Bitcoin Price Goes Up and Down

Currencies / Bitcoin Oct 21, 2014 - 06:45 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

Coinbase’s co-founder Brian Armstrong has highlighted the difficulties in convincing the banks to work with Bitcoin businesses in a conversation with the Telegraph, we read on the paper’s website:

Originally launched in the US, it [Coinbase] recently announced that it had secured banking and regulatory approval to launch in Europe, opening its services up to 18 new markets. But the UK was not among them.

The main hurdles for it to enter a new market are banks and regulation. You can’t set up in a country unless Bitcoin payments are legal, and you can’t handle business unless you can get a bank account. And they are struggling to get a UK bank account.

Even though many people see Bitcoin as undermining the two institutions of big finance and government, which in a sense it does, it is also beholden to them - at least, it is if you want a legitimate, easy-to-use, commercial payment system.

Getting banks on board is “challenging”, admits Armstrong, who points out that there are no British lenders currently offering accounts to Bitcoin startups. In other markets it has taken six months of meetings “just to get them comfortable”.

“These banks are usually quite sceptical. That’s a hard, difficult process that involves a lot of meetings,” he says. Coinbase hopes to launch on these shores “soon”.

“We have to be patient. It could happen in a week or ten years,” he adds.

So here it is, one of the biggest hurdles for the development of the Bitcoin ecosystem is the still present regulatory vacuum which makes traditional financial institutions wary of companies related in any way to cryptocurrencies. The banks simply don’t want to risk opening accounts for businesses they’re not sure are 100% legal.

This might change one more regulation is actually drafted on Bitcoin and the cloud of suspicion against the currency is blown away. The process is actually already underway as Coinbase was able to get a go-ahead for its business in new European markets. With more Bitcoin startups being set up, the need for regulation will only grow, and so will the authorities’ awareness and banks awareness of what Bitcoin is.

In our opinion, the currency has the potential to not be associated with illegitimate activities but rather with quick transactions. That’s still a long way off, but the potential is there.

For now, we turn to the charts.

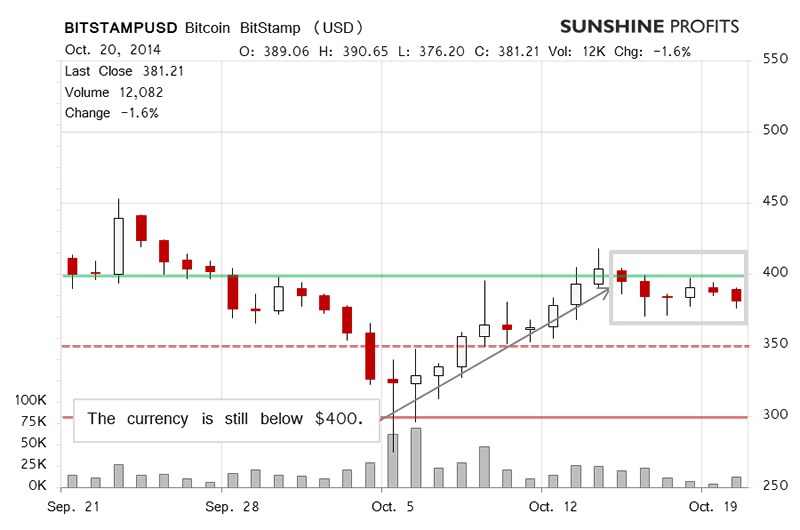

On BitStamp we saw a move down yesterday. The volume was relatively significant but nowhere near what we had seen during the recent strong declines. In this sense the action was not particularly exciting but it, nonetheless, brought further indications for traders. Yesterday, we commented:

The analysis of volume shows that the level of trading dropped over the weekend. This suggests that the action we saw over the weekend was not extremely significant. On the other hand, the prolonged inactivity might suggest that Bitcoin will move along its general trend which has been down for months now.

(…)

If it [volume] picks up, we might see the first sign of the next move. The situation has become more bearish than it was on Friday but there still hasn’t been enough momentum to support short positions.

Even though, we saw depreciation yesterday, the above remarks have been confirmed today as Bitcoin has rebounded and recovered (this is written before 9:30 a.m. ET). The move up hasn’t been supported by volume, which is relatively weak, decidedly lower than yesterday (at least, so far).

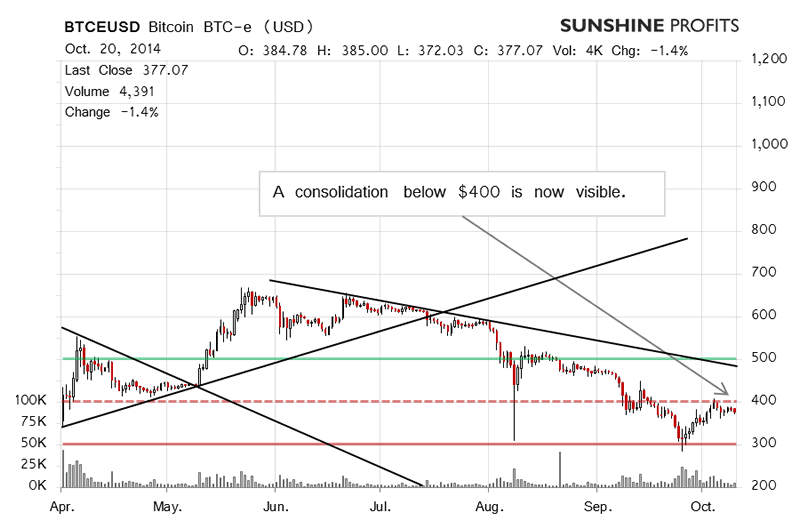

On the long-term BTC-e chart there hasn’t been much change. We saw a slight drop yesterday but it has been largely reversed today. There’s one difference compared with BitStamp here. The volume has been in line with what we saw yesterday on BTC-e, which means it has been more significant than on BitStamp.

It hasn’t been strong enough to signal a start of the new rally, though. Consequently, our yesterday comments remain up to date:

(…) we prefer to adhere to the previously described strategy. We make adjustments for the recent developments. It’s the case that the short-term outlook has become more bearish but our bet is still on the appreciation being resumed. In such an environment, we don’t suggest shorts. For the time being, it seems best to wait for a confirmation of a move down or for a rebound off $350.

The above points suggest that there’s not too much to be excited about today. The move up doesn’t look like a beginning of a new rally and Bitcoin still is in “consolidation mode.” The currency seems to be dancing around $380. The now prolonged period of trading below $400 might suggest weakness and we wouldn’t be too surprised to see Bitcoin move lower now, to $350 or so. On the other hand, there still hasn’t been enough downward pressure to suggest a move down just now.

Summing up, we don’t support any short-term positions in the market.

Trading position (short-term, our opinion): no current positions; a buy limit order, entry at $427, stop-loss at $357, initial target at $500.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.