Banks Hold Treasuries and Make Loans

Stock-Markets / Credit Crisis 2014 Oct 22, 2014 - 05:53 PM GMTBy: BATR

Ever since the 2008 financial collapse, banks have reduced their lending while accumulating U.S. Treasuries. On the surface placing capital into the safest depositor may seem prudent. On the other hand, Why Big Banks Are Suddenly Interested in Talking to You Again? According to Inc, “After years of turning away small-business borrowers, the country's largest banks are now granting one out of five loan applications they receive. The 20 percent benchmark represents a post-recession high for big banks (assets of $10B+). Further, small banks have been approving more than half of the funding requests they receive.”

Ever since the 2008 financial collapse, banks have reduced their lending while accumulating U.S. Treasuries. On the surface placing capital into the safest depositor may seem prudent. On the other hand, Why Big Banks Are Suddenly Interested in Talking to You Again? According to Inc, “After years of turning away small-business borrowers, the country's largest banks are now granting one out of five loan applications they receive. The 20 percent benchmark represents a post-recession high for big banks (assets of $10B+). Further, small banks have been approving more than half of the funding requests they receive.”

Such news would normally be welcomed. The Sovereign Man article, Here's Why US Banks Are Now Extremely Vulnerable, presents a sober warning that the banking industry is at risk from a bond market sell-off.

“In just the last month alone American banks increased their holdings of US treasuries by $54 billion, to a record $1.99 trillion.

Facing $127 trillion in unfunded liabilities – which is nearly double 2012’s total global output – and with no inclination to reduce those numbers at all, at this point disaster for the US is entirely unavoidable.

Under the rather arbitrary Bank of International Settlements Basel capital adequacy rules government debt rated at least AA continues to carry a “zero risk” weighting. Meaning that banks do not need to set aside capital against it.

Beyond that, regulations imposed after the last crash to reduce risk require banks to hold $100 billion in liquid assets, which of course includes bonds. Thus, they are not only encouraged, but actually forced to buy government bonds.”

The fundamental change in the last six years is that the banks were rescued from normal capital requirements under a zero interest rate discount window. The inevitable result starved the small business and personal borrowing market from obtaining loans. With the loosing of funds to finance business and consumers, could the dire warning that the banks understand they need to rotate out of Treasuries, be the reason for the shift in lending?

However, the rush to come into compliance has America's Banks Pile Up Treasuries as Deposits Overwhelm Lending. This explanation of a change in regulation ordains that U.S. Bonds are still a necessary component in their balance sheet.

“Rules approved Sept. 3 by the Fed, Office of the Comptroller of the Currency and Federal Deposit Insurance Corp. leave banks about $100 billion short of the $2.5 trillion in easy-to-sell assets that they need to meet the liquidity standard, according to the Fed. Lenders must reach 80 percent of their liquidity coverage ratios by January and have until the start of 2017 to reach full compliance.”

Illustrating this point, “Bank of America alone may need to purchase as much as $65 billion of government debt to become fully compliant, according to report last month from Marty Mosby, a banking analyst at Memphis, Tennessee-based Vining Sparks.”

Providing additional encouragement is a WSJ report that U.S. Bank Profits Near Record Levels.

“On the heels of the financial crisis, some lawmakers, regulators and consumers complained that banks weren't lending enough. But steady improvement in credit quality, or borrowers' ability to repay loans, is prompting banks not only to lend more but also to ease their standards.

The higher loan levels come as banks are easing up on their underwriting standards to borrowers. A Federal Reserve survey of senior loan officers released last week found that lenders were loosening standards and loan terms for commercial and industrial loans and commercial real-estate loans.”

Reconciling the need to keep buying treasuries and originating new loans to satisfy business demand is a challenging objective. By returning to the old fashion business model, of actually making loans to customers, banks are generating significant profits.

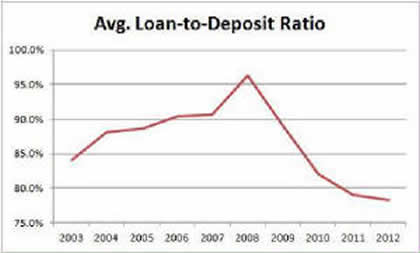

While graphs show the downward trend in loans since TARP, the current upturn is ready to be charted. Lending money for productive enterprise has contributed to a rise in GDP. The transition to a consumer based economy is dependent on the flow of transactions. When the pace of the velocity of money increases and confidence strengthens, prosperity usually follows.

The different in this feeble recovery phase is that the debt assumed by the Treasury, monetized within Federal Reserve liabilities, requires servicing no matter the health of the general economy. Near zero or cost free interest rates is approaching an expected crisis of uninterrupted maintenance. The exact trigger that drives up rates, while elusive to forecast, is inevitable in coming.

The Money Show article, Rising Rates? Beware of Big Banks, describes the predicament accordingly.

“The reality is that traditional commercial and consumer lending is no longer the big money maker that it used to be for banks. Since the 2008 financial crisis, households and businesses have been deleveraging—paying down debt—and demand for loans has been limp.

In recent years, the big banks have fattened their profits mainly from capital-markets businesses: Mergers and acquisitions, stock and bond offerings, and other types of trading. Rising interest rates also make the cost of capital go up for businesses, which can result in less deal making, lowering financing fees for the banks.”

Hype that loan demands have returned in earnest is overstated. Coming off such a low level, any modest increase looks bigger than it really is. That revered business cycle, simply is no longer the same.

So what happens in the catch-22 scenario when banks are adjusting to different capital requirements and Treasuries drop in price with a rise in interest rates? That’s the 64 trillion dollar question.

Banking is more about mathematics than business acumen when additional debt created money is needed to pay the service of obligations that come due. The roll over can be staggering. Banksters make up the monetary rules. That $127 trillion nut is bigger than all the bank reserves put together.

For those who argue the economy can grow its way out of this liquidity squeeze must have a time frame longer than the imaginative bag of tricks left in the vaults of banks.

James Hall – October 23, 2014

Source: http://www.batr.org/corporatocracy/102214.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2014 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.