Why China Thinks Gold is the Buy of the Century

Commodities / Gold and Silver 2014 Oct 01, 2014 - 11:12 AM GMT Let's start with some big, but digestible numbers:

Let's start with some big, but digestible numbers:

$3,950,000,000,000 = China’s total foreign exchange reserves

$1,250,000,000,000 = Value of the world’s 31,866 metric tonnes gold reserve at $1220/troy ounce

_________________________________________________________________________________________________________

$1,280,000,000,000. = China’s holdings of U.S. Treasuries in its foreign exchange reserves

$ 319,000,000,000. = Value of U.S. 8133 metric tonnes gold reserve at $1220/troy ounce

________________________________________________________________________________________________________

Now let's delve into what those numbers might mean to the average gold owner:

On the occasion of the launch of the Shanghai International Gold Exchange on September 19, 2014, Zhou Xiaochuan, the governor of the Peoples’ Bank of China (PBOC), reflected on his country’s view of gold. “[The] gold market,” he said, “is an important and integral part of China’s financial market. We are now the largest gold producer, as well as the biggest gold importer and consumer in the world. . . The People’s Bank of China will continue to support the sustainable growth and sound development of China’s gold market.”

“Can you imagine,” asks Koos Jansen, the Holland-based expert on China’s gold market, “Mario Draghi or Janet Yellen attending the opening ceremony of a gold exchange in Frankfurt or New York, let alone speaking about the importance of gold?”

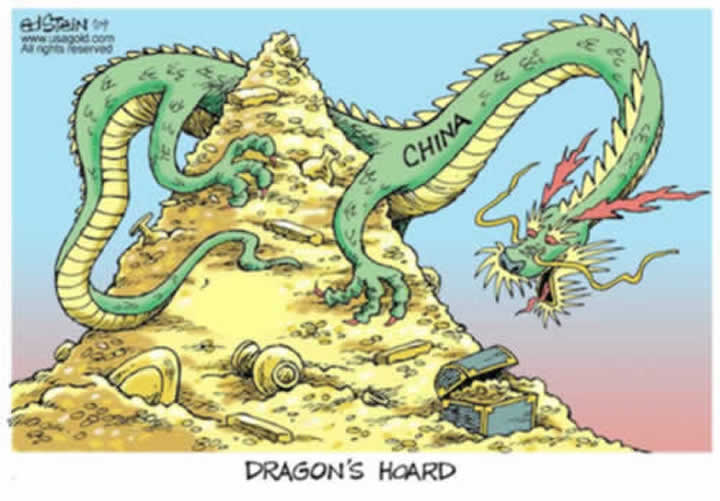

When it comes to the gold market, China is the dragon in the room. With its nearly $4 trillion in foreign exchange reserves and potential purchasing power, that presence is formidable.

How formidable? Consider this:

- China could purchase the total United States gold reserve (8133 metric tonnes) with 8% of its foreign exchange reserves.

- It could purchase the total global gold reserve (31,866 metric tonnes) with 32% of its foreign exchange reserves.

- It could purchase all the gold stored by Exchange Traded Funds ( 1750 metric tonnes) with less than 2% of its foreign exchange reserves.

- At $4900 per troy ounce, the value of U.S. gold reserves would match China’s U.S. Treasury holdings of roughly $1.28 trillion.

- At $4700 per troy ounce, the value of the world’s gold reserves would match China’s total foreign exchange reserves of roughly $4 trillion.

- To put it another way, China could pay double the current price for the world’s total gold reserve and still have nearly $1.5 trillion in foreign exchange reserves.

- China sits atop the list of the world’s foreign exchange holdings. The United States ranks thirteenth at $133 billion. For the United States to ascend to the top of the rankings, it would need to revalue its $319 billion gold reserve to almost $4 trillion – or raise the value to just under $15,300 per troy ounce.

These numbers are daunting. And for those unfamiliar with the massive scope of the monetary mess confronting the world's central banks, they might appear unbelievable. At the core, though, the yawning chasm between official sector gold and China's foreign exchange reserves suggests a serious undervaluation of gold at current prices. This imbalance is not likely to be addressed through mine production anytime soon, nor is it likely to be addressed by some realignment of international gold reserves, as some have suggested. Instead, the most likely outcome will be a significant adjustment in gold’s market price. It could come gradually or in fits and starts, or even all at once. Somehow though, sometime down the road, the market will address the imbalance. It always does. In fact, as some have suggested, China–through its staunch advocacy of gold–might already be in the process of forcing the issue.

For more information, please see "Chinese Gold Demand Explosive"/Koos Jansen/9-29-2014

In the meantime, the current monetary regime with the dollar as its centerpiece will continue bumbling along until something–probably another black swan event–intervenes. Though some might see that bumbling along as a positive sign, others see it as fraught with danger. Over the past few months, for example, several emerging countries experienced sharp corrections in their currencies as a result of institutions unwinding their vast dollar carry trades–a process that is on-going. The damage done serves as a reminder of the problems presented by an over-reliance on the dollar. None of this is lost on either China or the other countries affected. Managing a nation's reserves is not a whole lot different from managing one's personal investment portfolio. Diversification makes a great deal of sense. As a result, the trend among central banks to add gold reserves is likely to gather pace.

China, as suggested by PBOC governor Zhou's statement above, has taken the lead in that regard. It has been steadily adding to its official reserves and encouraging its citizenry to import the precious metal. (See chart) In 2009, it announced a national reserve of 1059 tonnes. The current level of reserves is a state secret, but some gold market analysts have suggested a doubling since the 2009 announcement with one analyst predicting an increase to 5000 tonnes. If the gold market is looking for a bombshell to shake it out of its current lethargy, the announcement of a major increase in China’s gold holdings would do the trick.

In my view China would swap its foreign exchange reserves for the world's gold supply in a heartbeat. It is a willing buyer perhaps without equal. Jeff Clark, senior precious metals analyst at Casey Research, puts it this way: “[T]he Chinese think differently about gold. They view gold in the context of its role throughout history and dismiss the Western economist who arrogantly declares it an outdated relic. They buy in preparation for a new monetary order–not as a trade they hope earns them a profit.” Private investors might take note.

_________________

* With apologies to Henry Hazlitt, author of "Economics in One Lesson" (1946) -- "The art of economics consists in looking not merely at the immediate but at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups."

If you are looking for a gold-based analysis of the financial markets and economy, we invite you to subscribe to our FREE newsletter – USAGOLD’s Review & Outlook, edited by Michael J. Kosares, the author of the preceding post, the founder of USAGOLD and the author of “The ABCs of Gold Investing: How To Protect And Build Your Wealth With Gold.” You can opt out any time and we won’t deluge you with junk e-mails.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.