Gold Firms on UN Warning of Global Stagflation

Commodities / Gold & Silver May 20, 2008 - 09:24 AM GMTBy: Mark_OByrne

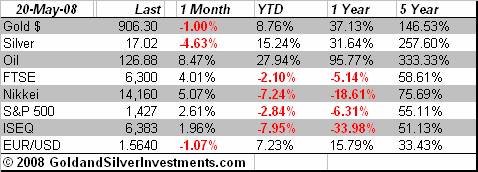

Gold and silver continued their recent move up yesterday prior to a slight sell off. They have traded sideways to slightly up in Asia and early trade in Europe. Since last Thursday gold had soared by more than 5% and thus profit taking was to be expected. Similarly year to date gold is up nearly 9% (unlike most equity markets) and in the last 12 months gold is up 37% and thus corrections are healthy and to be expected.

Gold and silver continued their recent move up yesterday prior to a slight sell off. They have traded sideways to slightly up in Asia and early trade in Europe. Since last Thursday gold had soared by more than 5% and thus profit taking was to be expected. Similarly year to date gold is up nearly 9% (unlike most equity markets) and in the last 12 months gold is up 37% and thus corrections are healthy and to be expected.

Gold may need to consolidate between $885 and $915 before the next leg up in the bull market.

Oil remains near record highs and the dollar has also weakened and this has likely contributed to gold's tentative rally this morning.

Today's Data and Influences

Markets await this afternoon's release of US PPI data for April which should help shed light on burgeoning inflationary pressures. The inflation rate is the main concern for U.S economic authorities as a continuance of surging commodity prices (especially the crude oil).

The Eurozone sees the release of important data this morning in the form of Germany's ZEW. The May expectations balance is seen coming in at -37.5, a modest improvement on -40.7 the month previous.

Oil and Gasoline Price Surge and UN Warns on Global Stagflation

In addition to oil futures edging higher, retail gas and diesel prices reached new records, creating frustrations for drivers planning road trips for the coming holiday weekend. According to a survey by AAA and the Oil Price Information Service, Americans are now paying an average of $3.79 for a gallon of regular gas and diesel now costs $4.52 a gallon.

These are creating real inflation pressures and the average consumer believes that government inflation data is underestimating soaring real prices in the food and energy sector. Importantly, consumer expectations of inflation have deteriorated sharply and the credibility of the Federal Reserve in tacking inflation is increasingly doubted by consumers struggling with vastly higher prices.

Inflation pressures around the world have intensified and broadened over the past few months. In some instances, we believe that inflation may be beginning to get out of control. Clearly, the Federal Reserve needs to increase interest rates by it is confronted with the huge ‘Catch 22 ‘of rising inflation coupled with falling house prices, decelerating economic growth and the credit crisis.

The UN see a global economy teetering on the brink of a severe downturn and forecast low growth (1.8%) this year and higher inflation (3.7%). There is a definite air of the 1970's in recent economic data and the reality of falling economic growth and rising inflation or stagflation.

Silver

Silver is trading at $17.05/17.10 per ounce at 1200 GMT.

PGMs

Platinum is trading at $2157/2167 per ounce (1200 GMT).

Palladium is trading at $444/448 per ounce (1200 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.