Gold to Silver Ratio - Sentiment

Commodities / Gold and Silver 2014 Oct 02, 2014 - 09:06 PM GMTBy: DeviantInvestor

The gold to silver ratio (GSR) acts like a sentiment indicator. When the GSR is low both gold and silver are usually running upward and strong. When the ratio is high, like now (Sept. 30, 2014), gold and especially silver are priced low and disinterest is nearly universal.

The gold to silver ratio (GSR) acts like a sentiment indicator. When the GSR is low both gold and silver are usually running upward and strong. When the ratio is high, like now (Sept. 30, 2014), gold and especially silver are priced low and disinterest is nearly universal.

This is my anecdotal interpretation of silver & gold sentiment from a high of 10 to a low of 1:

10: Silver is fantastic! I want to invest every last dollar into silver because I know it will quadruple by next year!

9: Gold is going great. I wish I had bought lots more a couple years ago!

8: Silver is a great investment. I spoke to my brother-in-law about buying more silver last night.

7: Gold looks good at this juncture. We might see a short term correction but long term gold should go much higher.

6: Silver investing can be dangerous but it has built a nice base and should be a safe buy at this time.

5. Gold belongs in the portfolio of most investors. We suggest a 3% allocation.

4. Silver has disappointed most investors for some time but I think we have a credible bottom here.

3. Gold is making me angry. I lost my ass on the stuff and now I'm just praying to break even.

2. Silver is a total disappointment! I should have bought S&P Index ETFs, or bond funds, or Florida Condos, or anything but silver. Silver was a huge mistake and the "gold bugs" are "out-to-lunch."

1. I never want silver or gold mentioned in this house again! Investing in silver is for fools, and gold is useless. Goldman Sachs was right. I hate the gold bugs and precious metals crazies and hard money crackpots who rant and rave about putting my savings into such useless crap.

On this anecdotal scale, I think current sentiment is about 1.5.

A disaster or an opportunity? Remember the admonitions:

- Buy when the blood is running in the streets.

- Buy when everyone is selling.

- Buy when nobody wants it.

- Buy low and sell high.

Consider these additional comments on current gold sentiment:

Hathaway continued: "The Ned Davis research index of gold sentiment is the lowest it's been in 30 years of data. They have data going back to December 30, 1994. Their chart of sentiment right now is basically at zero."

"The other thing worth mentioning is that Mark Hulbert's gold sentiment index is now at the second-lowest level ever. Hulbert said, 'There has only been one time in the last 30 years when the HGNSI got any lower than it is today. That came in June 2013 when it fell to minus 56. Today it's at minus 46.9.'"

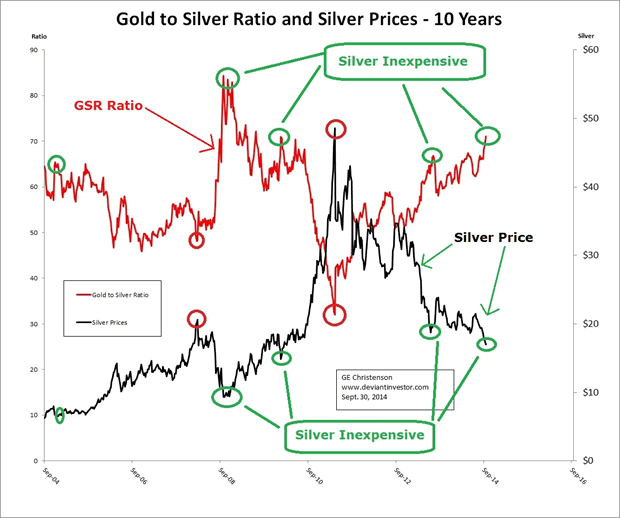

Examine the GSR for the past decade and compare the extremes in the ratio to the bottoms and tops in the price of silver.

The current GSR is approximately 70 - very high and the price of silver is at a 4.5 year low. I have circled other times when the ratio was either quite high or quite low. Those extreme readings usually marked highs or lows in the prices for silver and gold.

Other Ratios: Silver prices seem low or have increased slowly compared to: (no specific data provided)

- The official national debt - over $17.7 Trillion. Since 1971 silver prices have increased by a factor of about 12, while the official national debt has increased by a factor of over 44.

- The number of white house staff

- Average single family housing prices

- The price of a pack of premium cigarettes

- The price of a gallon of gasoline

- Average bonus on Wall Street

- The price of health insurance

- The price of a college education at a major university in the US

- The price of hamburger

- The price of a six-pack of beer

- The price of a ticket to an NFL game

And the list goes on. Inflation is alive and well all over the world. Central banks are printing paper and digital money by the $Trillions, governments are borrowing by the $Trillions, and there appears to be no end in sight.

Of course it will change, prices will adjust, and assets will be revalued. In the meantime, ask yourself:

- If a government is essentially bankrupt, can't pay its bills without going deeper into debt, and expects to increase its debts from $Trillions into $Quadrillions, how much is that country's currency really worth? How much are that country's 30 year bonds truly worth?

- Silver and gold have been money and a store of value for over 3,000 years. Will they still have value in 20 years?

- Central banks around the world are creating dollars, euros, yen, and yuan in what appears to be an endless process. Do you expect those currency units to retain their value? Hint: look at the inflation of prices in food and energy since 1971, since 1991, since 2001, and since 2008.

- Will our financial system survive another 10 years without massive destruction in the value of PAPER assets?

- Do you trust our politicians and central bankers to resolve our problems and improve our financial world? Hint: If excessive debt is at the core of our economic problems, will more debt fix our problems?

The GSR is approximately 70. That is an extremely high ratio and probably marks a major bottom in gold and silver prices. However, can the price of silver drop another buck? Of course! Do High-Frequency-Traders want to generate profits? Of course, and if they can smash silver down another buck, they will. But watch out for the snap-back rally. It will be impressive. Prices will reflect true value - eventually.

In the meantime, buy when blood is running in the streets, when sentiment is low, when prices have been smashed, and when nobody else wants to buy.

Silver and gold look good now!

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.