Gold Price Look Out Below

Commodities / Gold and Silver 2014 Oct 04, 2014 - 01:37 PM GMTBy: Sy_Harding

Gold experienced a spectacular bull market run from its low at $250 an ounce in 2001 to its peak above $1,900 an ounce in 2011. Its long bull market was largely supported by expectations that the Fed’s easy money policies would create spiraling inflation, of which gold, the historical hedge against inflation, would be the big benefactor.

Gold experienced a spectacular bull market run from its low at $250 an ounce in 2001 to its peak above $1,900 an ounce in 2011. Its long bull market was largely supported by expectations that the Fed’s easy money policies would create spiraling inflation, of which gold, the historical hedge against inflation, would be the big benefactor.

However, spiraling inflation did not materialize. In fact, inflation remained quite benign, and in 2011 gold gave up on the idea. It rolled over into a 37% bear market decline to $1,200 an ounce.

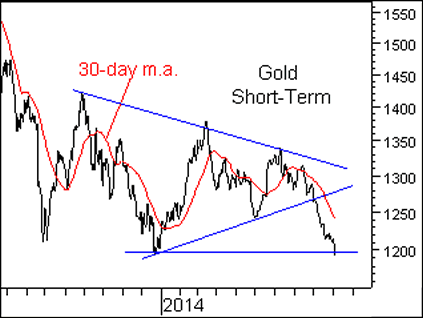

As with most bear markets, it was not a straight line down. There were rally attempts that kept hope alive, but they ended at lower highs, followed by declines to lower lows.

For the past 18 months, although the lower highs continued, there were no further lows. It looked like gold might actually be establishing a base from which to launch a new bull market.

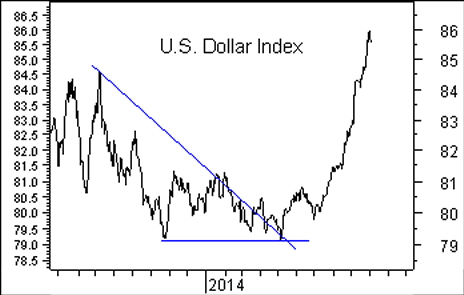

A significant decline in the U.S. dollar supported that hope. Gold and the dollar have an inverse-relationship, gold usually rising when the dollar is declining, and falling when the dollar is rising.

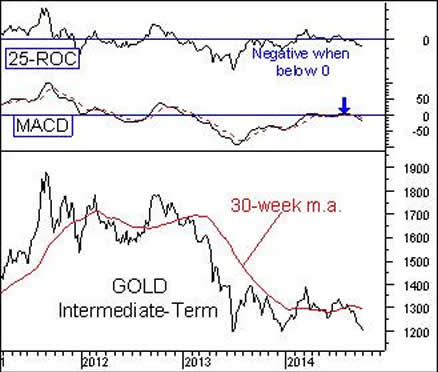

However, our technical indicators triggered a new sell signal on gold, and it fell back beneath its 30-week m.a., and has continued lower.

And in the background the U.S. dollar began spiking up in May.

Also among the fundamentals, the previous inflation concerns moved even further out of the picture. Recent reports of even lower PPI and CPI inflation in the U.S. and in the euro-zone have concerns rising that the real problem may even become global deflation.

It also became more apparent that gold was in trouble when it was unable to rally to any extent as a safe haven in reaction to the growing number of global hotspots and uprisings in recent months.

Meanwhile, I pointed out in a recent column that gold was dropping toward a level that would be its last potential stand.

Gold had been confined in a symmetrical triangle formation. The direction of the breakout from such a formation usually determines the next sustained direction.

So, it was not a positive for gold when it broke out of that formation to the downside and immediately headed lower.

I noted that the critical level was its previous low at $1,295 an ounce. A break below that would put it at a new bear market low and in uncharted territory.

With the U.S. dollar spiking up further in reaction to Friday’s employment report, gold has been trading as low as $1,189 an ounce.

With our technical indicators, both short-term and intermediate-term, remaining on sell signals, I believe gold is headed lower. If so, it looks like next potential support is just under $1,000 an ounce.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.