Gold & Silver Shorts, Failing Economies and The Quarter-End

Commodities / Gold and Silver 2014 Oct 03, 2014 - 04:16 PM GMTBy: Alasdair_Macleod

Precious metals have faced adverse weather as evidence mounts that major economies may be sliding into recession. Yesterday the ECB finally responded to the deteriorating situation in the Eurozone by announcing a discretionary form of QE to last up to two years if necessary. The only clues are the ECB will buy in covered bonds and asset backed securities issued in euros in the Eurozone with an objective to increasing the ECB's balance sheet by about €1 trillion.

Precious metals have faced adverse weather as evidence mounts that major economies may be sliding into recession. Yesterday the ECB finally responded to the deteriorating situation in the Eurozone by announcing a discretionary form of QE to last up to two years if necessary. The only clues are the ECB will buy in covered bonds and asset backed securities issued in euros in the Eurozone with an objective to increasing the ECB's balance sheet by about €1 trillion.

Some sort of easing had been expected, and at the same time the Fed's QE programme is due to be tapered out of existence this month. The market effect has been to encourage selling of the euro into the US dollar, while at the same time a sliding yen has also contributed to dollar demand.

Dollar strength has led to weakness over a whole swathe of commodities from energy to metals, and even dairy products. Bond yields after a brief rally have fallen sharply, signalling deflation, and at last equity markets seem to be cracking. The only good news was yesterday's US jobless claims which came in at about 10,000 less than expected.

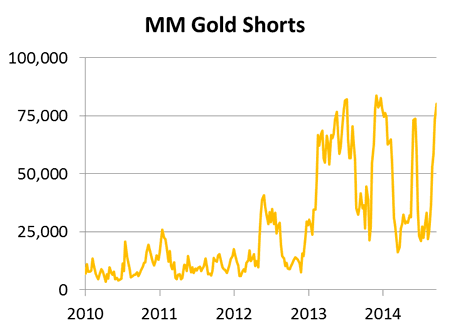

This statistic is however being increasingly questioned; so precious metals, seen as particularly vulnerable to dollar strength, have had to weather substantial negativity. Furthermore Tuesday was the quarter-end, which has come to be regularly associated with a general sell-off of precious metals since the first attempt to break the $1180-1200 level failed in June last year. However, for the last three weeks gold has refused to break that $1200 level again. On Comex, money managers are betting the farm on gold breaking it as can be seen in the following chart.

It is quite likely that the managed money shorts were even more extreme last Tuesday, for which the Commitment of Traders figures will be released tonight and viewed with interest.

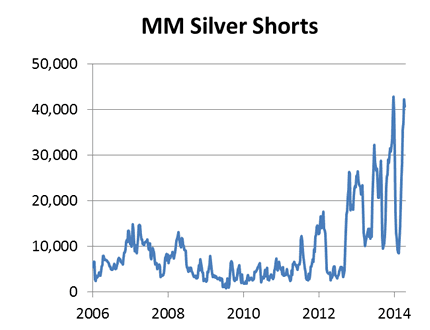

Precious metals with industrial use have suffered steep falls with both platinum and palladium hit hardest. Silver has also been badly mauled, slipping to new lows at $17. It now stands at one third of the brief high of nearly $50 achieved in April 2011. Silver is also very oversold as evidenced in the second chart of managed money shorts.

The managed money category is even net short of silver after their longs are taken into account. This is a rare occurrence, because just as market makers (the US bullion banks) normally run short books the managed money category is normally net long an average of 20,000 contracts.

This is possibly the strongest technical factor to favour precious metals. It tells us that the bearish opinion is a reflection of positions already taken, and that the bears have more or less exhausted their ammunition and are likely become net buyers. Against that there is the worry that if gold breaks $1180 normally unshakeable long-term bulls could throw in the towel.

The news on physical demand is better, increasing at current prices for both silver and gold. Physical gold deliveries on the Shanghai Gold Exchange last week totalled 46.3 tonnes, an annualised rate of 2,300 tonnes, so the underlying liquidity upon which paper gold shorts is based continues to diminish.

Next week's announcements

Monday. UK: Halifax House Prices. Eurozone: Sentix Indicator.

Tuesday. UK: Industrial Production, Manufacturing Production, NEISR GDP Estimate. US: IBD Consumer Optimism, Consumer Credit. Japan: Leading Indicator, Current Account, BoJ Overnight Rate.

Wednesday. US: Fed FOMC Minutes. Japan: Key machinery Orders, Economy Watchers Survey.

Thursday. UK: BoE Rate Decision. US: Initial Claims, Wholesale Inventories.

Friday. UK Construction Output, Trade Balance. US: Import Price Index, Budget Deficit. Japan: BoJ Minutes, Bank Lending Data, Consumer Confidence.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2014 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.