New Zero Bound Only Game In Town

Interest-Rates / Financial Markets 2014 Oct 12, 2014 - 06:43 PM GMTBy: Richard_Mills

The Federal Reserve tried to fix the U.S. economy by Quantifornication - stimulus measures.

The Federal Reserve tried to fix the U.S. economy by Quantifornication - stimulus measures.

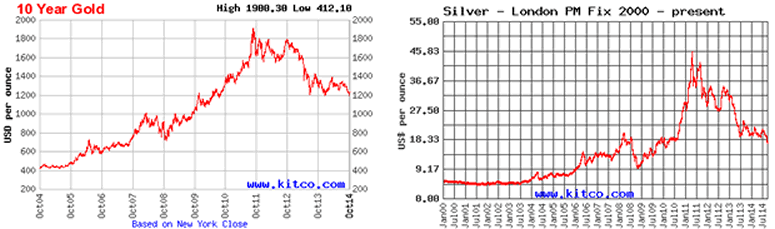

Investors reacted to the Fed's unconventional efforts. Since the U.S. dollar is the world's reserve currency and precious metals are priced in dollars they bought gold and silver to protect their wealth against currency devaluation and inflation.

Gold catapulted to a record in 2011 as investors wagered on higher inflation and a weakening dollar.

Gold and silver soar in price

How things have changed, the dollar has recently gained a lot of new friends while gold has very few left. The Fed is going to end its bond-purchasing program this month and start raising interest rates sometime in 2015, experts are talking June/July.

Investors believe:

- A substantial upward trend in real interest rates will soon begin.

- In a strengthening economy.

- In a future where there is no inflation.

Expectations regarding the Fed's present, and it's next moves, are pushing the dollar ever higher, gold and silver lower.

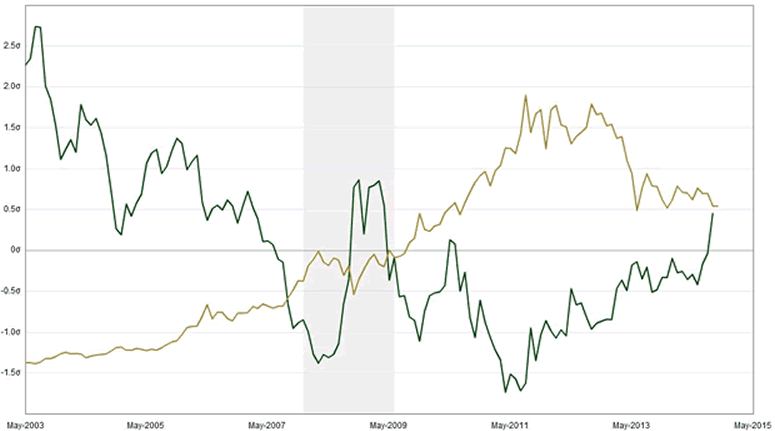

The chart above compares the movement in the dollar index with gold's price.

Have investors got it wrong? Should we be more happy about rising interest rates or more worried about Russia/Ukraine, religious genocide, China and its deteriorating relations with other China Sea stakeholders, Ebola, very weak macroeconomic data coming out of Europe/Japan/Brazil, a slowdown in China and more than a few other hot buttons?

And do rising long rates really threaten gold? Has gold's price ever gone up in conjunction with rising interest rates?

The following information and snippet is from Adam Hamilton and Scott Wright over at Zeal Intelligence.

Between August 1976 and January 1980 gold went up 731.7 percent, at the same time 10y Treasury yields climbed from 7.7 percent to 11.0 percent, a 42.2 percent climb.

From April 2001 to May 2006 gold nearly tripled with a 180.6 percent gain. During that time the average yield in benchmark 10y Treasuries was over 4.4 percent.

"For nearly its entire bull run, gold thrived in long-yield environments much higher than today's.

During the first 7 years of gold's secular bull climaxing in March 2008, the metal nearly quadrupled with a 291.7% gain. Yet over that entire span, 10y Treasury yields averaged 4.5%.

By December 2009 gold's secular bull had been powering higher for nearly 9 years, and somehow managed to gain 373.5% across a once-in-a-century stock panic over a secular span where the 10y Treasury yield averaged 4.3%...Rising long rates weren't a threat to gold in its last secular bull, and they weren't a threat to gold in this secular bull...

Between June 2003 and June 2006, 10y Treasury yields soared 68% higher from 3.1% to 5.3%. Surely 5%+ yields would crush gold, right? All those deluded fools buying that anachronistic zero-yielding relic would see the error in their irrational ways and shift into good safe Treasuries. But that's not what happened. Over that 3-year span, the gold price climbed 63.8% despite a steady rising-long-rate environment!"

Peters got his thinking cap on

"Peter Pan's advice was to think of an impossible thing each morning. FOMC members have presumably been following this advice..." Vincent Reinhart, chief U.S. economist at Morgan Stanley and former top U.S. central bank staffer, referencing the Federal Reserve's exit strategy

Are we even going to see rising rates?

The following snippets are from an article written by Michael Pento over at pentoport.com...

"Today, the equity and bond markets have positioned themselves for the best outcomes of all possible scenarios. These markets are assured that the Fed can painlessly exit QE in October and real interest rates will rise with no ill effects on the economy...

As the world's Central Banks frantically print money, the US dollar is soaring due to the belief that the US economy will remain unscathed from a global economic slowdown...

Investors should think again if they believe the Yellen Fed will be aggressively raising rates and boosting the value of the dollar given the labor market's already-fragile condition...today's central banks, determined to smooth out every hiccup in the economy, only have one answer--print money. When all you have is a printing press, every problem looks like a monetary crisis.

The Fed will not be raising rates anytime soon. To the contrary, Ms. Yellen will soon be forced back into the money printing business...

The next phase in the gold bull market will include the four conditions of; negative real interest rates, rapid money supply growth, a falling dollar and skyrocketing deficits." Michael Pento,Why Goldman Sachs is Wrong on Gold

Could the U.S. government survive higher rates? Not according to Peter Schiff of Euro Pacific Capital...

"Unfortunately, the Fed's zero interest-rate policy (ZIRP) is the very thing making the economy appear healthy. It has boosted stocks and financed corporate acquisitions. It has also allowed the federal government to continue operating under a crushing debt load. Even a rise in rates to historically average levels could very well bankrupt the federal government and many of America's remaining industrial giants."

Tom McClellan, from the McClellan Market Report, tells us the dollar is in for a big downturn.

The U.S. Dollar Index has recently been in one of the biggest blowoff moves we have seen in years. The lesson of the past blowoffs is that the downward slope out of the eventual top tends to symmetrically match the slope of the advance up into it.

...commercial traders of various currency futures contracts are already making a huge bet on a dollar decline...

The current reading is the highest in the history of this indicator, which dates back to the creation of the euro currency in 1999. That is another way of saying that the "smart money" commercial traders are making a huge bet that this uptrend in the dollar is going to reverse itself. Commercial traders are often early in adopting a lopsided position, but they are nearly always proven to be correct.

...a big dollar downturn should be a huge tailwind for gold prices finally starting to rise."

Here's Gregory Mannarino's take on whether or not the U.S. is really in a recovery.

"All you need to do is look at two metrics, just two, and you can see there is no economic recovery. One of them is the money velocity. That's the rate that cash is moving through an economy. We are at historic lows here. We also have a labor force participation rate at a three decade low. So, please explain to me how we can have a recovery without those two simple metrics." Gregory Mannarino, financial analyst/trader during a Greg Hunter interview on USAWatchdog

Zero Bound

According to Wikipedia "the Zero Lower Bound (ZLB) or Zero Nominal Lower Bound (ZNLB) is a macroeconomic problem that occurs when the short-term nominal interest rate is at or near zero, causing a liquidity trap and limiting the capacity that the central bank has to stimulate economic growth."

"Based on the lessons of the Depression scholars like Ben Bernanke and Lars Svensson have hit on the key ingredients to a monetary-policy solution.

They are:

- Announce an inflation or price-level target that guarantees a period of above-normal inflation.

- Depreciate the currency.

- Support the depreciation, to the extent necessary, through direct intervention in foreign-exchange markets: print money and buy foreign currencies or assets.

Mr Svensson describes his combining of these basic elements as the "foolproof" route off the zero lower bound." Economist, 'On escaping the zero lower bound'

Hello...hello, calling Ben and Lars, are you there? This is earth calling Ben and Lars, did you get the interstellar memo? It ain't working dudes, Janet's screwing everything up.

The reality we now have is a global wide QE is happening, every central bank is now creating, or will soon be creating money as fast as they can. All of this money is looking for a home where it will earn a return - a return that isn't being eroded by inflation - and right now their best option is supporting the U.S. dollar by printing their currency and buying assets denominated in dollars.

A rising dollar does have benefits for the U.S.:

- Higher demand for U.S. Treasuries - rising bond prices means falling interest rates.

- Lower borrowing costs for the Federal government - which is good, 47 percent of U.S. households receive some kind of government dependency check each month. The U.S. spent $2 trillion last year in handouts.

- Foreign demand for U.S. assets, primarily domestic large-cap stocks.

But a stronger dollar also comes with some serious problems although they will take a few quarters to manifest themselves:

- A stronger dollar makes U.S. exports more expensive and hurts U.S. based international corporation profits whose international earnings will be savaged. A five percent rise in the dollar versus the euro results in a drop of about $1 for full-year Standard & Poor's 500 Index per-share earnings - that is going to effect the stock markets immensely.

- The dollar rose 7.8 percent against the euro last quarter and 6.7 percent against a group of 10 currencies. According to U.S. Commerce Department exports from Italy to the U.S. are up 10.2 percent this year through August, German exports to the U.S. rose 10.7 percent, and French shipments climbed 6.5 percent.

- A dollar that is appreciating strongly against other currencies is a drag on U.S. growth - foreign goods are cheaper, U.S. exports are more expensive meaning the U.S. trade balance is going to deteriorate.

- Goldman Sachs says the dollar's rise could reduce real gross domestic product growth by 0.1 to 0.15 percentage point in 2015 and 2016.

- Deficits are going to rise - war fighting isn't cheap. Air power alone isn't enough to win against the Islamic State and 'boots on the ground' will be necessary - that's expensive. The cost of continual war is going to escalate drastically.

- Lower commodity prices - cheaper input costs will produce less or none of the much wanted inflation.

So far we're looking at U.S. based internationals earnings dropping, with a resulting fallout effect on markets. U.S. growth will slow, GDP will drop, deficits are going to again balloon out of control and disinflation or outright deflation instead of inflation will be the norm.

Some people would argue that QE has been successful, at the very least preventing full blown economic disaster. Well maybe, but for sure no one can argue against the fact it has been a resounding failure in reviving household consumption. Dropping labor force participation rates and vanishing money velocity equals low household expenditures.

"Since early 2008, annualized growth in real consumer expenditure has averaged a mere 1.3% - the most anemic period of consumption growth on record.

This is corroborated by a glaring shortfall in the "GDP dividend" from Fed liquidity injections. Though $3.6 trillion of incremental liquidity has been added to the Fed's balance sheet since late 2008, nominal GDP was up by just $2.5 trillion from the third quarter of 2008 to the second quarter of this year." Stephen S. Roach, 'The Fed Trap' Project Syndicate

Household consumption accounts for 70 percent of the U.S. economy.

Conclusion

As the dollar gains, gold loses more ground.

Ironical isn't it? After all, the main reason behind gold's bull market was a failing dollar system that, truth be told is in worse shape now then when the precious metal bull started to run.

Fact - Gold and silver are dollar alternatives.

Fact - All the talk regarding a return to higher interest rates is overshadowing escalating political tensions. You cannot ignore geo-politics, tensions are rising across the globe.

Fact - The U.S. is not going to be able to withstand the pressures on its economy arising from a much stronger dollar for long.

Every country is 'Beggaring Their Neighbor' by printing its own currency in a bid to keep their exports cheaper than their competitors. It's a race to not just worth less but to worthless and the new Zero Bound is the only game in town. The U.S. can't, and won't stand by and watch, sooner rather than later they will have to join the race...again.

Trying to pick an absolute bottom is a mug's game, yes there might be more downside coming to precious metals but this author believes there is a massive dollar correction coming.You need to have precious metals on your radar screen.<

Do you?

If not, it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2014 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.