HUI Gold Stocks Analysis

Commodities / Gold and Silver 2014 Oct 03, 2014 - 07:48 AM GMTBy: Gary_Tanashian

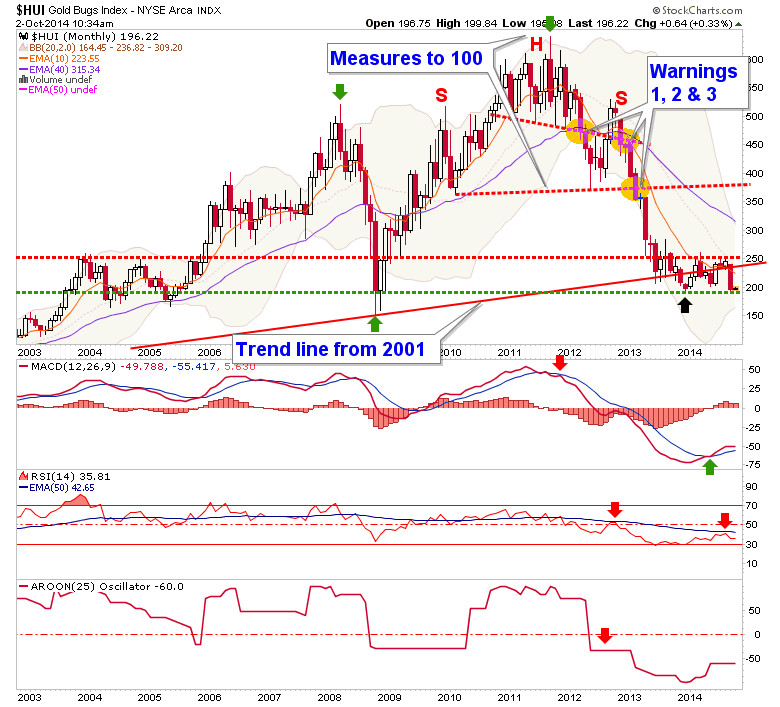

In February of 2013 we noted the big fat HEAD on the HUI’s massive H&S pattern. It was reviewed again in April of 2013 after it broke the neckline in a very bearish move. Mr. Fat Head’s technical objective was and is 100.

In February of 2013 we noted the big fat HEAD on the HUI’s massive H&S pattern. It was reviewed again in April of 2013 after it broke the neckline in a very bearish move. Mr. Fat Head’s technical objective was and is 100.

Why is this being revisited? Because I have gotten a couple emails noting that it is showing up again out there amidst the very bearish backdrop. If anything, if every gold bug on the planet is planning for 100, the ingredient is in place for this final indignity that they are so well prepared for, to maybe not happen.

But a target is a target and it is there for a reason; namely that its source – Mr. Fat Head in this case – has not been eliminated from the picture. Here he is updated…

There are other considerations…

- MACD is crossed up

- RSI is well below 50 and its EMA 50

- AROON is and has been trend down

- HUI is below thick resistance around 250

- It has notable support at current levels

- A higher low to 2008 is still in place

- A trend is a trend until it is broken, and it is down on all time frames

A lot of people think TA sucks because a lot of TA’s try to baffle people with b/s, ascribing greater power to charting than it deserves. Still, it is a handy tool as it irrefutably gave warning signals on the bear market. Signals 1, 2 (which is when NFTRH went into full risk management mode as HUI lost 460 in November of 2012) and 3.

Dial ahead to today. A final and terrible drop may indeed come about. But here again I remind you not to take anyone with just a chart and an overly bullish or overly bearish thesis too seriously. It stimulates the greed and fear response and right now everyone in the gold sector is well gripped in fear. There is much more to any given narrative.

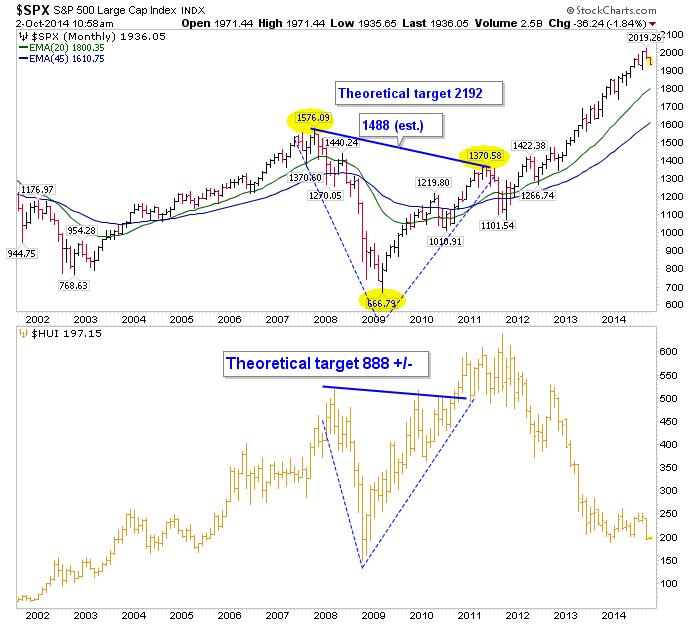

For reference on why charting in a vacuum in not good I trot out to you my one time 888 projection for HUI (I just love owning this one ![]() ) based on a pattern that was every bit as bullish as Mr. Fat Head is bearish. Just as I ask you now to take 100 for what it’s worth, I noted the same thing for the 3 Snowmen (888) back then. Targets are just targets/measurements, not directives.

) based on a pattern that was every bit as bullish as Mr. Fat Head is bearish. Just as I ask you now to take 100 for what it’s worth, I noted the same thing for the 3 Snowmen (888) back then. Targets are just targets/measurements, not directives.

For reference I offer my own screw up and the S&P 500’s target off a very similar pattern that has happily gotten most of the way to target.

TA is a guide (subject to ongoing revision), not a director. HUI has a target of 100 and so many other potentials in play. Only week to week management of not only the technicals, but especially the macro fundamentals will see us through.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart/trade ideas!

By Gary Tanashian

© 2014 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.