Investor Profit Opportunity in Hong Kong's Unrest

Stock-Markets / Hong Kong Oct 05, 2014 - 10:38 AM GMTBy: Money_Morning

Keith Fitz-Gerald writes: Most investors haven't got a clue about what Hong Kong's riots represent, let alone the investment potential that's being unleashed there. As a result, they're going to miss out on some really terrific profit opportunities.

Keith Fitz-Gerald writes: Most investors haven't got a clue about what Hong Kong's riots represent, let alone the investment potential that's being unleashed there. As a result, they're going to miss out on some really terrific profit opportunities.

Hong Kong is like an onion. Returned from a century of British rule to Beijing on June 30, 1997, there are layers and layers of subtleties. For most westerners, the place is a complete enigma.

For me, though, it's an economic playground. I've been very fortunate to have spent almost my entire career in global markets including a lot of time on the ground in Asia, so I am intimately familiar with both the culture and the perspective that can't be obtained by watching only Western news feeds.

It's this background that provides the ability to peer through the government and market filters, and find what I believe are solid niches for profit, even in the midst... and dangers... of the turmoil.

Indeed, understanding what's driving the unrest is our key...

Beijing's Response Is Muted... For Now

Contrary to what many in Hong Kong's elite circles like to believe, the world does not revolve around them. Beijing is the true power base.

So far, Beijing has demonstrated remarkable and unprecedented restraint in dealing with the protestors. What's happening in Hong Kong wouldn't be tolerated in mainland China for a nanosecond. Beijing will not hesitate to roll in the troops if it believes the Communist Party is threatened, even if it means they have to squash the "Capitalist" party now taking to the streets.

That said, the Central Committee is acutely aware of the stakes.

"Hong Kongers," in their arrogance, don't understand this. A century of British rule has led many to mistakenly believe that they are economically, politically, and morally superior to the mainland's "bumpkins." It's a serious lapse in judgment that has become a part of the cultural fabric over time.

The irony is that Beijing decided years ago - long before the handover - that Shanghai's financial markets are China's future. So they have largely left Hong Kong alone because it is a useful source of foreign capital and currency. Doing so conveys "face," a uniquely Asian concept incorporating the combination of influence, honor, social standing, and reputation.

But that's changing by the day as Hong Kong's markets become further marginalized and Shanghai's exchanges become increasingly modernized. Saving "face" becomes less important if Hong Kongers are willing to "de-face" Beijing by demonstrating in the streets.

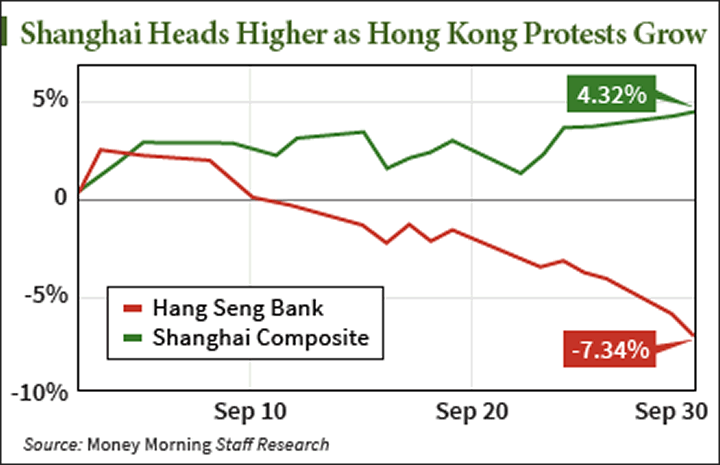

You can see that very clearly in the indices of both, which have diverged considerably over the past month as the protests have gathered steam. The Hong Kong-based Hang Seng Bank has lost 7.34% while the Shanghai Composite has gained 4.32% over the same time period.

If anything, further rabble-rousing in Hong Kong only solidifies Beijing's decisions. Further, the money being lost in Hong Kong's markets is irrelevant to Beijing's way of thinking with each new demonstrator taking to the streets

Remember, we are talking about a divide between the Communist Party and the "Capitalist" party... NOT the democracy the Hong Kongers are protesting and NOT the financial markets that western analysts believe.

To that end, if this really goes to the mat - and I think it will - there are going to be a number of things happening. And that brings me to your money...

Hong Kong's Weakness Will Benefit These U.S. Giants

First, these riots are going to resurrect the world's perception of the political risks of doing business in China. That's going to cause many big brand names to rethink their business there no matter how potentially lucrative and essential it is to future growth.

Second, property and casualty companies are going to take the first hit. Simply put, property values drop where there's political instability. Companies like Sino Land Co. Ltd. (HKG: 0083) and New World Development Co. Ltd. (HKG: 0017) are primed for a tumble. And so is some of the world's most expensive real estate.

That, in turn, will affect the financial houses who have long called Hong Kong home. Financial giants like HSBC Holdings Plc. (HKG: 0005) are going to get whacked because of the impact on earnings, so shorting the entire financial sector or specific companies like HSBC could be a really terrific way to capture this. So could buying long date put options that limit your risk while still giving you tremendous upside.

To give you an idea of the magnitude of the potential for profit, consider this: The Hong Kong market is worth some $3.7 trillion, and 56% of the Hang Seng is related to financial shares.

Closer to home, a failure in Hong Kong has the potential to hit pension fund and individual investors holding global ETFs with an emphasis on Hong Kong like the iShares MSCI Hong Kong ETF (NYSE Arca: EWH). So you'll want to take one basic precaution: If more than 20% of your investment in any given global instrument is tied to Hong Kong, I'd rethink that level of exposure. And, if needed, consider rebalancing in order to minimize risk.

Further weakness in Hong Kong is going to make the beleaguered U.S. dollar even stronger than it's already become in recent months. That's going to benefit large cap stocks because they're viewed as a hedge against global economic weakness.

The key here is to stick with companies having large brand names that Chinese consumers recognize, like Procter and Gamble (NYSE: PG) or Johnson & Johnson (NYSE: JNJ).

It's also going to benefit U.S. Treasuries, where the yield on average is 1% or higher than comparable Asian bonds at the moment.

And, finally, anyone who didn't flee Hong Kong in 1997 or just prior to the handover has to be rethinking that decision at the moment. Another wave of expat capital will hit western Canadian cities like Vancouver and Victoria, already expat Chinese enclaves, driving up real estate values. Apartments and condo investments may become even more appealing as a result.

Source : http://moneymorning.com/2014/10/04/the-profit-opportunity-in-hong-kongs-unrest/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.