Can Ebola Fears Deliver a Value Opportunity in the Cruise Industry?

Companies / Sector Analysis Oct 20, 2014 - 05:30 PM GMTBy: Investment_U

Tom Sandford writes: For a lesson on smooth sailing into global markets, one only needs to look at the global cruise industry.

Tom Sandford writes: For a lesson on smooth sailing into global markets, one only needs to look at the global cruise industry.

In just the last decade, the number of cruise passengers has jumped by 77% from 12 million to 21.3 million, according to the Cruise Lines International Organization.

But there’s one region they’re avoiding: West Africa.

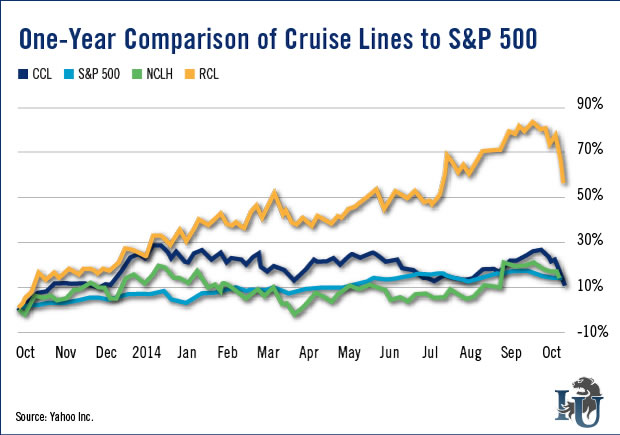

Fears about the Ebola outbreak have sent shares of major cruise lines spiraling in recent days. When Carnival Corporation (NYSE: CCL) said last week it would reroute stops to avoid Ebola, shares declined 5.5%.

Norwegian Cruise Line (Nasdaq: NCLH) also announced route changes. Its stock fell 2.8%.

Even Royal Caribbean Cruises Ltd. (NYSE: RCL), which stated it didn’t have any stops in Africa, fell by 5.9%.

It’s not just the cruise industry that has tripped on Ebola fears. On October 1, 23 out of 24 stocks within the S&P 1500’s hotels, airlines and casinos group closed down by an average of 2.2%. At the same time, the S&P 500 declined 1.3%.

Yet Africa plays only a small role in the daily operations of cruise ship companies. The most popular cruises are to the Caribbean and Bahamas, which encompass 37% of global cruises. Mediterranean tours comprise 20% of traffic.

This means the effect of rerouting the few cruises from West Africa should have little effect. Meanwhile, cruise profitability is rising.

A Growing Global Pastime

While 55% of cruise passengers are American, that number is declining, as vacationers in markets like China, Australia and Brazil take to the seas. Europe has also seen a 44% passenger increase from 2008 to 2013.

Although the global cruise industry is expected to continue growing, analysts expect it to grow faster in the East.

Especially in China, where a burgeoning middle class has a growing desire for cruises. In September, Carnival said it would move its COO to Shanghai to better serve the market.

"China continues to be a focus for emerging market development,” said Carnival CEO Arnold Donald, in a conference call. “[It is] where we expect double-digit growth over the next few years.”

Carnival and Royal Caribbean International are responsible for more than 70% of the market combined.

An Outlook on Ebola

Analysts say one of the reasons cruises are on the rise is their all-inclusive nature. Cruises simplify dining, travel and entertainment by packaging them together.

However, this has also proven to be an industry weakness. Cruise ships are a nexus point for people from around the world. Naturally, that also makes them a great venue for catching exotic diseases.

The Ebola scare unfortunately isn’t the industry’s first clash with virus concerns. In January, 160 passengers on Carnival’s Caribbean Princess were struck with gastrointestinal distress. The suspected cause was norovirus. Carnival stock sank by 1%.

Around the same time, a handful of other outbreaks fueled a media firestorm and a temporary stock shake-up, as well.

Ebola, however, is much less common of a disease. Though containment measures are being practiced, expect Carnival and Norwegian Cruise Lines to continue the shift away from West Africa.

Both should see business continue as usual, save for the chance that a case of Ebola is tracked back to a ship. Sanitation may be a key focus of cruise lines, but with more than 100,000 people boarding each of Carnival and Royal Caribbean’s ships each year, the possibility remains.

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.