Is October the Month for Technology Stocks?

Companies / Tech Stocks Oct 20, 2014 - 05:26 PM GMTBy: Investment_U

David Becker writes: Technology stocks generally perform well in October as investors begin to focus on third quarter earnings. While the group as a whole has outperformed the broader markets, there are a number of both software and hardware companies that have experienced stellar performance.

One way to measure the performance of a sector or a specific stock is to analyze its seasonality. Seasonality can be defined as regular changes that occur to a stock or sector every calendar year. For example, if the price of a stock climbs every October then it has a seasonal pattern.

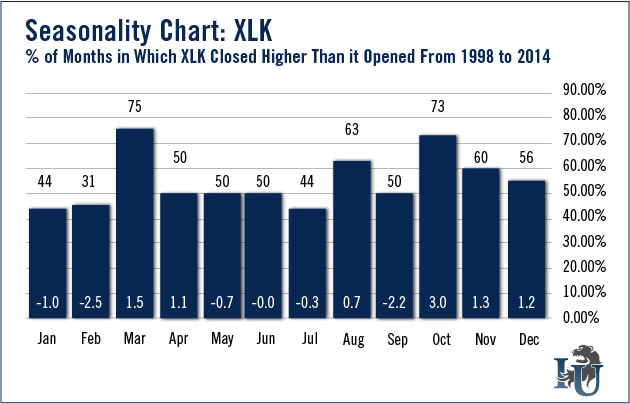

The Technology SPDR ETF (NYSE: XLK) shows a predictable seasonal return in October. And 73% of the time over the past 15 years, the SPDR technology ETF has climbed an average of 3% in October. The results are similar for the broader Nasdaq 100. The PowerShares QQQ Trust (Nasdaq: QQQ) has increased an average of 3.7% in October over the past 16 years, producing an average return of 3.7%.

Technology stocks have outperformed the broader markets recently too. Over the past 10 years, the S&P 500 index was up by 0.4% 55% of the time. Over the past 20 years, the large cap index was higher 60% of the time, for an average return of 1.5%.

Within the tech sector, there are a number of stocks that show strong seasonal patterns. Over the past 20 years, Apple’s (Nasdaq: AAPL) share price increased 70% of the time for an average return of 6.7%. Apple has performed even better in October during the past 10 years, climbing an average of 8.9% nearly 80% of the time.

Microsoft Corp. (Nasdaq: MSFT) has also been a great stock to own during past Octobers. Over the past 20 years, the stock price climbed 75% of the time for an average return of 5.6%. The returns over the past 10 years are similar as 70% of the time the stock is up by an average of 4.4%.

Google’s (Nasdaq: GOOG) returns also shows a robust seasonal pattern. The stock price has increased by a staggering 14% in eight out of the past 10 years.

On the hardware side, Intel (Nasdaq: INTC) has produced very impressive returns in October over the past 20 years. The stock was higher 80% of the time and showed an average return on its stock price of 5.9%. The past 10 years have not been as kind as Intel was up only 70% of the time, reflecting an average return of 2.1%. Not all chip companies have experienced positive performances in October. Advanced Micro Devices (NYSE: AMD) has only increased in value 40% of the time in October and its average return is slightly less than 2%.

Source: http://www.investmentu.com/article/detail/40423/seasonality-technology-stocks#.VEVhHE10y0k

Copyright © 1999 - 2014 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.