Singapore Becoming Global Gold Hub - Launches Kilo Bar Contract And Gold ATMs

Commodities / Gold and Silver 2014 Sep 30, 2014 - 02:12 PM GMTBy: GoldCore

Singapore continues its push to be a global gold hub. The new exchange traded Singapore kilobar gold contract will launch in less than two weeks - on October 13. The new contract is a 1 kilogramme physically deliverable gold contract for the Asian and global wholesale gold market.

Singapore continues its push to be a global gold hub. The new exchange traded Singapore kilobar gold contract will launch in less than two weeks - on October 13. The new contract is a 1 kilogramme physically deliverable gold contract for the Asian and global wholesale gold market.

In a joint statement, International Enterprise (IE) Singapore, Singapore Bullion Market Association (SBMA), Singapore Exchange (SGX) and the World Gold Council, announced the new contract yesterday.

The contract will be traded on SGX, the first wholesale 25 kilobar gold contract to be offered globally, and this is a collaboration among the four parties. The SGX is Singapore’s securities and derivatives exchange and clearing and depository provider.

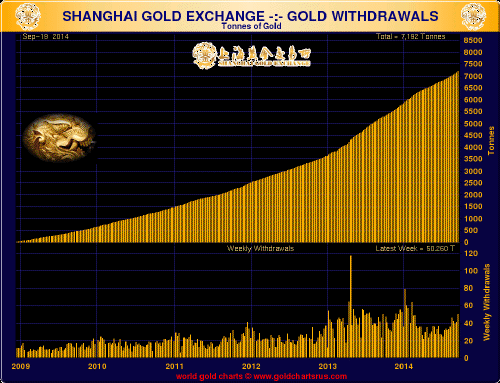

This caters to the very high demand for physical gold in China and throughout Asia, which has increased significantly over the last decade.

This new gold contract differs from others in that as well as acting as a price discovery benchmark for 1kg gold bars in the Asian region, it has been specifically designed to actually deliver gold to large buyers, wholesalers and institutions, presumably including central banks.

Settlement of the contract is in gold 1kg bars and not in cash. A 1kg gold bar is 32.15 troy ounces.

The Singapore contract will be in lots of 25 kilogrammes and denominated in U.S. dollars. It will trade for three hours in the Singapore morning time. Singapore is 7 hours ahead of London and 12 hours ahead of New York, and 2.5 hours ahead of the Indian market, but is in the same time zone as both Hong Kong and Shanghai.

Six consecutive daily contracts will trade at the same time, so when one contract expires, another will be added.

Physical settlement is two days after trade date and consists of 99.99 purity 1 kilogramme gold bars that meet the approval of the Singapore Bullion Market Association (SBMA) good delivery list . This means that wholesalers will be able to gauge demand and supply of 1 kg bars over the following week.

Some analysts have said that the protests in Hong Kong and the uncertain political outlook in Hong Kong may give Singapore an advantage in terms of becoming Asia and possibly the world’s global gold hub.

Separately, the first gold-dispensing automated teller machine in Asia have been launched in Singapore. The two ATMs are in Marina Bay Sands and Resorts World Sentosa hotels.

Launched by Asia Gold ATM, Singapore is the fourth country to have the facility, next to the UAE, the UK and the US. Items such as 1g to 10g pure gold bars, as well as customised gold coins, can be bought from the machine. Last Wednesday, the day the machines were unveiled to the public, a one gram pendant sold for $100 while it was $660 for a 10 gramme. The items can be paid through credit card or cash. Gold will be sold at different prices daily, based on the day's global prices.

The ATMs mean little or nothing with regards to Singapore becoming a global gold hub. However, they show how gold is respected and sought after in Singapore and the people and institutions of Singapore, have a significant cultural affinity with gold.

Unlike in the west, where people who believe in using gold for wealth preservation or for saving are sometimes called names and dismissively called “gold bugs”.

Gold and money, throughout history has flowed to where it is better treated. Today, gold continues to flow from West to East. A sign of shifting economic fortunes.

Faber Webinar On Storing Gold in Singapore

Essential Guide To Storing Gold In Singapore

MARKET UPDATE

Today’s AM fix was USD 1,210.00, EUR 959.94 and GBP 746.55 per ounce. Yesterday’s AM fix was USD 1,217.75, EUR 960.67 and GBP 750.54 per ounce.

Gold in Singapore was essentially flat and trading at $1,216.55 an ounce prior to a sharp bout of selling in late morning trading in London quickly pushed gold down nearly $10.

Gold fell $1.00 or 0.08% to $1,216.50 per ounce and silver slipped $0.14 or 0.79% to $17.49 per ounce yesterday.

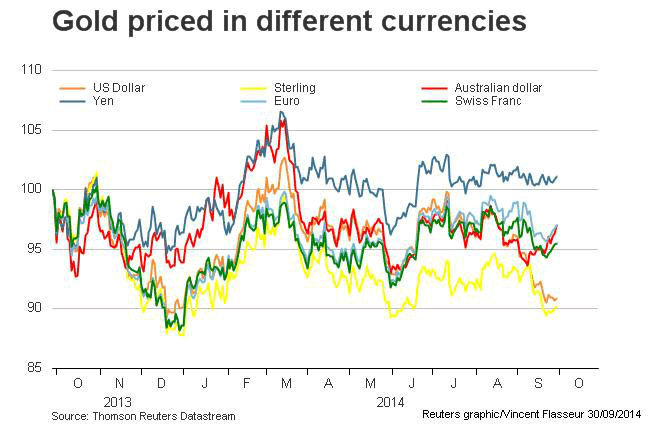

Gold has declined 5.5% in September, its worst monthly performance since June 2013, when it hit a 9 month low at $1,206.85 last week. Silver was set for a third consecutive monthly loss, and platinum is on track for an 8% drop, its worst monthly decline since May 2012.

Palladium has been by far the worst performer in the category with a 12.4% decline.

However, in physical markets, data from the U.S. Mint show that it has sold over 50,000 ounces of American Eagle gold coins so far in September, its highest monthly sales since January.

There is evidence too that demand has picked up significantly in India and China.

The world’s largest bullion buyer, China imported more gold in September than in the previous month due to demand from retailers stocking up for the upcoming National Day holiday.

In the last month, withdrawals from the SGE have totalled over 170 tonnes – this suggests an annual rate of over 2,200 tonnes. "The physical volumes have been high this month compared to August. I would say imports could be at least 30% higher than last month," a trader with one of the 15 importing banks in China told Reuters.

Meanwhile, demand in India - the second biggest buyer of gold - has also picked up significantly in recent days as the festival and wedding season began in earnest.

Speculators continue to sell paper and electronic gold while prudent buyers, in Asia and elsewhere continue to accumulate.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.