Grandma Yellen And The Economic Mushroom Cloud On The Horizon

Economics / US Economy Oct 05, 2014 - 10:58 AM GMTBy: Tony_Caldaro

Weekend. Saturday. Beautiful Indian summer imitation where I’m presently located in western Europe. Good time to start out with an empty sheet of text file (for lack of a better term), and stream some consciousness.

Weekend. Saturday. Beautiful Indian summer imitation where I’m presently located in western Europe. Good time to start out with an empty sheet of text file (for lack of a better term), and stream some consciousness.

Most people must have figured out that things in the economic sphere haven’t gotten any quieter lately. That’s at least something. Stock exchanges in the developed world jumped from a -1%+ loss one day to a 1%+ gain the next. Volatility, nerves, and probably ritalin, have returned. You have to wonder what that means in markets reigned supreme by high-frequency robot traders and central banks, but nevertheless, the public perception remains. And perception is key.

At first glance, US data coming in on Friday look positive, with more jobs and a lower unemployment rate of 5.9%. Bloomberg even had a headline that said the real payrolls increase was 600,000 jobs, instead of the ‘official’ BLS 248,000, because American wage slaves allegedly worked 0.1 hour more per week, 34.6, up from 34.5 in August.

The most since May 2008, the article claims, citing Deutsche’s Joseph LaVorgna. I’m sure if y’all clocked in those 0.1 hours, or 6 minutes, later, you really made them count. I just don’t know whether to laugh or cry when I see things like that reported.

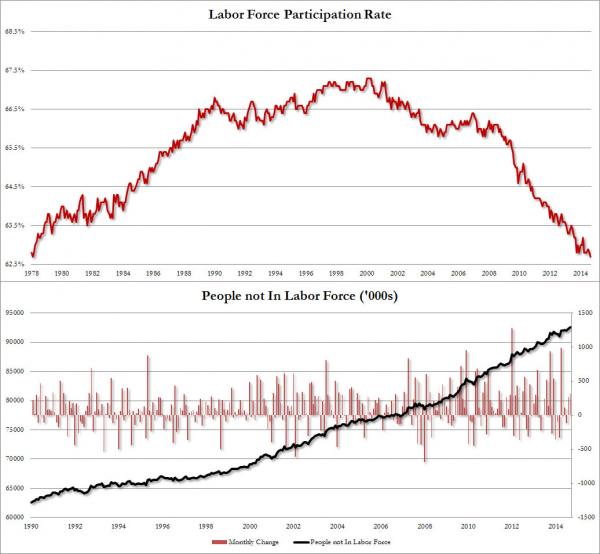

What would seem to me to matter more is the rates in labor participation and Americans not in the labor force.Unfortunately, both are still ugly as warthogs and getting worse. New records all around, as Tyler Durden notes:

While by now everyone should know the answer, for those curious why the US unemployment rate just slid once more to a meager 5.9%, the lowest print since the summer of 2008, the answer is the same one we have shown every month since 2010: the collapse in the labor force participation rate, which in September slid from an already three decade low 62.8% to 62.7% – the lowest in over 36 years, matching the February 1978 lows. And while according to the Household Survey, 232,000 people found jobs, what is more disturbing is that the people not in the labor force, rose to a new record high, increasing by 315,000 to 92.6 million!

But, you know, that’s just the usual nonsense from the usual suspects, and at least today for once we can confidentially state that America is not the horse most likely to be slaughtered tomorrow morning at the glue factory. Drinks all around! Just make sure you finish them within 6 minutes. Or if want to really help out, hand on to your glasses for 10 minutes, and raise job numbers, as calculated by Bloomberg and Deutsche, by a million …

Anyway, the US, the greenback, that’s this week’s story. And it will be for a while to come. The Fed has gone out all guns blazing, cold turkey QE, push up the dollar, (10% or so vs the ‘basket’ of currencies in no time), and the finishing touch waiting in the wings, the rate hike.

The US economy in the months ahead is set to shine. The higher dollar and rates will throw lots of Americans out of their – export-oriented – jobs, but you’re not going to see that reflected in the numbers. Remember how Obama said he was going to double exports in 5 years? That lofty thought is long gone; the basic reality always was.

America is in the process of calling its – dollar – children home. All it needs to do is execute those three steps: QE, dollar, interest rates. That will increase its power, economic and therefore political, over the rest of the world to such an extent that many nations will effectively turn to panhandlers in Lower Manhattan.

Emerging markets, and economies, are the easiest victims. They have risen to what seemed to be great heights, despite the global financial crisis – or is it because of it? – in the past 7-8 years, on the wings of loose monetary policy. From the Fed, from other central banks. Now they need to roll-over the debts that made them shine, and they find themselves having to scramble for the dollar their debts are denominated in.

Every step in the three step program, QE, dollar, interest rates, makes it harder and – much – more expensive for them to service their debts. And the effects haven’t even truly started to sink in yet. For that matter, even the Fed policies haven’t. 2015 is not going to be a nice year for the citizens of Brazil, Thailand, Turkey, you name them, and there will be an enormous amount of unrest and fighting and worse.

Whoever prints the reserve currency rules the world, and the lives of untold millions trying to make a better future for their kids. That last bit: not going to happen.

Japan still plays the role of a rich society, and convincingly, but in reality it’s done. It has been able to keep up appearances more or less so far by selling state debt to its own citizens, but Mrs. Watanabe is not a complete fool. If your 2nd quarter GDP is down -7.1%, that’s not some minor detail.

The final blow to the Japanese economy will be delivered by PM Abe’s insistence that the main pension funds invest in stocks, which will plummet in the upcoming global market plunge – or recalibration if you will -. At which point Abe will be left with two choices: either he leaves in disgrace, not a favorite pastime among the Japanese, or he declares war on China over a bunch of islands. I think Abe’s mind is made up.

As for China, it will have to accept that growth numbers will be way below what it desires, and that ‘massaging’ those numbers is not a solution anymore than it is in Washington, although creative accounting can buy time. The present ‘official’ Beijing growth target is 7.5%, but the real number is nowhere near that.

Which is a huge problem in a society built on the effects and consequences of the higher numbers. Like the by far largest human migration in history, which has seen 100-200 million Chinese peasants into urban centers. And the empty apartment buildings these former peasants have ‘invested’ their hard earned money in. And the unprecedented pollution and other devastation in the areas the peasants came from, to which they can now never return and make a living.

I have no idea how the sequence of Xi’s and Li’s plan to keep that burning cooking cauldron in check, but there’s no way this is going to be pretty and peaceful. Hong Kong is a 5 year old girl’s birthday party compared to what’s coming. And a soaring US dollar will hit the Forbidden City, just as it will most of the world, like a sledgehammer.

And then there’s Europe.. Which needs no help on the way down, it has all the boxes ticked for a descent into mayhem. From what I can see, it will take years for Brussels to admit that Brussels is a really bad idea (and it eats women and children alive), other than as the capital of Belgium, and Europe doesn’t have those years. It needs to decide now that if Germany wants Greece in the eurozone and EU, it will have to pay big bucks for that. No such notion is even considered, but that makes it no less true.

The EU is a dead experiment, a Frankenstein and Mr. Hyde all in one. But no-one wants to see it, and no-one has a clue. Well, wait till interest rates go back up to historically ‘normal’ levels, to 5% or so for the lowest, to 8% or so for you average mortgage loan. That should be interesting to watch.

It’s coming, though, courtesy of Grandma Yellen and the puppeteers that move her limbs and lips up and down. It’s time, wherever you are on the planet, to collect your belongings outside of the reach of the ‘system’, sit down on your porch, and watch the sky for that mushroom cloud on the horizon.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.