Russia’s Gokhran Buying Gold Bullion In 2014 and Will Buy Palladium In 2015

Commodities / Gold and Silver 2014 Sep 29, 2014 - 05:53 PM GMTBy: GoldCore

Gokhran, the Russian precious metals and gems repository, said it has been buying gold bullion in 2014 and will likely to start buying palladium bullion in 2015, Interfax news agency reported this morning, citing the head of Gokhran, Andrey Yurin.

Gokhran, the Russian precious metals and gems repository, said it has been buying gold bullion in 2014 and will likely to start buying palladium bullion in 2015, Interfax news agency reported this morning, citing the head of Gokhran, Andrey Yurin.

GOKHRAN, Russian State Precious Metals and Gems Repository

Gokhran has been buying gold bullion on the Russian market this year and has no plans to sell palladium from stock in 2014 , Yurin said.

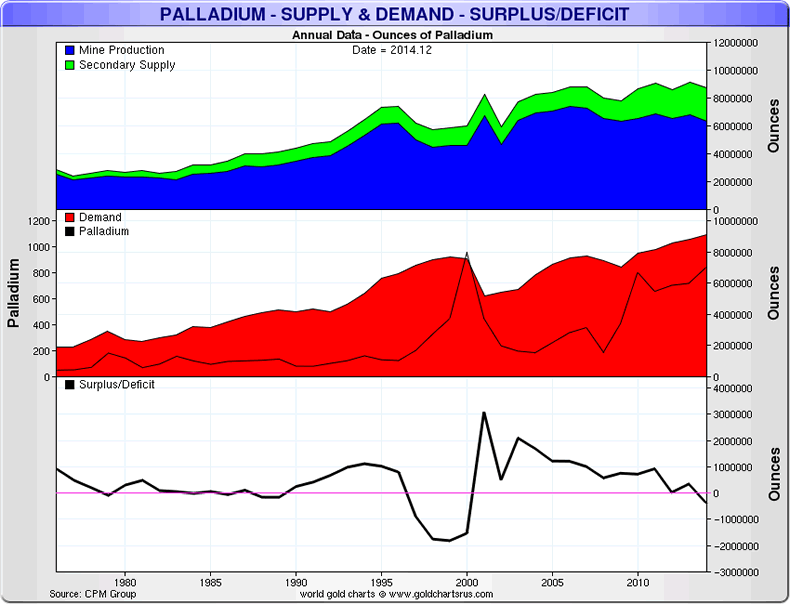

Gokhran’s palladium reserves are a state secret and analysts try to guess the level each year but they are widely believed to have been depleted according to Reuters.

Gokhran was influential on global platinum group metals (PGMs) markets in the 1990s and 2000s, when its palladium stocks, accumulated during the 1970s and 1980s, came to the market, depressing prices.

Gokhran is the State Precious Metals and Gems Repository which is a state institution under the Russian Ministry of Finance. It is responsible for the State Fund of Precious Metals and Precious Stones of the Russian Federation. It is responsible for the purchase, storage, sale and use of precious metals, precious stones, jewellery, rocks, and minerals by the State Fund.

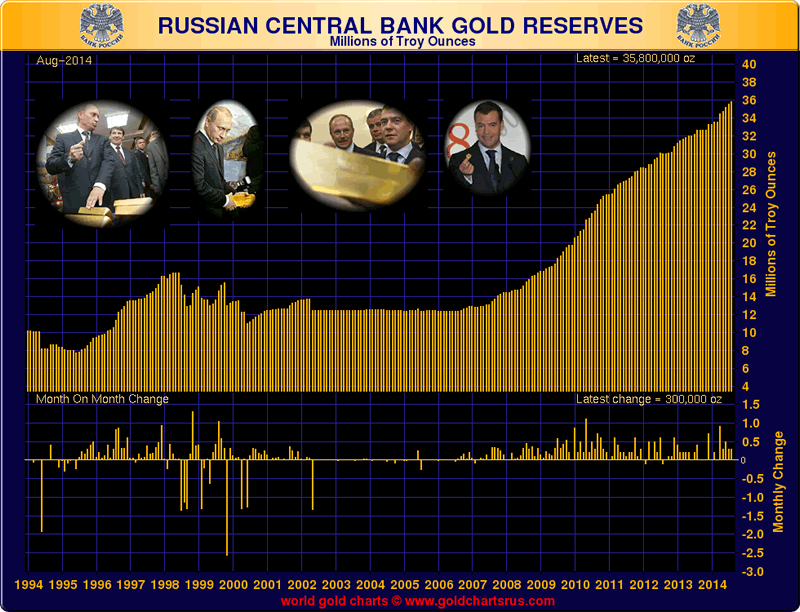

Russia again added to its growing and increasingly substantial gold reserves in August, with the Russian central bank purchasing 232,510 ozs (7.23 tonnes) and bringing its total gold reserves to 35.769 million ozs or 1,112.5 tonnes. Likewise, the National Bank of Kazakhstan purchased a very large 795,213 ozs or 24.7 tonnes in August bringing its total gold reserves to 5.848 million ozs (181.9 tonnes).

Palladium is already in a structural deficit and this new source of demand should result in palladium continuing to see gains in the coming months.

MARKET UPDATE

Today’s AM fix was USD 1,217.75, EUR 955.71 and GBP 750.54 per ounce. Friday’s AM fix was USD 1,222.25, EUR 958.70 and GBP 749.11 per ounce.

Gold fell $3.50 or 0.29% to $1,217.50 per ounce and silver climbed $0.11 or 0.63% to $17.63 per ounce Friday. Gold and silver were both down on the week at 0.01% and 1.51% respectively.

Gold in Singapore was essentially flat, trading around the $1,219/oz level and remained tethered to this level in London trading. Palladium gained about 1% while silver and platinum were largely unchanged.

The dollar hit a four year peak against a basket of currencies this morning and this is pressuring the precious metals.

Gold Down 5.2% In September and Headed For Quarterly Loss Of over 8%

September has been a poor month for precious metals. Gold is down 5.2%, despite it being gold’s strongest month from a seasonal perspective. The price fall means that gold is heading for the first quarterly loss this year.

Silver has fallen by a larger amount and is down 9.6%. While platinum is 8.3% lower.

Palladium’s 12.7% drop this month means that it is on track for its worst monthly performance since September 2011. It remains higher for the year and is 12.5% higher than the low in January 2014 at $693/oz.

Demand for physical gold could be affected by the Chinese holiday period that begins this week, MKS note this morning.

"Beginning on Wednesday this week we have Chinese Golden Week commencing, which will keep Chinese markets shut between 1-8 October," it said. "Given the natural support derived from Chinese physical demand, their absence over this period, combined with another strong payrolls figure expected this Friday, could heap added pressure on the gold. This is a very similar scenario to last year where gold was aggressively sold by speculators during the absence of the Chinese."

Gold in USD - 5 Years (Thomson Reuters)

Canny buyers in Asia and globally will use further price weakness to dollar cost average into gold.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.