Don't Get Ruined by These 10 Popular Investment Myths (Part VII)

InvestorEducation / Learning to Invest Oct 22, 2014 - 11:16 AM GMTBy: EWI

Interest rates, oil prices, earnings, GDP, wars, peace, terrorism, inflation, monetary policy, etc. -- NONE have a reliable effect on the stock market

Interest rates, oil prices, earnings, GDP, wars, peace, terrorism, inflation, monetary policy, etc. -- NONE have a reliable effect on the stock market

You may remember that after the 2008-2009 crash, many called into question traditional economic models. Why did they fail?

And more importantly, will they warn us of a new approaching doomsday, should there be one?

This series gives you a well-researched answer. Here is Part VII; come back soon for Part VIII.

Myth #7: "Peace is bullish for stocks."

By Robert Prechter (excerpted from the monthly Elliott Wave Theorist; published since 1979)

Most people would not argue that peace is bearish for stock prices. It would seem logical to say that peace allows companies to focus on manufacturing goods, providing services, innovation and competition, all of which helps the overall economy.

But does peace in fact have anything to do with determining stock prices?

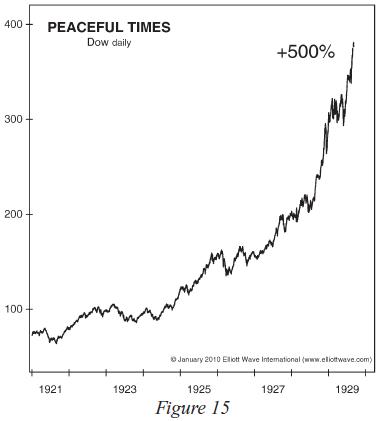

Figure 15 provides an example of peaceful times -- the 1920s -- in which stock prices seemingly benefited. After all, they rose 500% in just eight years, as there was mostly peace around the globe.

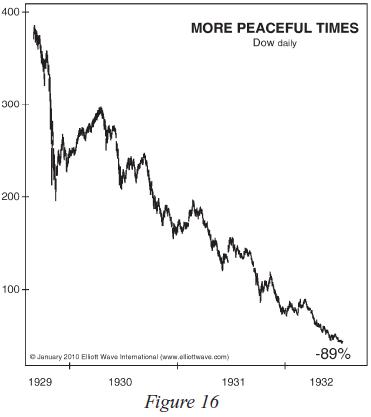

Figure 16, however, shows that in the time immediately following, stock prices lost 89% of their value. During this time as well, there was mostly peace around the globe. Yet stock prices fell more in under three years than they had gained in the preceding eight years!

It seems that we cannot count upon any consistent relationship between peace and stock prices, either.

(Stay tuned for Part VIII of this important series, where Prechter examines another popular investment myth: Namely, that "Terrorist attacks would cauase the stock market to drop.")

Free Report:

|

This article was syndicated by Elliott Wave International and was originally published under the headline Don't Get Ruined by These 10 Popular Investment Myths (Part VII). EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.