“Money Bubble” Predictions Coming True - Stock Market Volatility Surges

Stock-Markets / Stock Markets 2014 Oct 04, 2014 - 12:56 PM GMTBy: John_Rubino

In The Money Bubble: What To Do Before It Pops, James Turk and I climb out on some long, skinny limbs with a series of extreme predictions. Now it’s time to start tracking the ones that are (or seem to be) working out, beginning with increasingly wild swings in US equities:

In The Money Bubble: What To Do Before It Pops, James Turk and I climb out on some long, skinny limbs with a series of extreme predictions. Now it’s time to start tracking the ones that are (or seem to be) working out, beginning with increasingly wild swings in US equities:

Chapter 26, page 294:

For a sense of how an over-indebted financial system enters a catastrophic collapse, imagine a spinning top. For a while after being set in motion, the top stays in one place, spinning smoothly. But then a slight wobble creeps into its rotation, gradually becoming more pronounced until it turns violent. The unstable top then shoots off in a random direction to crash against whatever is nearby. That’s how the financial markets will behave when the Money Bubble bursts.

As this is written in late 2013, our imagined top is spinning smoothly again after a huge, near-catastrophic wobble in 2008. With US stock prices at record highs, interest rates still historically low and daily fluctuations in major markets reasonably muted, all looks well. But soon, probably in 2014 but almost certainly by 2015, the fluctuations will begin to increase until the system spins out of control.

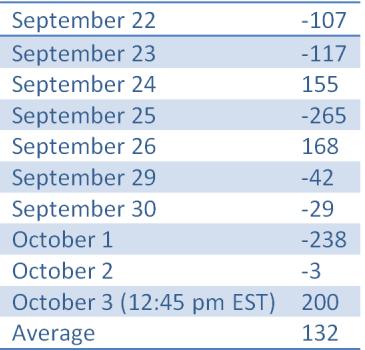

Now consider the US stock market over the past two weeks. The following table lists the daily fluctuations of the Dow Jones Industrial Average, which in the space of ten trading days has seen seven triple-digit moves, for an average swing of 132 points. Mr. Market is looking increasingly bi-polar.

More from The Money Bubble:

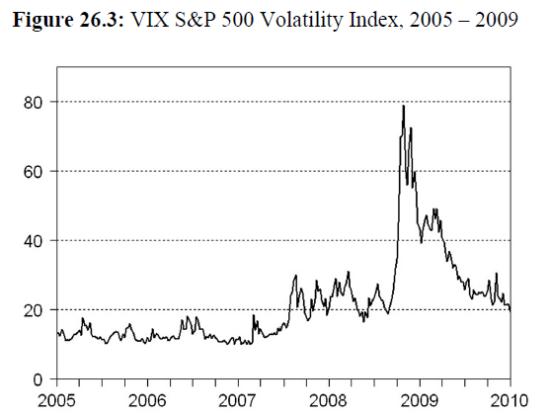

A useful indicator of where the markets are in this process is the VIX index of volatility in the S&P 500 options market, which predicts month-ahead fluctuations in the stock market. Figure 26.3 shows how placid the US stock market, as depicted by its low volatility, was while the housing bubble was inflating in the mid-2000s. But notice what happened in 2007 and early 2008: First came some wobbles, as the early indications of a bursting housing bubble hit the markets. Then in 2008 the bubble burst and the banking system began to implode. The markets were terrified and capital was pouring in and out (mostly out) of stocks and pretty much every other financial asset class, causing wild fluctuations. The VIX soared from 20 to 80 in a matter of months.

In late 2013 the top was once again spinning smoothly. But under the surface, all the imbalances that nearly destroyed the global financial system in 2008 were not only still resent, they were being amplified by governments around the world borrowing aggressively, printing, and intervening. By late 2013 the system was once again primed to start wobbling. Which means a spectacular trade is just waiting to be placed.

So the follow-on prediction is that today’s volatility, like that of 2007, will be resolved to the downside via a market crash and possibly a full-blown financial crisis sometime in the coming year. Stay tuned.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.