Stock Market Ideal Turning Point is at Hand

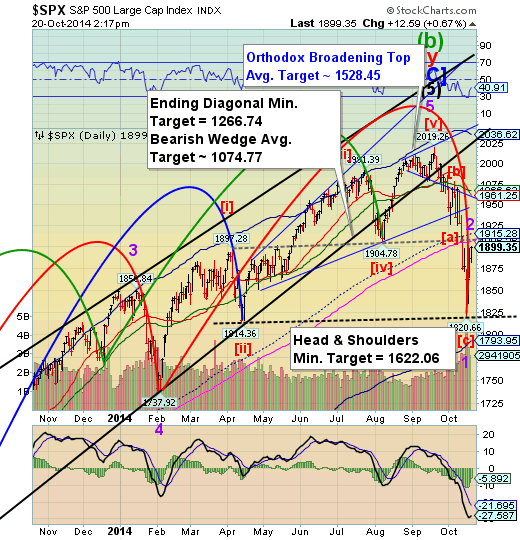

Stock-Markets / Stock Markets 2014 Oct 20, 2014 - 05:42 PM GMT SPX appears to be letting the clock run out on the rally today. The 200-day Moving Average is the likely target, but there are no assurances that it will get there. I drew the dotted line across the supports and resistance points at 1906.36 to show the natural stopping place for the right shoulder.

SPX appears to be letting the clock run out on the rally today. The 200-day Moving Average is the likely target, but there are no assurances that it will get there. I drew the dotted line across the supports and resistance points at 1906.36 to show the natural stopping place for the right shoulder.

Today seems like a snoozer, but the reversal may be a real wake up call. Those who stepped aside from the market may wish to go short again before the close.

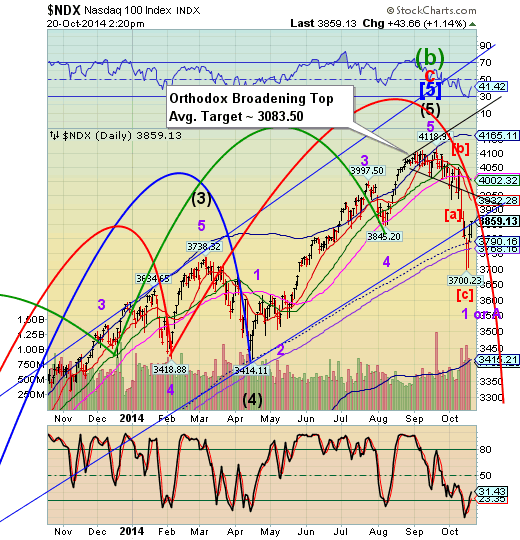

NDX is challenging its trendline and appears to have stalled there. The corresponding technical resistance is the top of Wave (iv) at 3860.04. The pattern now appears complete.

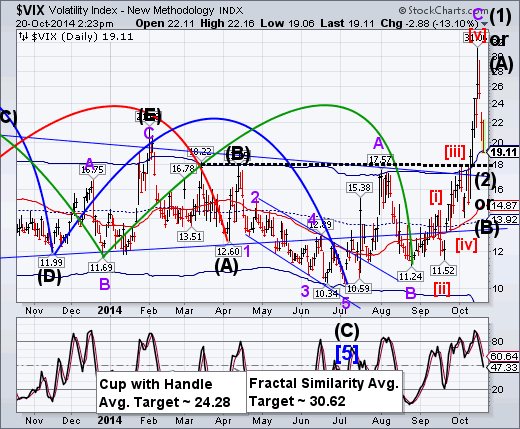

VIX is challenging its Cycle Top at 19.34 and has yet another support at 18.95 (not shown). It, too, seems to have stalled here and may be ready to reverse higher.

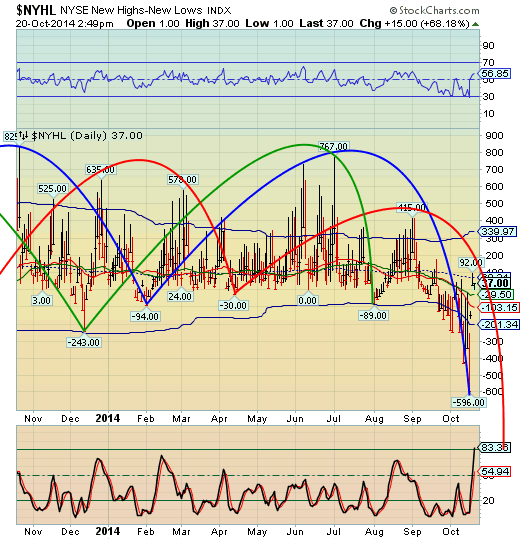

The NYSE Hi-Lo index has dropped beneath its mid-Cycle support/resistance at 69.21 and is on an unconfirmed sell signal. The signal is confirmed beneath its 50-day Moving Average at -29.50.

The seeming lack of volatility today may be putting investors at ease and bringing in the speculators. But the greater opportunity is to sell to those who expect the market to resume its upward bias.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.