Stock Market Dow Theory Update

Stock-Markets / Dow Theory Oct 20, 2014 - 03:11 PM GMTBy: Tim_Wood

From my seat and in light of the price action this past week, I truly find the lack of understanding surrounding Dow Theory amusing. I also find the content from most any article on this subject to be inaccurate and/or typically misleading. Such erroneous articles result from the misunderstandings and/or the lack of quality study of Dow Theory, which in turn makes such articles dangerous to those who read them, as well as being a discredit to Dow Theory. In my experience, virtually 99.9% of all articles written on the subject of Dow Theory are wrong. I think this is because of the scarcity of the original writings by our Dow Theory Founding Fathers and again, the lack of quality research.

More often than not, someone will make an erroneous Dow Theory call, then blame Dow Theory for being wrong or no longer applicable when it doesn't work out. In reality, it always turns out to be the misapplication of Dow Theory. Dow Theory was just as applicable at the 2000 and the 2007 tops as it was at the 1966 bull market top or at the 1929 top when William Peter Hamilton wrote his article, A Turn in the Tide, in which he called the top. Also, the Dow Theory Primary Bullish Trend Change following the 2002 low and the 2009 low proved just as applicable as the one following the 1932 and the 1974 lows. To think that Dow Theory is somehow no longer relevant simply has no merit. Rather, what happens is we see erroneous applications of Dow Theory, which are then blamed on the theory rather than the error of the practitioner.

Fact is, according to orthodox Dow Theory, there is no such thing as a "buy" or "sell" signal. That's right! So if you see this in an article, that is clue number one. Rather, there are Bullish and Bearish Primary Trend Changes. A Bullish Primary Trend Change requires a close by both the Industrials and the Transports above their previous Secondary High Points. Conversely, a Bearish Primary Trend Change requires a close by both the Industrials and the Transports below their previous Secondary Low Points. Furthermore, once a Primary Trend Change occurs, that Bullish or Bearish Primary trend is assumed to be "in force" until it is "authoritatively reversed" by an opposing trend change. The tricky aspect of Dow Theory, which most people get wrong, is the identification of Secondary High and Low Points. I get that, because identifying these points is subjective. However, while cycles have absolutely nothing to do with Dow Theory, I have found that intermediate-term cycle highs and lows are one and the same as Secondary High and Low Points, in accordance with Dow Theory. And, since the cycles are quantifiable and Dow Theory is not, this in turn allows me to quantify the Secondary High and Low Points, which in turn removes the subjectivity.

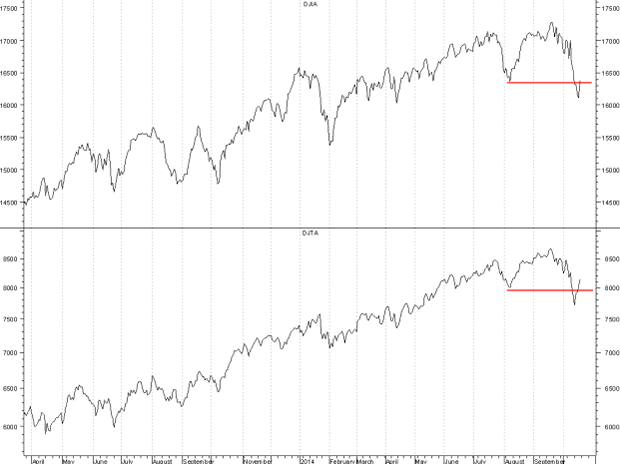

This all said, on Friday, October 10, 2014, the Transports closed below their August 7th Secondary Low Point. On Monday, October 13, 2014, the Industrials followed with a close below their August 7th Secondary Low Point. In the wake of this development, I have sat quietly to see what, if anything, would be written on this development. The current Dow Theory chart can be found below. As a result of this joint close below the previous secondary low points, an orthodox Dow Theory Primary Bearish Trend change has been triggered. Yet, I have not seen a single article on this development. Not one. In fact, I have only seen one Dow Theory article period and guess what? It proclaims that because of the strength seen by the Transports later this past week, this is a signal that the correction in the broader markets may be over. Cyclically, yes, a short-term low was seen and further strength may well follow. But, the Dow Theory Founding Fathers made it perfectly clear that, "Both Averages Must Confirm." In but one quote, Robert Rhea wrote, "students of Dow's Theory must not ever forget that an indication of one average, unconfirmed by the other, should never be considered as having any valid forecasting significance."

So, here is the reality and the irony. The very week an orthodox Dow Theory Primary Bearish Trend Change occurred, I only see one article in which Dow Theory is so completely misapplied that it is basically the polar opposite of the truth. Therefore, once again and true to form, because of the universal misunderstanding of Dow Theory, the misapplication of Dow Theory lives on. Regardless of what anyone else says, we now have a bonafide Primary Bearish Trend Change in place and it will remain in force until it is authoritatively reversed.

From a cyclical perspective, I told my subscribers that in spite of Monday's developments, we were looking for a low this past week. What happens in the wake of this cyclical low has nothing to do with the fact that the Transports closed up last week, with Dow Theory or with the Bearish Primary Trend Change. All Dow Theory Primary Trend Changes are not always created equally. It is the weight of the overall evidence and the totality of the DNA Markers, the cyclical setup and the associated statistics, all of which I am currently monitoring at Cycles News & Views. If you would like to know more about the current expectations in the wake of this Dow Theory Bearish Primary Trend Change, that research is being covered at https://cyclesman.com as it unfolds.

By Tim Wood

Cyclesman.com

© 2014 Cycles News & Views; All Rights Reserved

Tim Wood specialises in Dow Theory and Cycles Analysis - Should you be interested in analysis that provides intermediate-term turn points utilizing the Cycle Turn Indicator as well as coverage on the Dow theory, other price quantification methods and all the statistical data surrounding the 4-year cycle, then please visit www.cyclesman.com for more details. A subscription includes access to the monthly issues of Cycles News & Views covering the stock market, the dollar, bonds and gold. I also cover other areas of interest at important turn points such as gasoline, oil, silver, the XAU and recently I have even covered corn. I also provide updates 3 times a week plus additional weekend updates on the Cycle Turn Indicator on most all areas of concern. I also give specific expectations for turn points of the short, intermediate and longer-term cycles based on historical quantification.

Tim Wood Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.