Gold - Time to Buy the Dip?

Commodities / Gold and Silver 2014 Sep 30, 2014 - 11:01 AM GMTBy: Jason_Hamlin

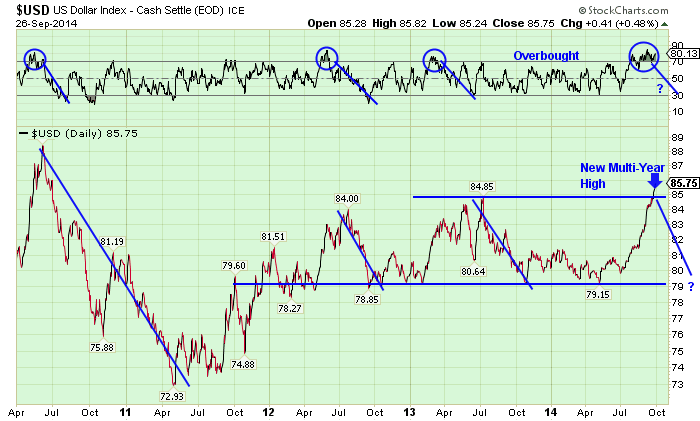

The dollar index rallied to a multi-year high today, but was quickly turned back lower. The USD index is the most overbought it has been in years. The dollar has followed a very predictable pattern during every previous move to such extreme overbought levels (RSI 70+).

The dollar index rallied to a multi-year high today, but was quickly turned back lower. The USD index is the most overbought it has been in years. The dollar has followed a very predictable pattern during every previous move to such extreme overbought levels (RSI 70+).

Likewise, gold is oversold according to technical momentum indicators and is due for a rally. Gold has strong support in the $1,180 to $1,200 range and may test this support before bouncing.

Furthermore, the gold price is now near the tipping point for mine cuts and closures. Most miners simply can’t turn a profit at current price levels. In some cases, it is costing miners more to pull an ounce out of the ground than it costs to buy the finished product in the open market.

Can you think of other products that you can buy at a price point below the cost to produce? Simply put, the market is out of whack and these conditions can not persist for long. Lower gold prices are already causing some mine closures, along with lack of funding and overall disinterest in the sector. In the first five months of 2014, U.S. mine production was 85,400 kilograms, down 4% from the 89,200 kg of gold bullion produced in the first five months of 2013.

While supplies are starting to decline, it is estimated that roughly 10% of miners have decided to close miens or suspend operations. Imagine if prices remain at current levels or drop lower in the coming months. There simply will not be enough supply to keep up with the continuing robust demand. Anyone that has taken Economics 101 understands the ramifications of lower supply with steady or increasing demand.

Bullion sales started picking up in the past month. Data for August shows gold sales stronger at 36,369 ozs compared to 25,103 ozs in July, with silver sales also up strongly at 818,856 ozs compared to 577,988 ozs in July. Month-to-date for September, gold Eagle sales across all coin sizes have already reached 43,200 oz compared to total gold eagle sales of 25,000 oz in August. This is also well ahead of September 2013, when total gold eagle sales for the month only touched 13,000 oz.

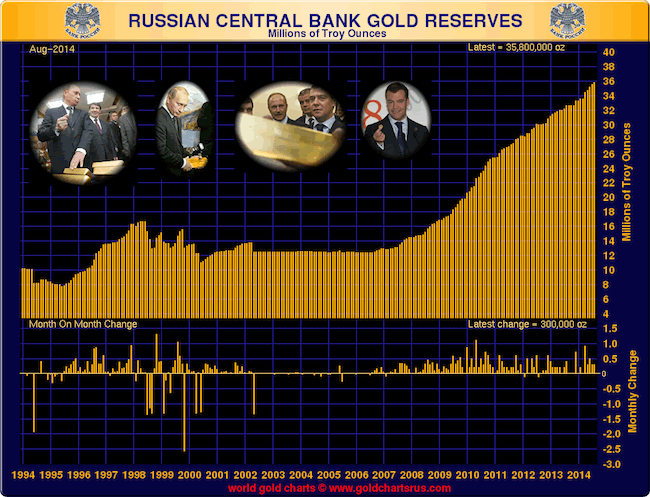

But of course the real demand is coming from central banks around the globe that remain net buyers. China and Russia in particular have been buying gold aggressively over the past few years. This is continuing, despite sharp declines being reported in Hong Kong. This is due to a shift in transaction to the new gold exchange in Shanghai. Total demand from China in 2014 is likely to be near the record levels from 2013, not down double-digits as some with an anti-gold bias have been inaccurately reporting.

There is a growing movement away from the U.S. dollar and it is only a matter of time before price discovery moves from banker-controlled Western markets to the East. China and Russia continue to purchase gold aggressively and once China announces updated reserves, the true extent of their buying will be known to the public. This could be the spark that lights the fuse for gold!

The following chart gives a good indication of just how aggressively Russia has been purchasing gold in recent years. If only we had a similar chart for China, we would see gold reserves spiking off the chart.

Lastly, both gold futures expiration and options expiration are now passed. Short-sellers with the ability to manipulate prices often hold down the gold price until these dates pass. This allows their short trades to rack up profits, while the call options they sold to unsuspecting investors expire worthless.

I believe we are witnessing one of the last great buying opportunities in precious metals. When prices start moving higher again, there will be little time to jump aboard the train. The downside risk at this juncture pales in comparison to the upside potential.

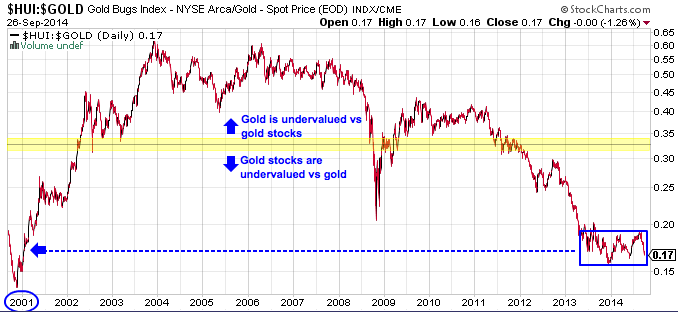

Even more exciting is the profit potential from select, best-in-breed mining stocks. Relative to the metals, mining stocks are currently the most undervalued they have been since the start of the bull market. I expect leverage of 2 to 4 times the advance in the underlying metals once a new uptrend begins.

For example, if silver doubles back to its 2012 high of $35, we are likely to see quality silver stocks advance by 200% to 400%. These numbers may sound extreme, but this type of leverage has been commonplace throughout the current bull market. Of course, it cuts in both directions, which fuels the high levels of volatility in this sector.

Smart money has been moving into precious metals during dips in recent months and many view the sector as one of the last places to find real value. Stocks, bonds, real estate and nearly every other asset class has been inflated to lofty levels by the FED’s easy money policies since 2009. These markets may continue higher a bit longer, but the easy fruit has already been plucked and the upside is limited in my view.

Therefore, I believe this is an opportune time to book profits in tech stocks, REITs, etc. and begin shifting your wealth into precious metals. Investors should consider doing this is tranches, rather than trying to call an exact market bottom.

I like holding physical bullion in my possession first and foremost. I will be adding to my silver bullion holdings this week. Additional funds will be going into a few hand-picked junior mining stocks with new discoveries, strong growth profiles and short-term catalysts that I believe could send their share price soaring. I also remain bullish on royalty and streaming companies that are able to mitigate downside risk, while keeping upside potential wide open.

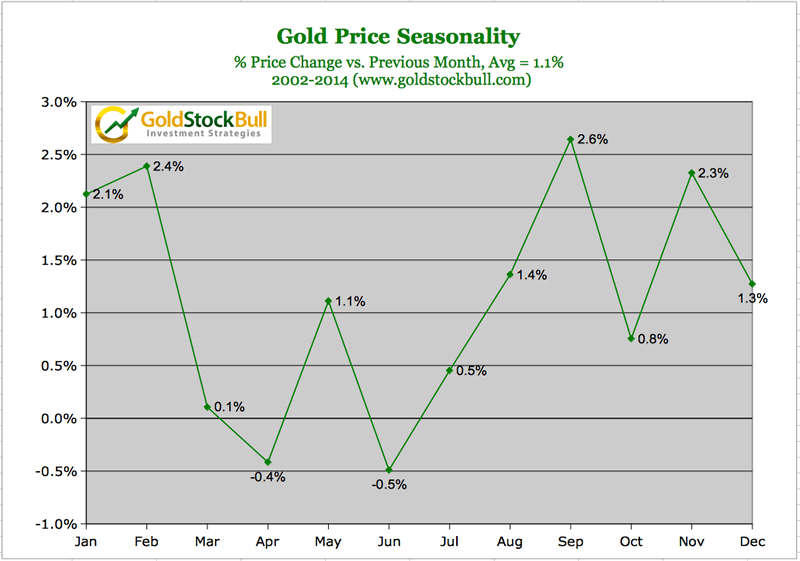

I am still waiting for our technical models to give the green light that a bottom is in place, but it appears we are getting close. Buying opportunities like this do not come along very often and we are heading into the Indian Festival season and highest seasonal period for gold. With the normal increase in the gold price not occurring in September, the potential for a price spike in October – February has increased substantially.

So, is it time to buy the dip in gold and silver? In my opinion, not quite yet, but we are getting very close.

What do you think? Is this a good time to buy the dip in precious metals? Please leave a comment below to share your views.

If you would like to receive our timing alerts, consider becoming a Gold Stock Bull Premium Member. You will also be able to view the 10 stocks we currently hold in the Gold Stock Bull Portfolio and the 20+ stocks in the Gold Stock Bull Watch List. The premium membership also includes our top-rated monthly newsletter and detailed email alerts whenever we are buying or selling.

Best of all, you can try out the service for 30 days risk free! Our trial offer gives you a 3-month quarterly membership at just $95. If you do not find our research and analysis valuable, you can cancel at any time within the first 30 days for a full refund. Just click the button below for instant access!

Follow our views on the gold market and track which stocks we hold in our portfolio by becoming a premium member.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. You can try it for just $35/month by clicking here.

Copyright © 2014 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.