Here's What Rising Interest Rates Really Do to Your Shares

Stock-Markets / Stock Markets 2014 Sep 29, 2014 - 02:43 PM GMTBy: Money_Morning

Sid Riggs writes: There is a lot of lip service being paid to the upcoming stock market crash that we're supposed to expect once the Federal Reserve starts raising rates.

Sid Riggs writes: There is a lot of lip service being paid to the upcoming stock market crash that we're supposed to expect once the Federal Reserve starts raising rates.

Every time we get close to a regularly scheduled Federal Reserve statement, financial pundits pontificate about the nuances of what the Fed Chair might say, not say, or imply.

It's like clockwork.

But one theme remains constant: any tightening of the Fed's easy monetary policies will spell impending doom for the easy-money-addicted stock market.

The only problem, though, is that historical facts just don't support the fear. In fact, there are opportunities for investment out there no matter what rates do...

A Powerful Lesson from the Recent Past

First, let's rewind a moment to late 2013.

Just about every talking head in the financial media was sure that stocks were going to crater as soon as the Fed announced even a whiff of a taper in its bond-buying program.

And then the Fed began...

On December 18, 2013 it announced it would start to taper its aggressive bond-buying program to $75 billion a month beginning in January 2014 - and what happened?

The S&P 500 rallied to a then-record close of 1,810.65.

Oops, I guess traders forgot to listen to the talking heads.

And there was a good reason for that.

Traders are constantly taking in all available information and continually adjusting positions accordingly. So when the Fed announced initial plans to taper, the news had likely been priced into stocks for weeks - if not months.

And the fact that the taper was just $10 billion a month was a pleasant surprise.

Fast forward to September 2014 as the Fed closes in on the end of its QE3-related bond-buying program - the markets have gained 9.5% from the initial December 18, 2013 announcement.

Traders who swallowed the taper-tantrum red pill and moved to cash in December 2013 have a lot of catching up to - and that means they are likely going to have to take on excessive risk to make up the difference.

With the taper almost behind us, now the dialogue has shifted to "rising interest rates." The almost unanimous opinion is there will be a sell-off because the market, the economy, you name it, are all addicted to cheap credit.

I don't buy it - and I have the hard facts to support my position.

The Pundits Have It Wrong

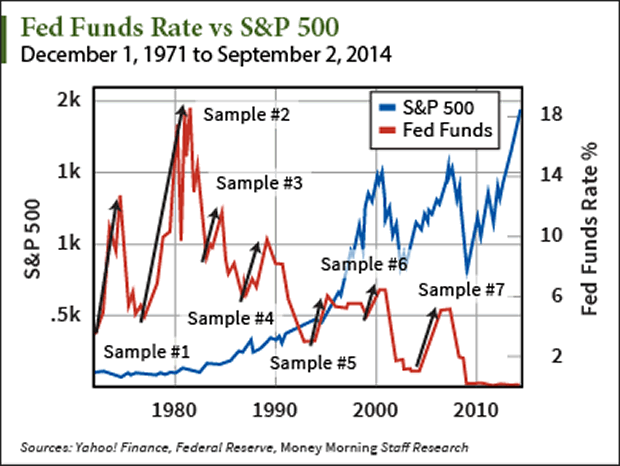

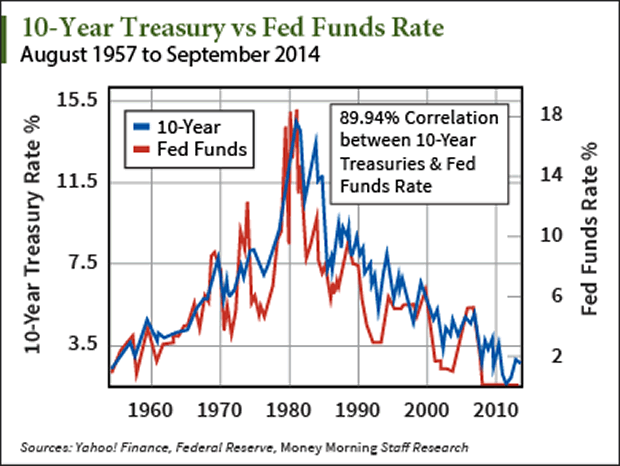

The chart at right demonstrates S&P 500 performance vs. Fed Funds Rate going all the way back to December 1, 1971.

It might be hard to see what's truly happening in that chart, so I broke it down in the table below, based on seven sample periods when the Fed was raising the Fed Funds Rates.

Six out of the last seven periods during which the Fed was raising rates, the markets actually went up - gaining an average 13.47% during the rising rate periods.

And, as you can see at left, the only time the S&P 500 didn't increase in value alongside of rising rates was all the way back in the early 1970s, when the Fed Funds Rate increased a whopping 9.21 percentage points, from 3.71% to 12.92%.

I don't know about you, but I'm not too concerned with the Fed raising rates to nearly 10% anytime soon.

The Great News for Equities

What's lost in all the chatter about the Fed increasing rates is one simple point: the Fed typically only raises rates when it believes the economy can absorb the increase - and even then, it's usually slow to finally increase rates. When it does, the increases come in small increments that the market can digest... at least to a point, then the cycle reverses, the economy goes into a recession, and the Fed lowers rates again.

I don't see any reason to think Team Yellen is going to break with tradition and raise rates so fast as to kick the feet out from under the U.S. economy.

Granted, once the Fed does increase rates you can expect a period of volatility - but don't read too much into it.

Of course there's going to be volatility as institutional traders around the world adjust their respective positions based on risk models that use the Fed Funds rates as a critical input.

And then there is the correlation of 10-year U.S. Treasury to Fed Funds rates...

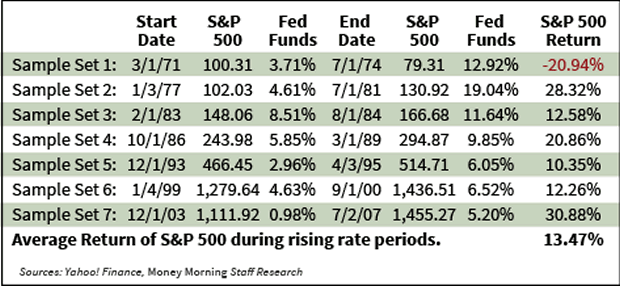

The chart at left demonstrates an 89.94% correlation between Fed Funds rates and U.S. 10-Year Treasury rates. Of the data so far, the chart above might be the most important because of how it correlates to the first rule on money: capital always goes where it's treated best.

The chart at left demonstrates an 89.94% correlation between Fed Funds rates and U.S. 10-Year Treasury rates. Of the data so far, the chart above might be the most important because of how it correlates to the first rule on money: capital always goes where it's treated best.

If 10-year rates are "increasing" it's because traders are "selling" - and that freed-up capital has to go somewhere. I think it would follow historical examples and move into equities.

That being said, I admit, we could see capital move into commodities, but historically the shift has been from treasuries into equities.

The Counterargument Is Wrong

Could you make the argument that "This time it's different," because the Fed has injected so much liquidity into financial markets? Sure you could. But it would represent a break with historical norms and I'm more interested in historical statistics rather than unproven hypotheses.

Could you make the "All that liquidity is going to eventually create massive inflation" argument? Sure you could. But inflationary periods have typically favored stocks so that would likely favor equities.

And could you make the case that "The impending inflation means you should, in fact, be invested in commodities such as oil and gold"? Again, sure you could. But even then, you'll want to have a portion of your portfolio (depending on your own risk tolerance) allocated to commodity-related stocks, such as gold miners, oil and gas exploration companies, and agricultural-related companies.

Finally, could you make the "Geopolitical risk will drive a flight to safety into U.S. debt and out of equities" argument? And, of course, you could. But that condition would likely be temporary. Eventually the 89.94% correlation between 10-year Treasuries and the Fed Funds rate would normalize and 10-year rates would likely rise, which favors equities.

The main takeaway is the importance of taking a step back and looking at the big picture - especially when it comes to your money and your investment strategies.

Don't simply follow the herd. It's a recipe for underperformance.

Think for yourself. It's the only way to have an investing idea you can stand behind.

And check the true facts.

It's the only way to know if your investment idea actually has merit.

I think legendary investor Jim Rogers summed it up perfectly when he said:

Acknowledge the complexity of the world and resist the impression that you easily understand it. People are too quick to accept conventional wisdom, because it sounds basically true and it tends to be reinforced by both their peers and opinion leaders, many of whom have never looked at whether the facts support the received wisdom. It's a basic fact of life that many things "everybody knows" turn out to be wrong.

Source : http://moneymorning.com/2014/09/29/heres-what-rising-rates-really-do-to-your-shares/

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.