Energy Sector: Crude Oil Demand from China , India , Rockets Upward

Commodities / Energy Resources May 19, 2008 - 06:53 AM GMTBy: Joseph_Dancy

Long term supply and demand trends continue to keep energy prices elevated. The easiest to locate and cheapest oil to produce on the global scale has been for the most part found. Many of the major older fields are in decline. New production tends to be more expensive to develop, and access to potential fields is increasingly restricted by nationalistic concerns as governments try to control resources to benefit their own citizens. In many areas a shortfall of drilling and production equipment exists.

Long term supply and demand trends continue to keep energy prices elevated. The easiest to locate and cheapest oil to produce on the global scale has been for the most part found. Many of the major older fields are in decline. New production tends to be more expensive to develop, and access to potential fields is increasingly restricted by nationalistic concerns as governments try to control resources to benefit their own citizens. In many areas a shortfall of drilling and production equipment exists.

Demand for crude oil and liquefied natural gas (LNG) continues to rocket ahead, especially in dynamic economies that are continuing to grow even in the face of the slowing U.S. economy. Last month we saw the following developments in the energy sector:

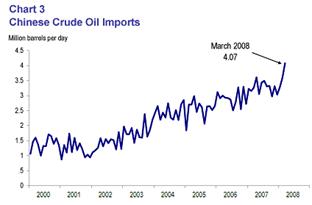

• China 's consumption of crude oil and refined oil products both hit record highs in the first quarter of the year according to statistics released by the China Petroleum and Chemical Industry Association. China 's consumption of oil products - composed of gasoline, diesel and kerosene - rose by 16.5 percent year on year in the first three months. Crude oil consumption rose by eight percent. (Xinhua)

Data released recently by Chinese customs authorities show a surge in the emerging giant's oil imports in March. On a year-over-year basis, China 's crude oil imports rose 25 percent in March. Although there have been reports of diesel fuel shortages in China, the gains in China's oil imports may owe to inventory accumulation in anticipation of the Olympics rather than a dramatic acceleration in its oil consumption. ( Dallas Federal Reserve)

Data released recently by Chinese customs authorities show a surge in the emerging giant's oil imports in March. On a year-over-year basis, China 's crude oil imports rose 25 percent in March. Although there have been reports of diesel fuel shortages in China, the gains in China's oil imports may owe to inventory accumulation in anticipation of the Olympics rather than a dramatic acceleration in its oil consumption. ( Dallas Federal Reserve)

- According to well known academic energy economists in China , the 14 largest oil fields in the world, which together account for a fifth of global output, are all showing declining production. These old fields, where the cost of producing each extra barrel of oil is just a few dollars, are having to be replaced by new more expensive fields. (MSN Money)

- With China 's crude demand expanding at 11 per cent a year the country will soon replace the US as the world's biggest oil importer. The growth of India 's oil demand isn't far behind. These two nations account for a third of humanity. And as economic development continues, the energy needs of their factories - along with those in Brazil , Mexico and other populous emerging markets – will escalate. As these countries get richer the number of cars in the world, now around 625 million, is set to double in less than 20 years. The impact of that on global oil demand will be immense - around 70 per cent of current crude output is used to fuel autos. (Telegraph)

• In 2008 China , India , Russia and the Middle East for the first time will consume more crude oil than the U.S. , burning 20.67 million barrels a day this year, an increase of 4.4 percent over year earlier levels, according to the International Energy Agency. U.S. demand will contract 2 percent to 20.38 million barrels daily, the IEA forecast. (Bloomberg)

- China , the world's second-biggest energy user, will consume 7.89 million barrels of oil a day in 2008. China 's passenger car sales jumped 22 percent to 6.3 million last year and may rise 16 percent to about 7.3 million this year. India will use 2.9 million barrels of oil a day in 2008, more than is pumped by OPEC member Venezuela . (Bloomberg)

- The average person in China consumed less than 20 percent as much energy as the average American in 2005, the latest year data is available, according to U.S. Energy Department. In India , energy use is less than 10 percent of America 's on a per capita basis. The 2.45 billion people in China and India combined used only half as much crude as 300 million Americans last year. (Bloomberg)

Russia 's economy is expected to grow 7.1 percent this year and Middle Eastern economic growth will probably accelerate to 6.1 percent this year from 5.8 percent in 2007, according to the International Monetary Fund. Oil demand and economic growth are strongly correlated. Oil demand in the Middle Eastern region will surge 5.8 percent to 6.97 million barrels a day this year, according to the IEA.

Russia 's economy is expected to grow 7.1 percent this year and Middle Eastern economic growth will probably accelerate to 6.1 percent this year from 5.8 percent in 2007, according to the International Monetary Fund. Oil demand and economic growth are strongly correlated. Oil demand in the Middle Eastern region will surge 5.8 percent to 6.97 million barrels a day this year, according to the IEA.

- World oil production has stagnated at about 85-million barrels per day over the last two years, with growing demand met by increases in natural gas liquids. Growing demand in China , India , Russia and the Middle East will more than offset declines in the industrialized world. “Millions of new households will suddenly have straws to start sucking at the world's rapidly shrinking oil reserves,” according to an energy analyst. (Globe & Mail)

- The future supply of Russian oil is threatened by a likely decline in production levels one of the country's top oil executives warned last month. Lukoil's Leonid Fedun said $1 trillion would have to be spent on developing new reserves if current output levels were to be maintained. Recent figures show Russian output fell 1% in the first quarter of 2008, and several experts expect the production decline to accelerate. (BBC News)

- Crude oil prices continued rising last month, with the benchmark West Texas Intermediate (WTI) crude oil setting new records last month. Real oil prices also hit all time highs. (Dallas Federal Reserve Bank)

- U.S. natural gas prices are poised to head higher over the long term as commercial demand increases according to a report issued by the Federal Reserve Bank of Dallas last month . The report noted that domestic natural gas prices are depressed compared with the fast-rising prices commanded on the international market for liquefied natural gas, selling for between $18 and $19 per million cubic feet, about twice the domestic price.

"Much higher natural gas prices seem likely even though U.S. producers are thought to be sitting on sizable supplies of undeveloped resources," the bank said. "A recovery in U.S. manufacturing should sharply boost natural gas demand. Once LNG imports become the marginal source of U.S. supply, much higher international natural gas prices should prevail."

"Much higher natural gas prices seem likely even though U.S. producers are thought to be sitting on sizable supplies of undeveloped resources," the bank said. "A recovery in U.S. manufacturing should sharply boost natural gas demand. Once LNG imports become the marginal source of U.S. supply, much higher international natural gas prices should prevail."

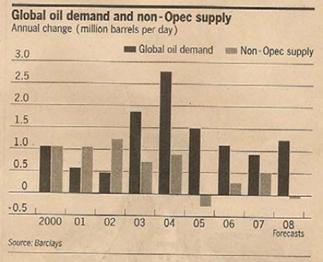

• The growth in global oil demand over the last five years has dwarfed the increases in global oil supplies from non-OPEC nations (see chart at right). As demand continues to rocket upward the incremental excess global productive capacity continues to shrink, which helps support higher prices. (Financial Times)

• Production associated with the damaged Independence Hub in the offshore Gulf of Mexico remains shut-in at month end. The facility has been shut-in for three weeks while repairs are completed, a process expected to be finished in the first half of May. Until that time about 900 million cubic feet (MMcf) per day of supplies will not be available to the market. (Cattle Network)

• Liquefied natural gas (LNG) imports to the U.S. continue at a level well below last year's volumes. An average of 0.9 billion cubic feet (Bcf) per day was imported during April, less than one-third of the 3.2 Bcf per day imported during April 2007. Although deliveries are expected to increase in the month of May, there has been a sharp reduction in import levels so far in 2008. LNG deliveries totaled about 116 Bcf through April 2008, while volumes reached about 283 Bcf during the comparable period last year. LNG cargoes are heading to Europe and Asia, where buyers continue to purchase LNG at much higher prices than those that have prevailed in U.S. markets. (Cattle Network)

- Hurricane forecasters from Colorado State University last month raised the number of storms they expect this year to 15, including eight hurricanes, half of them major. The Gulf Coast , home to dozens of oil and gas fields and a large share of the U.S. refining capacity, has about a 45 percent chance of being hit by at least one major hurricane. That compares with a historical average of about 30 percent. (Bloomberg)

AccuWeather.com Hurricane Center meteorologists also released a preliminary hurricane season forecast for 2008 last month. They believe the waning La Niña conditions and a continued warm water cycle in the Atlantic Basin will be the two defining factors influencing the 2008 hurricane season, causing the number of storms to be slightly above average. More importantly, these factors will increase the chance for landfalling storms in the United States

The third forecast released last month comes from the British group Tropical Storm Risk. They forecast percentages of storms, but come up with something similar: 14.8 named storms, 7.8 hurricanes, and 3.5 intense ones. They also see an enhanced U.S. landfall risk.

Regardless of how accurate or inaccurate these forecasts prove to be the fact is we have seen eight Category 5 Atlantic hurricanes in the past 5 years. And last year, two Category 5 hurricanes -- the most intense on a five-tier scale -- made landfall in the Atlantic Basin for the first time ever. The frequency of intense storms is off the charts statistically when compared to historical records.

An anomaly perhaps, but should a Category 5 storm strike in an area populated with a high density of oil refineries, oil and gas fields, or for that matter people, the outcome could be catastrophic.

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2008 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.