Bubble Trouble - What 2014 Demographic Trends Show About Urban Life

Stock-Markets / Demographics Oct 01, 2014 - 03:24 PM GMTBy: Harry_Dent

Demographic trends clearly show that as any emerging or more developed country urbanizes, people tend to have fewer kids. Urban life costs more and people tend to be more highly educated and naturally, they want to better educate their kids… so they choose to have one or two.

Demographic trends clearly show that as any emerging or more developed country urbanizes, people tend to have fewer kids. Urban life costs more and people tend to be more highly educated and naturally, they want to better educate their kids… so they choose to have one or two.

Nearly 25% choose their well-paid careers and social life over having children.

Almost all developed countries are experiencing a slowing down of their economies due to fewer kids and sluggish demographic growth.

The best English-speaking countries like Australia, Singapore, Switzerland, Canada and New Zealand have offset such slowing to some degree, or even fully, with high immigration. Immigrating households, especially the Chinese, tend to prefer a wealthy country where their kids can get a high-quality English-language education.

Other countries ranging from Japan and South Korea to Germany and Italy (to name a few) have steep demographic cliffs ahead. They’re not only having fewer kids but aren’t attracting substantial immigration. Most developed countries fall into this category of “decliners”…

“Decliners” are countries with futures made up of declining workforces and shrinking populations.

Ask Japan how hard it is to stimulate your way out of that. It’s been flat lining since 1990 after almost two decades of money printing and massive fiscal deficits.

There’s another trend that leads to fewer kids and slower demographic growth and decline in the future… not getting married at all.

The U.S. Census Bureau recently announced that single people became a majority in the U.S. for the first time reaching 50.2%.

Demographic Trends Over the Last Century

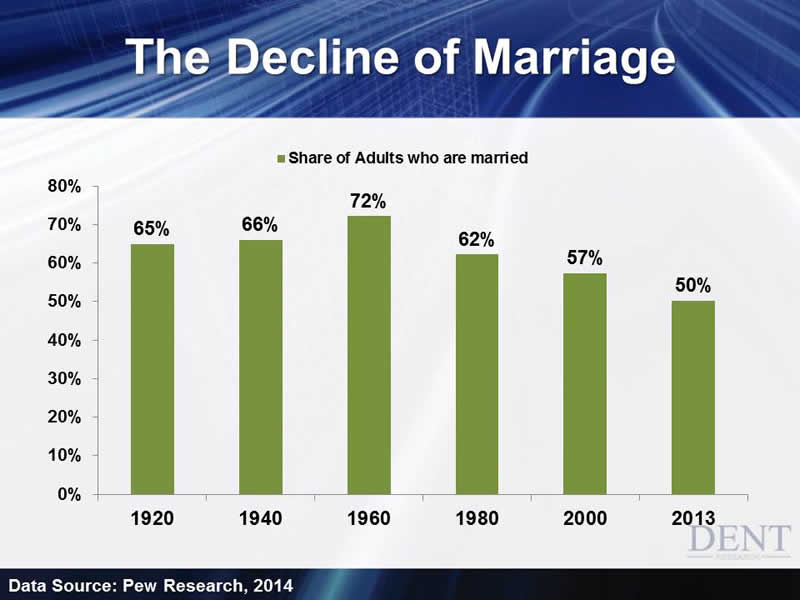

In 1920, 65% of people were married. That rose to a peak in 1960 at 72%. That means that only 28% of people were single back then. By 2000, those who were married had dropped to 57% and in 2013, it hit 50%.

As I mentioned earlier, as we get more urban and affluent, social and career options expand. But since the great recession in 2008 and 2009, it’s also fair to point out that more young people are too financially insecure to buy a house or get married.

Job prospects aren’t good for the young right now. Unemployment is four percentage points higher for younger people and they’re vying more for part-time jobs and at lower salaries, to boot.

They’re the first generation to be saddled with high and rising student debt (over $1 trillion and rising) once the government decided to stop subsidizing education as much. They actually encouraged student loans with the knowledge that they make money off of it to the tune of $600 billion a year in interest until the default rates go high enough… and they will. In our depression scenario for 2015 to 2020 and on, this trend will only get worse.

This means we’ll have more single people in the years ahead. I’ve argued for a long time that even married (and cohabiting) households have less kids in down times just like in the 1930s and 1970s. Since 2007, the falling birth rate alone is proof enough already as is the trend toward more single people and households.

Here’s another worrisome trend. The number of households in the U.S. has grown from 52,000 in 1960 to around 122 million in 2013, but the number of people per household has fallen from 3.36 to 2.54 with most of that decline occurring by 1989. Since 2012, this trend has gone dead flat and smaller households aren’t as good for the economy as larger ones.

More people are moving in with roommates or staying with parents later. This is to be expected in a down economy, but this is occurring as most people see the recovery as increasingly sustainable after going on for over five years (even though they’ll be wrong about that).

This shows that the new younger generation doesn’t see the economy improving as much as older and more affluent households that have better job security and more financial assets that are benefiting from the Fed-generated stock bubble.

It’s estimated that every new household formed contributes $145,000 immediately in new construction and furnishings, not to count the acceleration in spending after people have formed the household and/or get married. It’s simple… no growth in households is NOT a good trend.

From every demographic angle, the long-term looks less promising, much more for some countries than others. Australia, Singapore and Switzerland look the best in the aging, developed world with the U.S., Canada, France and the U.K. more in the middle. Most other countries in central, southern and Eastern Europe, Russia and East Asia look downright horrible for decades to come.

The short-term demographic trends with fewer households, more singles, more older people and the more affluent going off their demographic cliff (after age 53), look dismal for the next several years as well.

The Fed and central banks around the world have gone to unprecedented lengths to pump money into our economies to offset these trends. But demographic trends, from all angles, only get worse ahead, especially starting in 2015.

This bubble and desperate stimulus plan WILL fail.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.