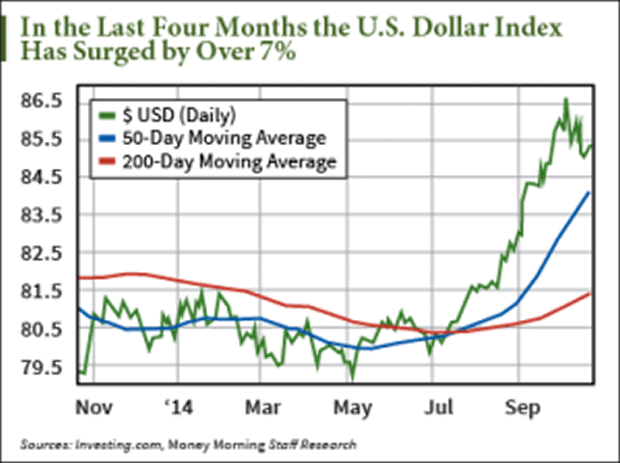

In the last three months the US Dollar Index has surged by over 7% – a massive move that almost never comes over such a short period of time in currency markets.

But volatility is a sign that investors and traders are edgy and unsettled.

Right now, the dollar is strong, in part because investors have been chasing U.S. markets. They've been on a tear for nearly five years, and increasingly people "want in on the action."

Another strong-dollar factor is simply the weakness in other currencies.

For instance, the pound sterling was hit last month by uncertainty surrounding the now-resolved Scottish independence referendum.

And the yen's been whacked by its massive QE program, while the euro's been trashed by slashing rates – and expectations that the European Central Bank (ECB) would embark on its own massive QE to kick-start inflation.

A strengthening dollar has numerous benefits. Imports become cheaper, and Americans travelling abroad find their dollar goes further.

But it's still a double-edged sword. The stronger dollar, which prices commodities, means weaker resource prices. That's good for companies that use them as inputs, as costs come down, but it's a real headwind for those that produce the commodities themselves, as margins get squeezed.

At the same time, American exports become more costly to their overseas buyers, and foreign tourists may decide to postpone that trip to Walt Disney World, as it suddenly becomes that much more expensive.

Not all of this is good for the economy; there's a delicate balance to contend with.

"Super Mario" Has a Tougher Job Ahead

On the other side of the Atlantic, the EU hasn't enjoyed the same supposed recovery as the U.S.

So ECB President Mario Draghi is desperate to kick-start activity and boost inflation, stuck at an anemic 0.3% in August.

Eurozone unemployment is running at 11.5%, with some countries like Greece and Spain weighed down with rates above 24%.

Back in April I said "…Draghi shocked exactly no one when he said they were committed to nipping persistent low inflation in the bud. He confirmed that quantitative easing was part of a 'rich and ample discussion,' with Eurozone inflation at 0.5%, well below the 2% target."

Then in June I explained the ECB's new and more drastic measures:

- Interest on main refinancing operations (MROs) was lowered by 10 basis points to 0.15%. These are loans to banks secured by sovereign debt.

- 400 billion euros were made available in loans to banks with a limit of up to 7% of existing loans to the nonfinancial private sector (excluding home lending).

- Marginal lending facility (overnight credit from ECB) was lowered from 0.75% to 0.4%.

But here was the real kicker…

- Deposit rates (interest paid to banks on deposits at the ECB) were lowered from 0% down to -0.1%. Banks will now have to pay the ECB to leave funds on deposit.

So, Draghi's on a mission…

In mid-September the ECB followed up with a new stimulus program to get banks to lend more to businesses. This first round of ultra-cheap loans amounted to 82 billion euros, yet that was considerably below the expected range of 100 billion to 200 billion euros, as banks shunned the offer.

Given the run up in U.S. stock markets, and some limited success in both the U.K. and Japanese markets, Europe is hoping they can achieve similar results.

Frankly, it just might work for a while.

Markets have begun pricing in the effects of European stimulus. We've seen EU stocks exhibit strength over the past year, and the euro tank in the last six months.

The modus operandi of central banks has been, and will continue to be, extended ultra-low interest rates and rampant money printing. That's exactly what I expect more of from the Fed if it decides to try and "do something" about the stronger dollar.

If we consider weaker currencies and rising stock markets, along with some housing price improvements, these tactics are having at least some of the intended effect.

But it becomes a vicious circle. Once central planners take their collective foot off the gas, asset prices won't just go sideways, they'll go into reverse.

So I don't expect rates to be raised anytime soon in the United States, and even if they do, it's not likely to last long.

Right now, the dollar is benefitting – as it has so many times in the past – from its safe haven status, and that's what's pushing it higher temporarily.

I expect its current strength to be temporary, and for it to return on a path to its intrinsic value: zero.

How will it work its way down? One possibility is a major loss of confidence in the greenback. That could be triggered once inflation noticeably picks up, and then much higher inflation expectations become entrenched.

At that point people could look to bail from the dollar, but that's still some ways off.

Our Currency Conflict Play Is…

In the meantime, here's what we can do to profit while the issue slowly sorts itself out: We go through Europe.

To benefit, consider a large multinational like Royal Dutch Shell Plc. (NYSE ADR: RDS.A), the world's third-largest integrated oil producer.

This $240 billion energy behemoth is headquartered in the Netherlands. With over 90,000 employees, Shell operates in over 80 countries producing oil and natural gas, as well as a full gamut of petrochemicals through its 30 refineries and chemical plants.

Shell has great worldwide exposure, while providing investors with a hefty dividend in the 4.7% range at current prices.

Remember, every central bank wants a weaker currency; Draghi's already trashed the euro.

And his determination to inflate is likely to work.

And that means we can expect European stocks to head higher. Much higher.

Source : http://moneymorning.com/2014/10/20/this-bear-market-indicator-is-off-the-mark/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.