The Similarities Between Germany and China

Economics / GeoPolitics Oct 21, 2014 - 12:10 PM GMTBy: STRATFOR

I returned last weekend from a monthlong trip to both East Asia and Europe. I discovered three things: First, the Europeans were obsessed with Germany and concerned about Russia. Second, the Asians were obsessed with China and concerned about Japan. Third, visiting seven countries from the Pacific to the Atlantic in 29 days brings you to a unique state of consciousness, in which the only color is gray and knowing the number of your hotel room in your current city, as opposed to the one two cities ago, is an achievement.

I returned last weekend from a monthlong trip to both East Asia and Europe. I discovered three things: First, the Europeans were obsessed with Germany and concerned about Russia. Second, the Asians were obsessed with China and concerned about Japan. Third, visiting seven countries from the Pacific to the Atlantic in 29 days brings you to a unique state of consciousness, in which the only color is gray and knowing the number of your hotel room in your current city, as opposed to the one two cities ago, is an achievement.

The world is not getting smaller. There is no direct flight from the United States to Singapore, and it took me 27 hours of elapsed travel to get there. There is a direct flight from Munich to Seoul, but since I started in Paris, that trip also took about 17 hours. Given how long Magellan took to circumnavigate the world, and the fact that he was killed in the Philippines, I have no basis for complaint. But the fact is that the speed of global travel has plateaued, as has the global economic system. There is a general sense of danger in Europe and Asia. There is no common understanding on what that danger is.

I was in Seoul last week when the news of a possible wave of European crises began to spread, and indications emerged that Germany might be shifting its view on austerity. It was striking how little this seemed to concern senior officials and business leaders. I was in the Czech Republic when the demonstrations broke out in Hong Kong. The Czechs saw this as a distant event on which they had opinions but which was unlikely to affect them regardless of the outcome.

There has been much talk of globalization and the interdependence that has flowed from it. There is clearly much truth in arguing that what happens in one part of the world affects the rest. But that simply was not evident. The eastern and western ends of the Eurasian landmass seem to view each other as if through the wrong side of a telescope. What is near is important. What is distant is someone else's problem far away.

Germany and China as Economic Centers

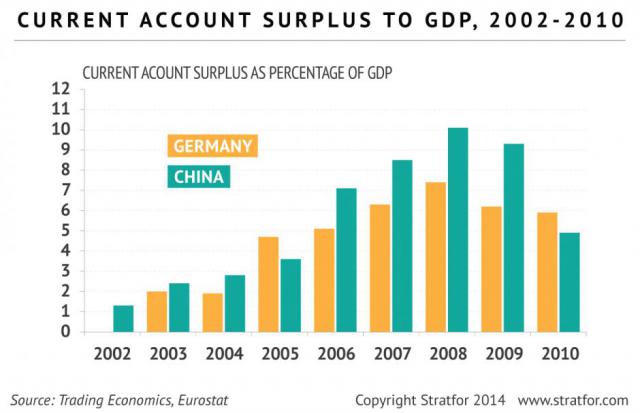

There is symmetry in this view. Europe cares about Germany and Asia about China. In some fundamental ways these countries have a substantial amount in common. China is the world's second-largest economy. Germany is the world's fourth-largest exporter. Both countries are at the center of regional trade blocs -- Germany's formal, China's informal. Both trade on a global basis, but both also have a special and mutual dependency on their regions. China and Germany both depend on their exports. Germany's exports were equivalent to 51 percent of its gross domestic product, or about $1.7 trillion, in 2013, according to the World Bank. China's exports equaled 23.8 percent of a larger GDP, or about $9.4 trillion.

The two countries at the center of their respective regional systems have both been extremely efficient exporters. The United States, by comparison, exports only 14 percent of its GDP. But it is precisely this ability to export that makes both Germany and China vulnerable. Both have created production systems that outstrip their capacity to consume. For Germany, increasing consumption can be only marginally effective because it is already consuming at near capacity. For China, there is more demand, but much of it is among the roughly billion people who lack the purchasing power to the buy the goods China produces for the regional and global market. China's society lives on a steep cliff. On top of the cliff is a minority who can purchase goods. In the deep valley are those who cannot -- and also cannot readily climb the cliff. Thus, like Germany, China's effective demand cannot absorb its exports.

Therefore, economic viability for both Germany and China depends largely on maintaining exports. No matter how much they import, their exports maintain domestic social order by providing a significant source of jobs right away, rather than in some future scenario involving the rebalancing of their work forces. For Germany, which has memories of massive social dislocation in the 1920s, maintaining full employment cuts to the heart of the country's social order. For China, whose Communist Party was shaped by the rising up of the unemployed in Shanghai in 1927, maintaining full employment is a bulwark in defense of the government. Both countries look at unemployment not only in terms of economics, but also in terms of social stability and governmental survival. Therefore, exports are not simply a number, but the foundation of each country.

An Economic Model's Shortcomings

The problem with an export-based economy is that the exporter is the hostage of its customers. Germany's and China's well-being depend not only on how they manage their economies, but on how their customers manage their own economies. If the customer's economy fails, the customer cannot buy. It doesn't matter whether the problem is a policy failure or a cyclical downturn -- the exporter will pay a price. Both Germany and China exist in this precarious position.

Germany and China are dealing with the fact that their customers' appetites for goods are declining -- whether because of price competition or because of economic decline. Europe is in economic turmoil. Southern Europe is suffering from massive unemployment, and the rest of Europe is experiencing slower economic growth, no growth, or even decline. Demand in this market is essential to Germany, and it is difficult to maintain demand under these circumstances. It is not surprising, then, that the German economy appears to be moving to recession.

China's problem is different from Germany's, if somewhat more hopeful in the long run. The 2008-2009 global financial crisis decimated China's low-end export sector. The crisis halted the decadeslong low-cost export boom that the Chinese government had kept alive well beyond its natural life span through years of systematic wage repression and wasteful subsidies, both direct and indirect, to manufacturers. As a result of the crisis, the portion of China's GDP tied to exports collapsed almost overnight, from 38 percent in 2007 to just under 24 percent now. This collapse has forced Beijing to keep the economy on life support through massive expansion of state-led investment into housing and infrastructure construction. The housing boom is showing signs of having finally run its course.

China's problem is different from Germany's, if somewhat more hopeful in the long run. The 2008-2009 global financial crisis decimated China's low-end export sector. The crisis halted the decadeslong low-cost export boom that the Chinese government had kept alive well beyond its natural life span through years of systematic wage repression and wasteful subsidies, both direct and indirect, to manufacturers. As a result of the crisis, the portion of China's GDP tied to exports collapsed almost overnight, from 38 percent in 2007 to just under 24 percent now. This collapse has forced Beijing to keep the economy on life support through massive expansion of state-led investment into housing and infrastructure construction. The housing boom is showing signs of having finally run its course.

Beijing is pinning its hopes, in part, on a revival of China's export manufacturing might -- not of the low-cost, low-value added goods that were once the country's mainstay, but increasingly of the kind of value-added goods proffered by more-advanced export economies such as South Korea and Germany. However, this evolution is a long-term goal, not one that can be realized in one, two or even five years. In the meantime, Beijing will struggle to maintain stable growth and high employment in the face of an anemic low-end export sector, a deflated housing and construction bubble, less-than-robust domestic consumption, and inadequate services and high-end manufacturing sectors.

Germany's and China's regional partners may not, in the long run, benefit from German and Chinese export power. It is interesting that in general, everyone fears the major readjustment that might be coming. Germany's power and ability to flood markets are seen regionally as problems that need to be corrected. At the same time, Germany's regional trade partners understand the instability that readjustment would bring and are content, particularly among the corporate and financial communities, to maintain the current order with Germany at the center. The same might be said for China. When I spoke of China's weakness, there was no longer any resistance to the idea, as there was a few years ago. At the same time, no one was eager to see a changing of the guard. The western and eastern parts of Eurasia were each built around the power of a single country: Germany in the west and China in the east. Each region understands the economic price it pays for German and Chinese power, and each region understands that pivoting around these two countries provides an element of stability.

Variables in East Asia and Europe

Another wild card exists in each region. In Europe, it is Russia. In East Asia, it is Japan. Russia has already become active in asserting itself. It is not challenging German power, as Russia is not an industrial competitor with German exports. Rather, the country is an exporter of energy needed by Germany and Europe, and it is a significant, if regional, military power. In Eastern Europe where I travelled, the discussion frequently turned on the question of whether Germany and Russia had reached some sort of secret accord that was playing out around the Ukraine crisis. If there is an agreement, then the region will have to dance to the Moscow-Berlin tune. If there is no deal, then no one wants to see Germany destabilize. But there is also a sense that there is nothing to be done about it.

In East Asia, there was also a sense that Japan is reappraising its postwar pacifism and preparing to take a more active military role in the region. Concerns about Japanese remilitarization were much less visible in Singapore than in Korea, and it is not an overwhelming concern anywhere. But there was still the feeling that as China enters an unpredictable phase economically, it enters one socially and politically as well. All of Japan's forays among the small islands to China's east may portend more aggressive moves. My own view -- that China is not nearly as capable militarily as it might appear -- was at once acknowledged and brushed off. In the region, risks can't be taken. Japan was seen as the wild card. Still the world's third-largest economy, with a substantial military establishment already, Japan might find it necessary to be a counterweight to China. There is as much enthusiasm for this in East Asia as there is for Russian aggressiveness in Europe.

Seeing Both Sides of Eurasia

A trip to both East Asia and Europe allowed me to see two things I never quite noticed before. The first is the symmetry between the two ends of Eurasia. Both are built around a strong exporting power that is now in very dangerous waters. Neither export powerhouse is loved in its home region, but few regional trade partners are eager to deal with the risks that instability might bring. And in each region there is an actor just off stage that is flexing its muscles and potentially changing the way the regional game is played.

The second thing I noticed, which I don't think I would have seen without flying first to Singapore, then to Europe and then to South Korea, is the degree to which the two ends of Eurasia are decoupled. We talk about global interdependence, and it is real. But while, whatever the economic dynamics, each region is intellectually aware of what is going on at the other end of Eurasia, each sees the other as distant and ultimately unconnected from its concerns. They are aware of each other, but not concerned about each other, as each region plays its own game. What makes this ironic is how similar the two games are.

The primary question that people on both sides of Eurasia asked was, "What is the United States going to do?" I was always asked about the decline of the United States and then, in the next sentence, asked about what the United States will do in Ukraine, Iraq or the South China and East China seas. There is a sense that Europe and China are far apart, but the United States is near. There was also a frustration that the United States is not prepared to play roles that would serve these regions' best interests and instead insists on pursuing what is seen as its own foolish ends. It was good to hear this, as it assured me the world has not completely uncoupled.

Distance does seem to disconnect people. Money might flow in milliseconds, and flights can be made in (too many) hours, but human lives are built around what is nearby and therefore familiar. Each region saw itself as unique. I might have been startled by how much they have in common, and Europe's and Asia's fates might be similar. But I have the sense that despite all we say about a small planet, similarity is not the same as being linked.

"The Similarities Between Germany and China is republished with permission of Stratfor."

This analysis was just a fraction of what our Members enjoy, Click Here to start your Free Membership Trial Today! "This report is republished with permission of STRATFOR"

© Copyright 2014 Stratfor. All rights reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis.

STRATFOR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.