Investors Quit Complaining, The Environment is Perfect Right Now

Stock-Markets / US Economy Oct 20, 2014 - 09:17 PM GMTBy: DailyWealth

Steve Sjuggerud writes: Man, I'm tired of the complaining in the last few weeks...

Steve Sjuggerud writes: Man, I'm tired of the complaining in the last few weeks...

Everyone is worried the U.S. economy is weak... and that stocks therefore have to fall. Everyone sees the recent volatility in the markets as proof of this.

I disagree – completely...

The way I see it, this moment – right now – is the absolute perfect moment to be in as an investor.

Conditions in America are perfect... It's a Goldilocks economy right now – not too hot, and not too cold... It's just right.

You see, if the economy was too hot, then the Federal Reserve would be hurrying to raise interest rates. But it's not too hot. It's just right.

Right now, there's a heightened sense of fear in the markets. That's perfect, too... Markets actually need fear to have room to move higher. The level of fear is just right for higher prices.

Before you give in to your fears, let me give you a dose of reality here... where "reality" is not nearly as bad as the news makes things out to be.

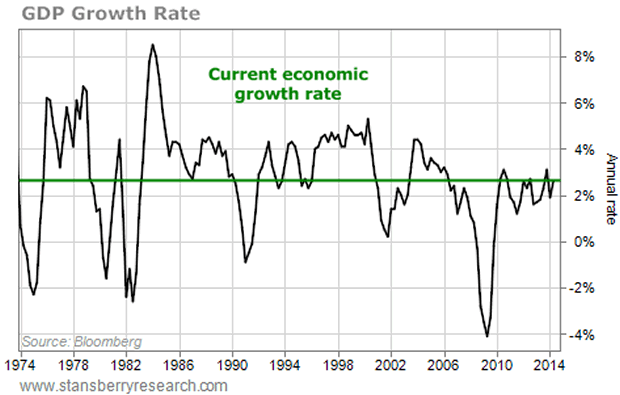

Three charts tell the story...

Check out our Goldilocks economy right now... It's just right for higher stock prices. Not too hot, and not too cold:

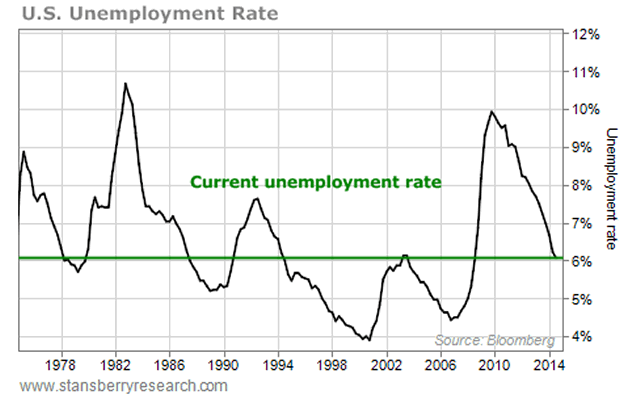

Contrary to what the fear mongers would have you believe, the unemployment rate is actually pretty darn low compared with the last 40 years. It is just right.

You don't want to see it go to 1999s "dot-com boom" levels, because the Fed would raise interest rates if that happened. Today is just right. Take a look:

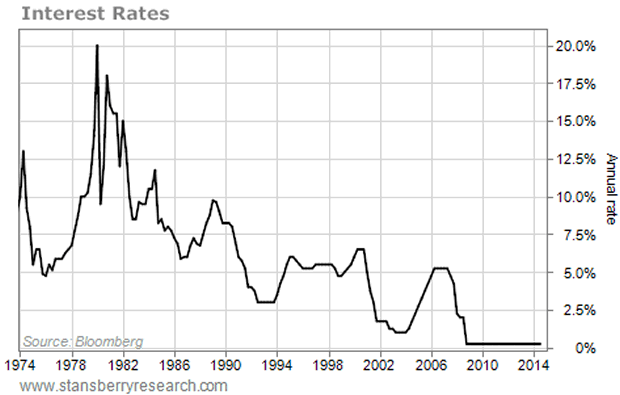

So we have our perfect little investing environment with our Goldilocks Economy... Don't forget about the one little piece of magic that should continue to turbocharge our investments higher... Interest rates at zero:

The investment environment right now is perfect...

You have a perfect economy (growing, but not growing too fast). You have a perfect unemployment rate (low, but not too low). And as an added bonus, you have zero-percent interest rates – that really should be higher – but the U.S. Federal Reserve is too scared to move them higher yet.

It doesn't get any better than this.

Stop waiting for a better moment. Seriously, it doesn't get any better.

Quit your complainin'.

And get on to some real investin'.

Be bold. Be contrarian. Step up. Chances are good you'll be glad you did...

Good investing,

Steve

Editor's note: If you'd like more insight and actionable advice from Dr. Steve Sjuggerud, consider a free subscription to DailyWealth. Sign up for DailyWealth here and receive a report on the five must-read books on investing. This report will show you several of the DailyWealth team's "must read" books, which will help you become a better investor right away. Click here to learn more.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.